India ranks as the 5th largest economy globally by nominal GDP and stands as one of the top economies when measured by purchasing power parity (PPP). Over recent decades, the country has transitioned from being primarily agrarian to a more diversified economy, with significant growth in sectors such as services, manufacturing, and infrastructure development. This shift has played a key role in driving the nation's economic expansion and transformation.

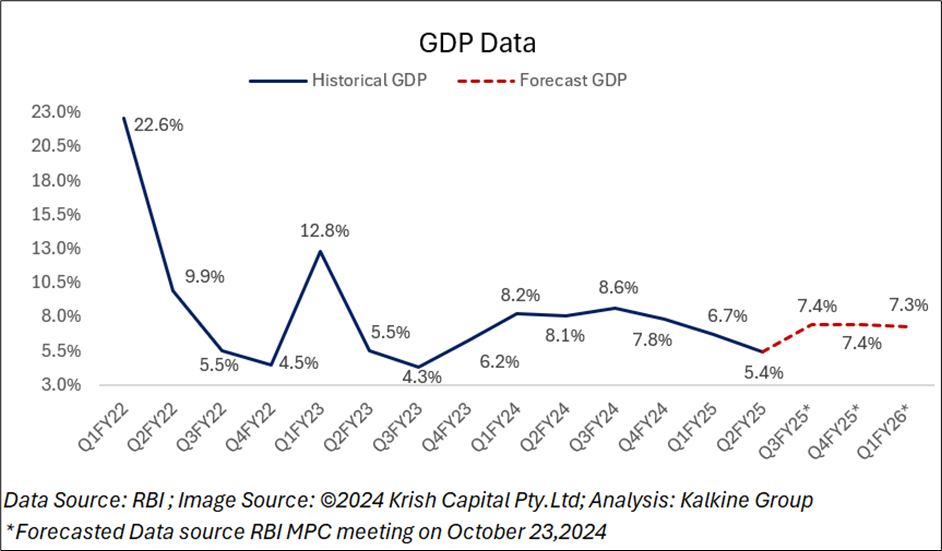

Several research firms have projected India's GDP growth to be between 6.5% and 7.2% for the fiscal year 2025. The Reserve Bank of India (RBI), during its Monetary Policy Committee (MPC) meeting, announced a GDP growth rate of 7.2% for fiscal year 2025. Additionally, the International Monetary Fund (IMF) has forecasted India's GDP growth at 7.0% for the same period.

