India’s manufacturing sector recorded its strongest growth in over a year during July 2025, driven by solid domestic demand and favorable market dynamics. Despite this momentum, lingering concerns related to inflationary pressures, global trade developments, and competitiveness have weighed on business confidence, adding a layer of uncertainty to the short-term outlook.

As per the latest HSBC India Manufacturing Purchasing Managers’ Index (PMI) by S&P Global, the index climbed to 59.1 in July from 58.4 in June. Although slightly below the preliminary estimate of 59.2, the reading remained well above the 50-point threshold, signaling continued expansion in manufacturing activity.

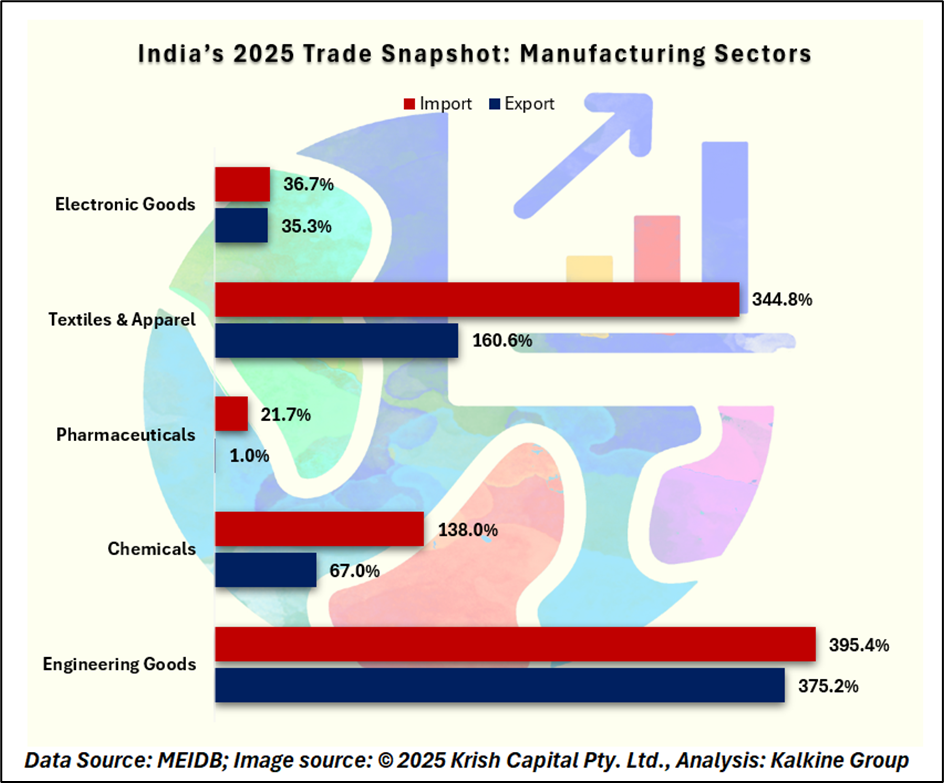

Export Momentum

Manufacturing activity in India accelerated in July, fueled by a significant increase in new orders—the quickest rate of expansion seen in nearly five years. Businesses credited the growth to successful marketing efforts and a favorable economic backdrop. This surge in demand propelled output to its highest level in 15 months, underscoring the sector's underlying strength. Although export order growth eased slightly from June’s exceptional 17-year high, global demand continued to play a vital role in supporting the sector. Facing mounting input costs, manufacturers raised output prices for the tenth month in a row, capitalizing on strong demand to maintain profitability. This sustained ability to transfer cost pressures to customers points to robust pricing power, despite ongoing inflation throughout the supply chain.

