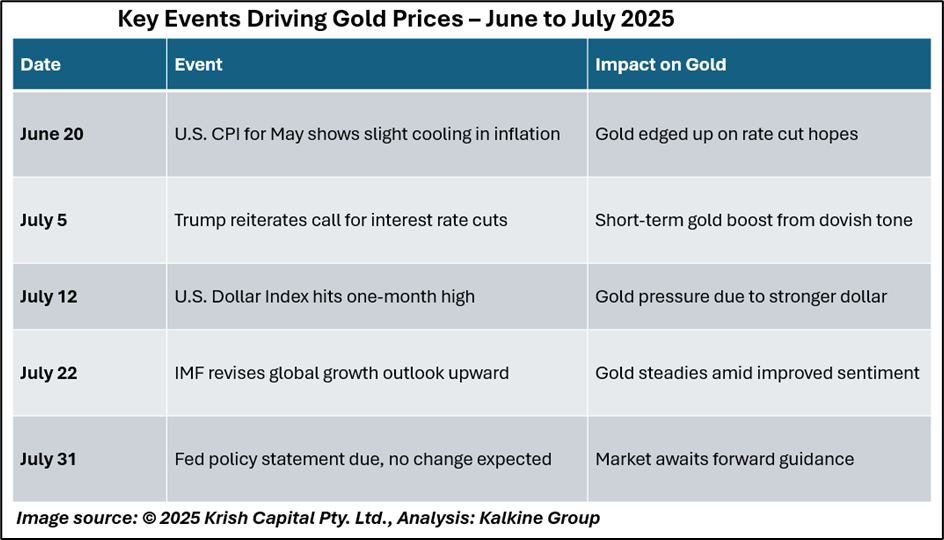

Gold prices remained steady in early Wednesday trading as investors awaited clarity from the U.S. Federal Reserve’s interest rate policy meeting. Spot gold was priced at up to USD 3,329.20 per ounce as of 05:19 AM GMT-5, while U.S. gold December futures inched up 0.16% to USD 3,387.10 per ounce. With the Fed widely expected to keep rates unchanged, attention is focused on the central bank’s forward guidance on rate cuts amid slowing inflation and uneven economic growth.

Although U.S. President Donald Trump has consistently pushed for lower interest rates, the Federal Reserve remains committed to a data-dependent policy approach. The U.S. dollar index held near a one-month high, limiting gold's upside by making it more expensive for holders of other currencies. Market participants are watching closely for any signals that could influence monetary policy in the second half of 2025.

Trade Talks and Tariff Risks

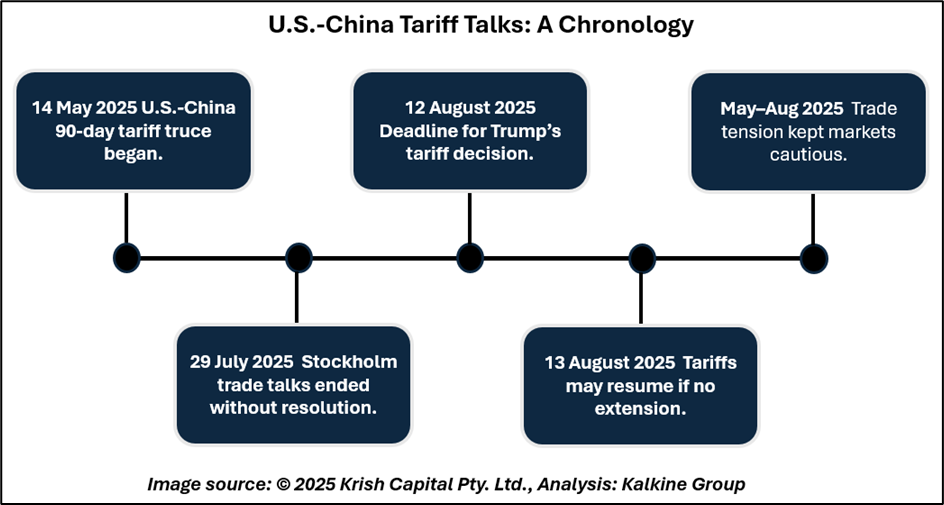

U.S.-China trade tensions resurfaced as both nations concluded two days of discussions in Stockholm with a mutual interest in extending the current 90-day tariff truce. The final decision, however, rests with President Trump, who may allow the truce to expire on August 12, potentially triggering a sharp increase in tariffs. The uncertainty around tariff escalation continues to weigh on investor sentiment, creating a cautious environment for risk assets and safe havens alike.