Current Market Scenario

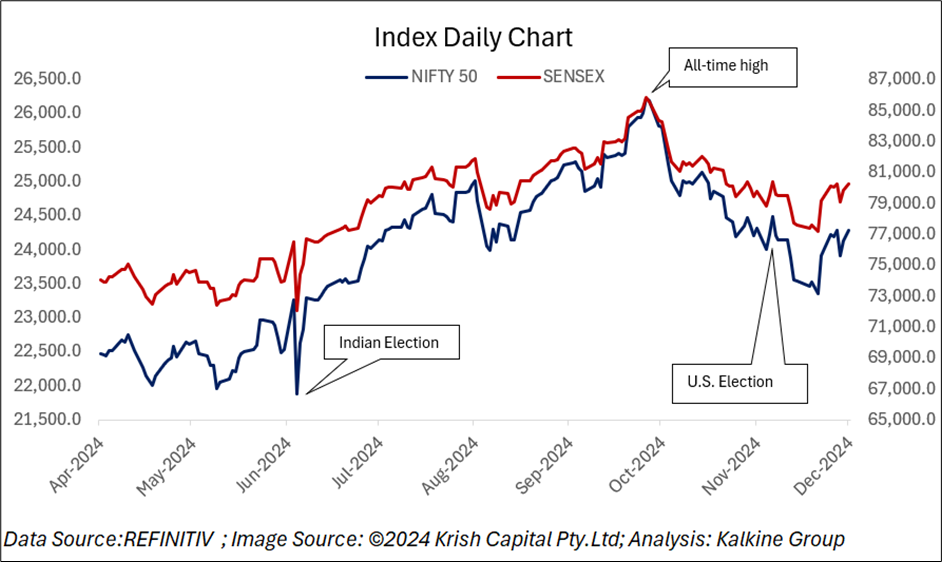

The NIFTY50 index of the Indian stock market reached an all-time high of 26,277.35, while the BSE Sensex hit a record of ₹85,978.25 on 27th September 2024. After reaching these all-time highs, the market trend appears to be shifting, with a bearish phase potentially ahead. The Nifty50 breached strong support levels of ₹24,800 and ₹24,500, falling to a low of ₹23,263.15, while the BSE Sensex dropped to ₹76,802.73 on 21st November 2024.

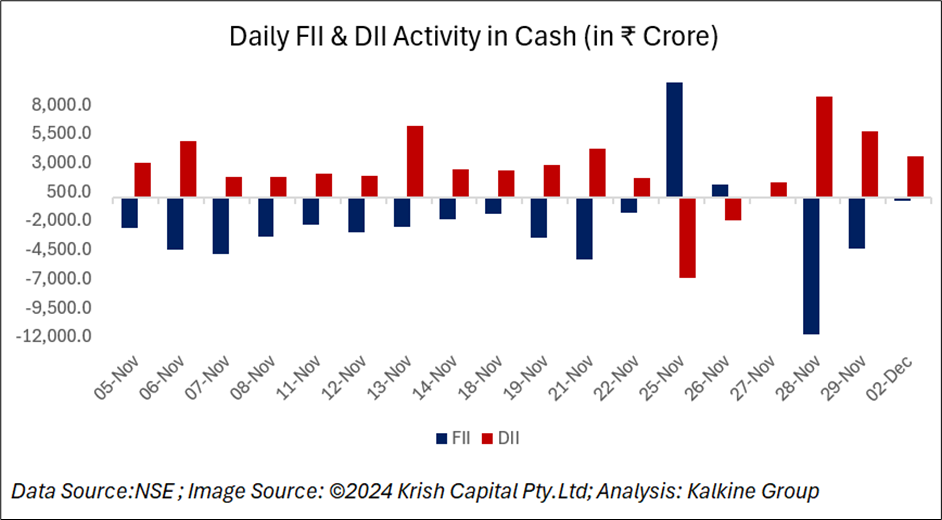

Since October, the markets have experienced significant pressure due to several factors, including weaker-than-expected Q2 earnings, high stock valuations, uncertainty of US Federal Reserve rate cuts, foreign capital outflows, and the depreciation of the Indian rupee. Foreign portfolio investors (FPIs) have been scaling back their investments in Indian equities during this period. While it is common for FPIs to reduce their exposure to emerging markets before the year-end holiday season, this year's trend may not be as marked, given the significant sales they have already made.

Brokerage Firms’ Projected Targets for Nifty 50 and Sensex

India's economy experienced a slowdown in Q2 of FY25, with GDP growth reported at 5.4%. This slower pace of economic growth may affect the future performance of the stock market. The combination of a decelerating economy, geopolitical tensions, and the impact of high U.S. tariffs is expected to influence the stock market's performance going forward.

The recent economic slowdown in India can be attributed to several short-term, cyclical factors, including the Indian general elections, the ongoing Russia-Ukraine conflict, the U.S. presidential election, the strengthening of the U.S. dollar, and rising bond yields. However, it is important to recognize that India, as an emerging market, remains on a strong growth trajectory in the long term. Despite these temporary challenges, India’s economy is expected to maintain its resilience and continue evolving as one of the world’s most promising economies.