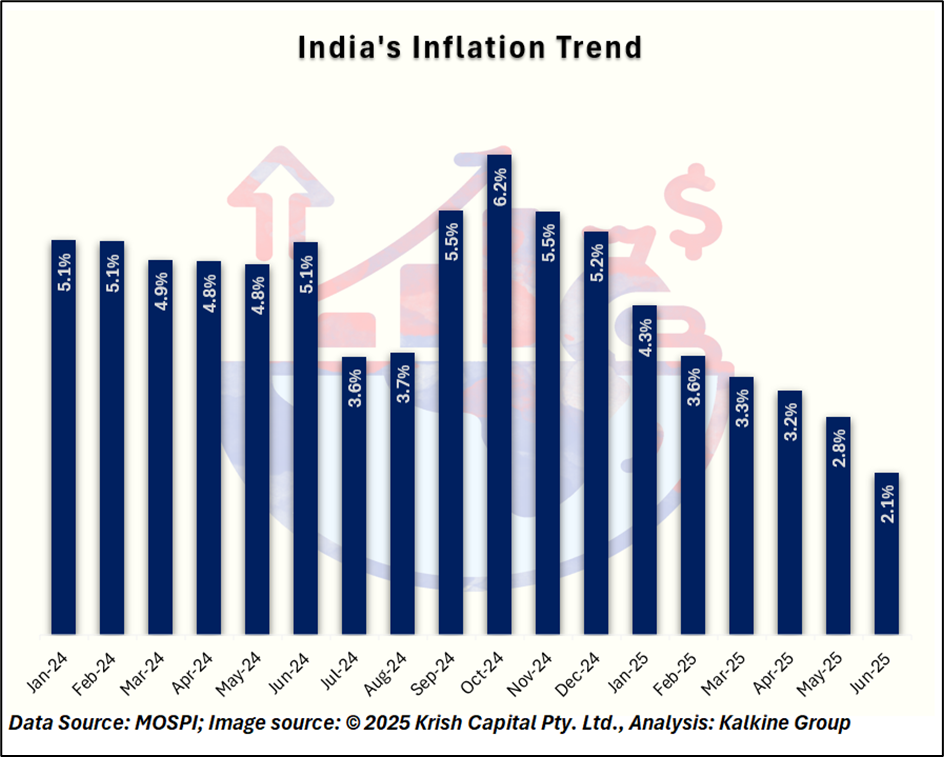

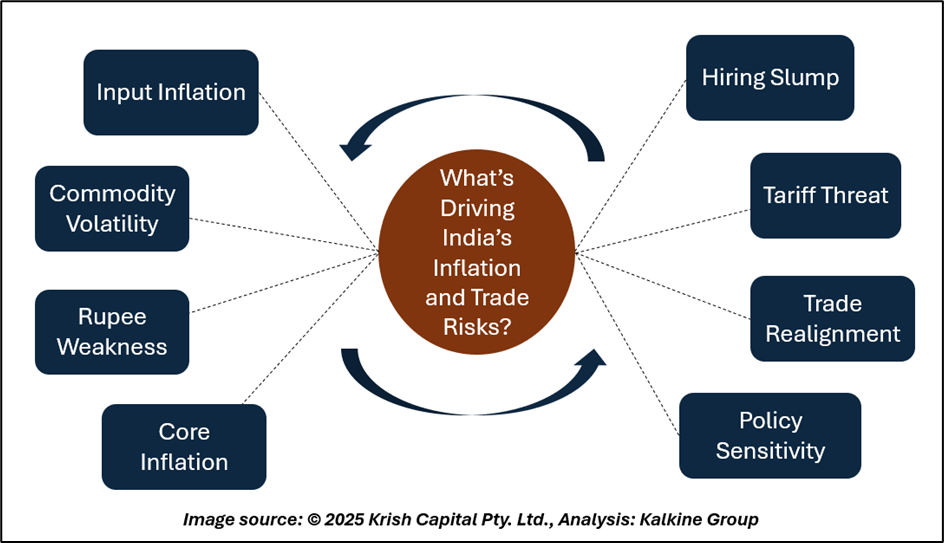

Inflation Concerns

Despite decent operational growth, business sentiment weakened, with manufacturers' confidence falling to its lowest level since July 2022. This cautious outlook was reflected in hiring activity, which slowed to its weakest pace since November 2024.

Around 93% of manufacturers reported having adequate staff for current production, indicating reluctance to expand workforces despite decent sales. Broader concerns about employment are also surfacing. A Reuters poll of economists questioned the accuracy of the official 5.6% unemployment rate for June, citing flaws in the data methodology, particularly regarding informal sector representation.

Tariff Threats

Inflationary pressures intensified in July, as businesses reported a more pronounced rise in input costs, largely driven by increasing raw material prices. These cost escalations are adding strain throughout the supply chain. This development comes amid expectations that the Reserve Bank of India (RBI) will maintain its benchmark interest rate at 5.50% in the upcoming policy review. However, a continued upward trend in inflation could prompt a reassessment of the central bank’s monetary policy stance.

Complicating the outlook further, external challenges are gaining prominence. The U.S. administration, led by President Donald Trump, plans to implement a 25% tariff on Indian exports starting this Friday. This move introduces a notable downside risk for India’s trade sector and could put additional pressure on bilateral relations between the two economies.

Conclusion

India’s manufacturing sector showed strong momentum in July 2025, supported by robust demand and output growth. However, rising inflation, softening business confidence, and external trade risks—especially looming U.S. tariffs—pose significant headwinds. The near-term outlook remains uncertain, with policy responses and global developments likely to shape the sector’s trajectory.