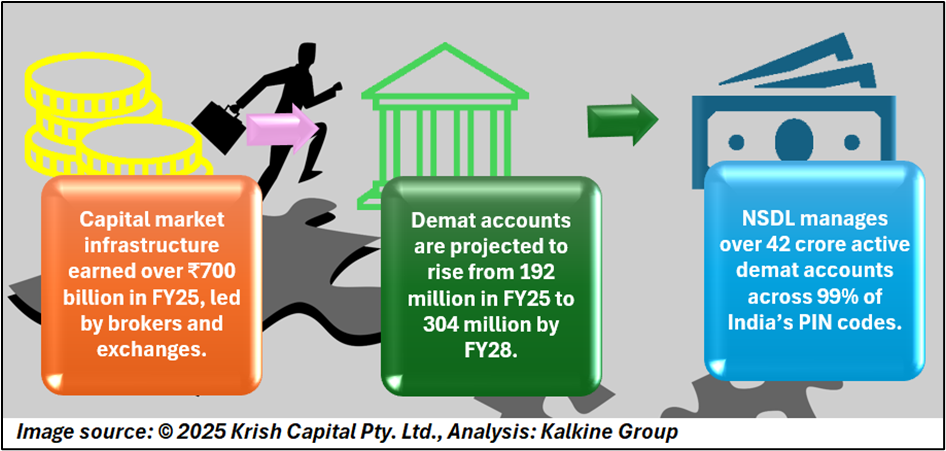

India’s capital market infrastructure sector delivered strong performance in FY25, earning more than ₹700 billion, according to a Jefferies report. Brokers and stock exchanges contributed the largest share of revenues, supported by rising trading volumes and increased market participation. The report notes that improving access to markets and growing investor awareness continue to support steady expansion across the ecosystem.

Brokers and Exchanges Expected to Outperform

The report expects brokers and stock exchanges to grow faster than depositories and registrar and transfer agents (RTAs). This is mainly due to business diversification, product expansion, and evolving regulatory conditions. Higher market activity, along with new offerings beyond traditional trading, is likely to support stronger earnings growth for these segments in the coming years.

Jefferies highlights rising retail investor participation as a key growth driver. Demat accounts are expected to increase from 192 million in FY25 to 304 million by FY28, while mutual fund assets under management are projected to grow from ₹67 trillion to ₹103 trillion during the same period. A notable trend is the growing presence of young investors, with those below 30 years accounting for nearly 40% of total participants, reflecting strong long-term growth potential.

NSDL Reflects Deepening Use of Demat Accounts

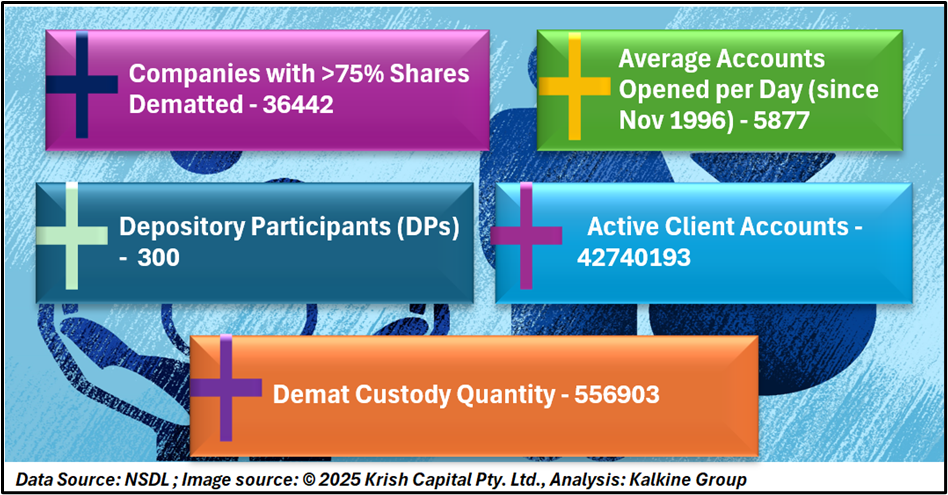

NSDL’s data highlights how widely demat accounts are now used across India. As of November 30, 2025, NSDL had more than 42 crore active demat accounts, with investor presence in 99.37% of all PIN codes. Since its launch in 1996, nearly 5,900 new accounts have been opened every day, showing consistent adoption over nearly three decades.

Digital Shift Removes Physical Certificates

One of NSDL’s major achievements has been the elimination of over 11,000 crore physical share certificates. This shift has made investing safer, faster, and fully digital. More than 1.05 lakh companies are now connected with NSDL, strengthening transparency and reducing risks linked to paper-based securities.

NSDL holds securities worth ₹527 lakh crore in demat form, covering equities, debt instruments, commercial paper, and sovereign gold bonds. In November 2025 alone, equity settlements across NSE and BSE crossed ₹8.14 lakh crore in value. With over 300 depository participants, nearly 57,000 service centers, and presence in over 2,060 cities and towns, NSDL continues to play a vital role in keeping India’s capital markets secure, efficient, and inclusive.

Conclusion

India’s capital market infrastructure is entering a strong growth phase, supported by rising retail participation, increasing market volumes, and a rapidly expanding young investor base, as highlighted by the Jefferies report. The sharp rise in demat accounts and mutual fund assets under management reflects growing trust in formal financial markets. At the same time, NSDL’s wide reach, large custody base, and successful shift to a fully digital system underline the strength of India’s market infrastructure.