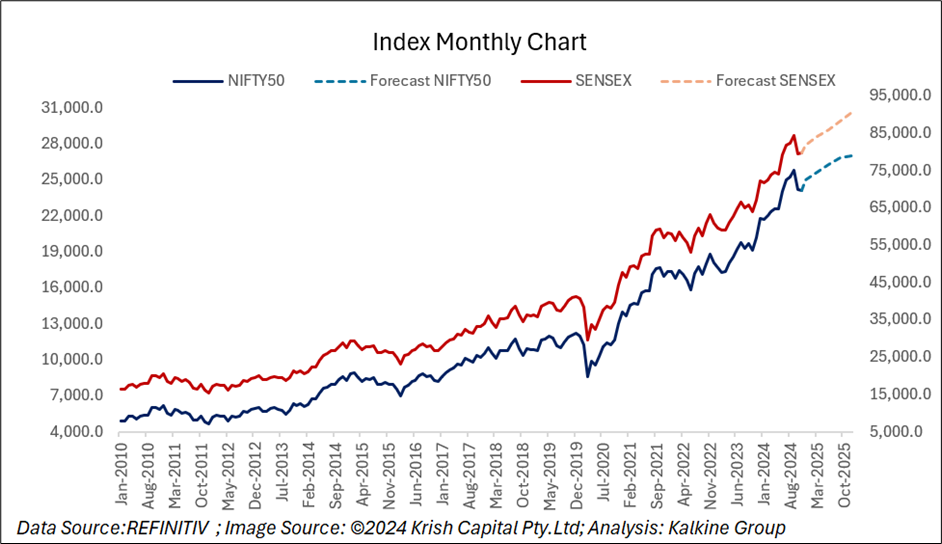

According to Goldman Sachs, the Nifty 50 index is expected to reach ₹27,000 by the end of December 2025. This projection is based on factors such as strong corporate earnings growth, continued economic expansion, and favourable market conditions. Analysts predict that India’s economy will maintain a robust growth trajectory, supported by a young and growing population, digital transformation, and improving infrastructure. As these elements drive productivity and investment, the Indian equity markets are likely to benefit from sustained growth.

HSBC has revised its target for the BSE Sensex index to ₹90,520 by December 2025, down from an earlier estimate of ₹100,080. This adjustment reflects concerns about the pace of India's economic growth, which has been slower than anticipated, and the underperformance of Indian companies in meeting consensus estimates during the recent Q2 FY25 earnings season.

Indian brokerage firms have set modest targets for Nifty50 and Sensex, predicting Nifty50 to reach between ₹24,000 and ₹25,000, and Sensex to range from ₹80,000 to ₹81,700 by the end of December 2024. Given the current economic indicators and market conditions, a gradual recovery is expected in the latter part of the year. This recovery will largely depend on factors such as inflation management, corporate earnings growth, and geopolitical events. A more significant recovery is likely when Foreign Institutional Investors (FIIs) return to the Indian market.

However, India's economy remains robust and diverse, with sectors such as agriculture, technology, infrastructure, and manufacturing driving its growth. The country has also developed a robust domestic investor base, encompassing both institutional and retail investors. Retail investor participation has surged in recent years, as more individuals become increasingly aware of the stock market and investment opportunities. This surge in retail investment has resulted in a significant inflow of capital into stocks and other financial instruments, reflecting a higher level of financial awareness and confidence in the market.

Additionally, a global shift from goods to services consumption is underway, with emerging markets like India poised to benefit. India’s manufacturing sector is gaining momentum as global production patterns evolve. As geopolitical dynamics change, including potential future tariff increases by the U.S. on China, India stands out as a strong contender to absorb production that may shift away from China. This trend presents a significant opportunity for India to expand its manufacturing capabilities and solidify its position as a global manufacturing hub.

The combination of a dynamic and diverse economy, a growing domestic investor base, and the country’s potential role in reshaping global supply chains positions India for continued growth and development in the coming years.

Conclusion

India’s stock market faces short-term challenges like weaker earnings and geopolitical uncertainties, its strong economic fundamentals and diversified sectors support long-term growth. With increasing domestic investor participation and a growing role in global supply chains, India is poised for recovery and sustained economic expansion. Despite current market volatility, India remains a promising investment destination for the future.