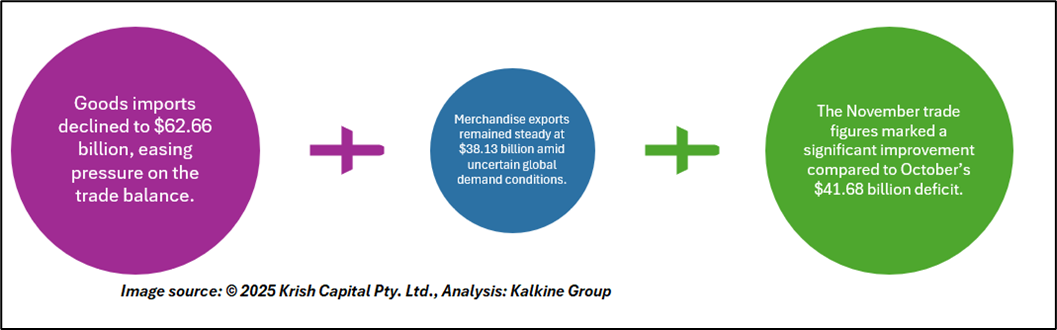

India witnessed a marked improvement in its merchandise trade balance in November, with the deficit narrowing significantly compared to the previous month. The deficit fell to $24.53 billion, a sharp correction from $41.68 billion in October, reflecting easing pressures on the import front and a relatively stable export performance. This turnaround helped restore balance after the deterioration seen earlier in the quarter.

Merchandise Exports Hold Steady

Merchandise exports during November were recorded at $38.13 billion, indicating resilience amid uncertain global demand conditions. While export growth remained moderate, the steady performance ensured that the contraction in the trade deficit was not undermined by a sharp fall in outward shipments. The export figures suggest that Indian manufacturers and exporters were able to maintain overseas demand despite external headwinds.

The primary driver behind the narrowing trade deficit was a notable decline in imports. Goods imports fell to $62.66 billion in November, easing pressure on the trade balance. Lower import volumes across key commodities helped bring down the overall import bill, providing immediate relief to the merchandise account.

Gold, Oil and Coal Imports Ease

A significant factor contributing to the reduced imports was a steep fall in gold shipments. Gold imports declined by nearly 60 percent during the month, substantially lowering overall import expenditure. In addition, reduced inflows of oil and coal further supported the contraction in imports. These commodities form a major portion of India’s import basket, and moderation in their volumes had a direct and visible impact on the trade deficit.

Services Trade Continues to Support External Balance

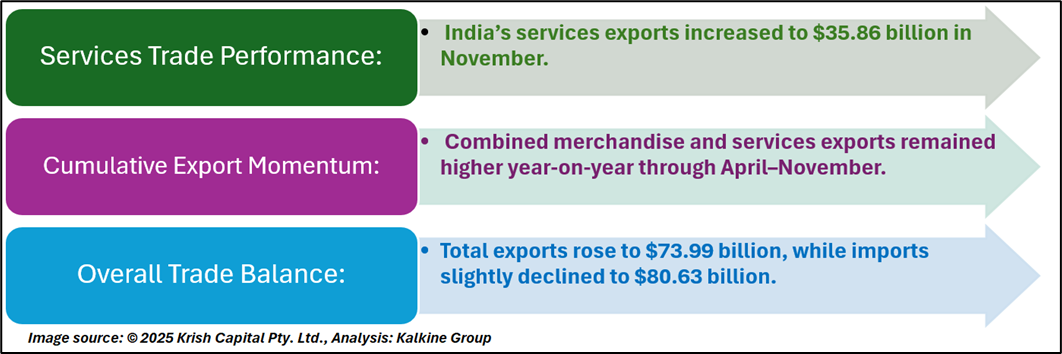

India’s services sector continued to act as a stabilising force for the external account. Services exports rose from $32.11 billion to $35.86 billion in November, highlighting sustained global demand for Indian services. Meanwhile, services imports edged up marginally to $17.96 billion, keeping the services trade surplus intact and helping offset part of the merchandise trade gap.

Officials highlighted that combined merchandise and services exports during the April–November period of the current financial year were higher on a year-on-year basis. This indicates that, despite month-to-month volatility, India’s overall export momentum remains intact. November’s improvement helped compensate for the losses recorded in October, effectively smoothing the trade trajectory.

On an aggregate basis, total exports in November reached $73.99 billion, rising from $64.05 billion in the same month last year. At the same time, overall imports slipped marginally to $80.63 billion, compared with $81.11 billion a year earlier. The combination of higher exports and slightly lower imports contributed to a more balanced trade position.

Outlook Remains Cautiously Optimistic

The sharp narrowing of the trade deficit in November suggests that adjustments in import patterns and steady services exports are improving India’s external trade dynamics. While global economic uncertainty continues to pose risks, the latest figures provide cautious optimism that trade pressures may remain manageable in the coming months, supported by disciplined imports and consistent export performance.