Meanwhile, the U.S. goods trade deficit narrowed in June to its lowest level in nearly two years, largely due to a drop in imports. This supports expectations of a Q2 economic growth rebound. Additionally, the International Monetary Fund (IMF) slightly raised its global growth forecast for 2025 and 2026, attributing the upgrade to stronger-than-expected pre-tariff demand and a reduction in the effective tariff rate from 24.4% to 17.3%

India’s Gold Demand Outlook

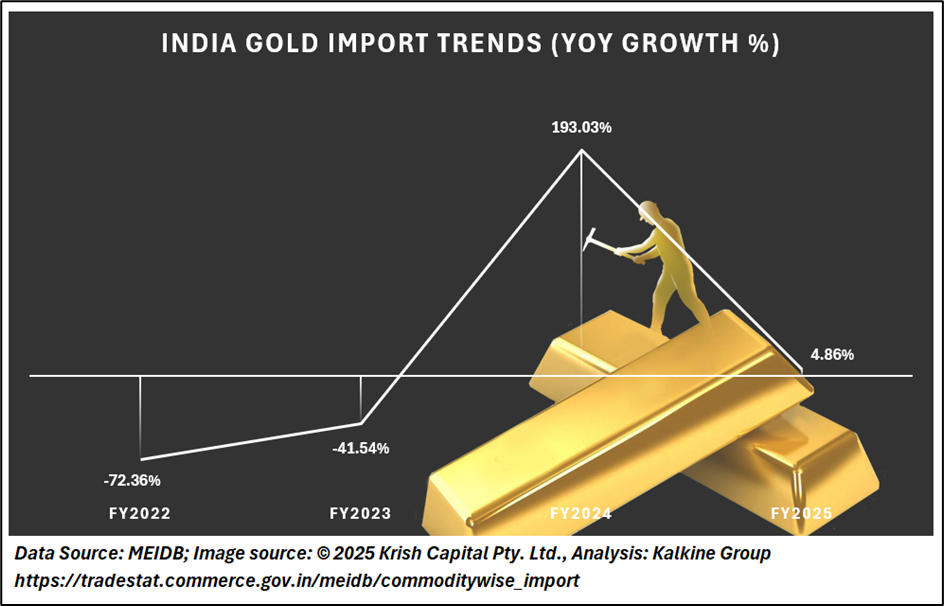

India, the world’s second-largest consumer of gold, remains a key player in shaping global bullion market trends. Although domestic gold demand saw some softness in the first half of 2025 due to elevated prices and a weaker rupee, analysts forecast a seasonal uptick heading into the festive and wedding season beginning in Q3. Indian buying patterns, traditionally influenced by global prices and currency strength, could act as a stabilizing force for international gold demand.

Moreover, any changes to India’s import duties, inflation trajectory, or consumer sentiment could significantly influence global gold flows. With India’s central bank maintaining a cautious monetary stance, gold remains an important asset class for both household savings and investor portfolios in the country.

Conclusion

From a broader economic perspective, gold's steadiness reflects investor caution amid conflicting signals geopolitical tensions, uncertain monetary policy, and volatile trade dynamics. The narrowing U.S. trade deficit and slightly improved IMF forecasts suggest some resilience, but any recovery may be offset by renewed tariff risks or ambiguous Fed communication.

As investors await definitive cues on interest rate direction and trade policy outcomes, gold is likely to remain range-bound in the short term. Regional developments, including India’s upcoming gold-buying season, will also be key to determining physical demand trends in the months ahead.