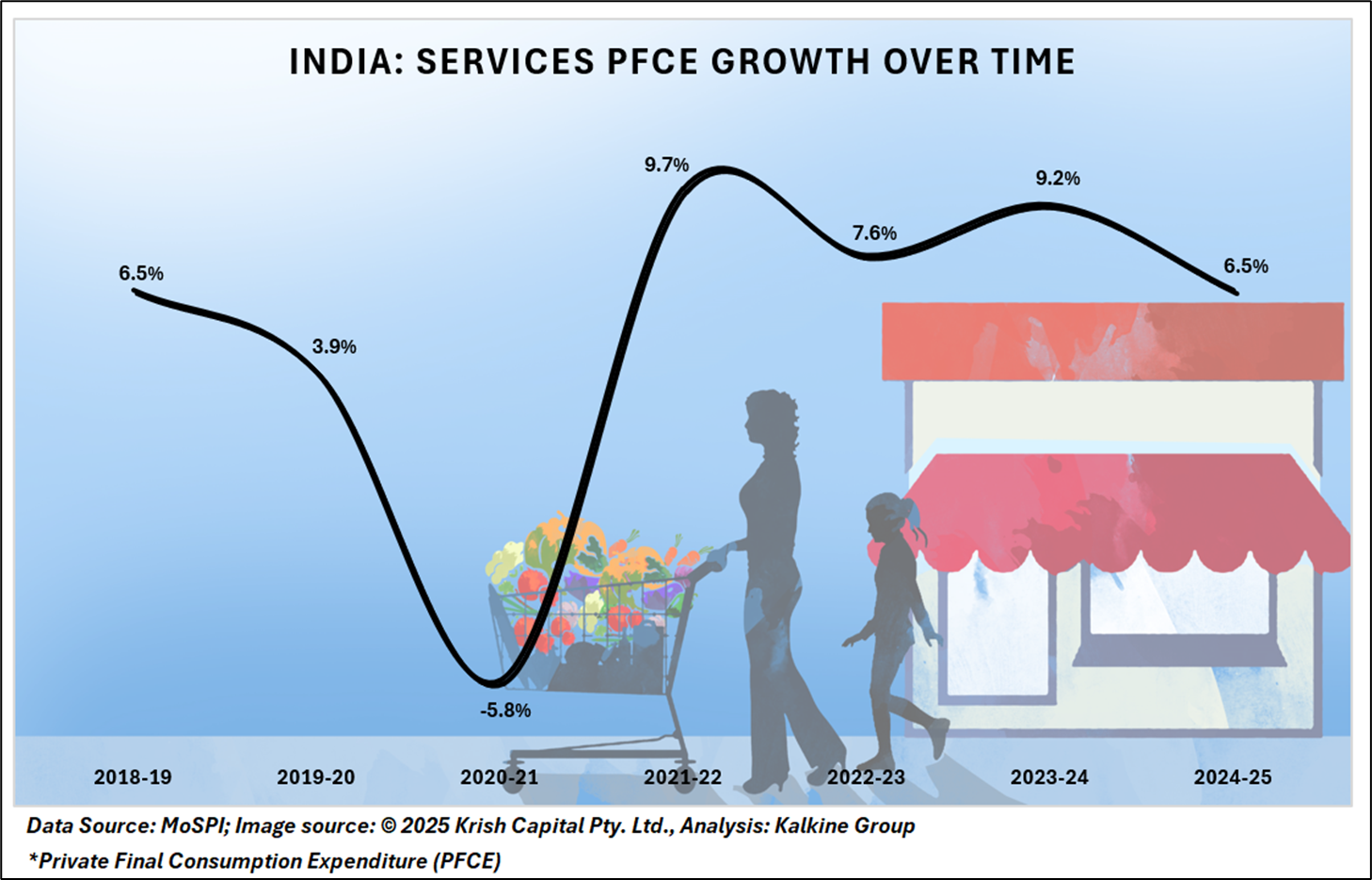

India's services sector has witnessed a notable upswing in June 2025, with the Purchasing Managers’ Index (PMI) for services climbing to a 10-month high. This resurgence points to strengthening domestic demand and signals broader economic resilience, particularly in non-manufacturing industries that contribute significantly to India’s GDP.

Strong PMI Signals Economic Momentum

India’s seasonally adjusted Services PMI rose to 60.4 in June, up from 58.8 in May, though marginally lower than the flash estimate of 60.7, as reported by S&P Global. A PMI above 50 indicates expansion, and this sustained rise highlights increased new business intakes, stronger consumer confidence, and improved employment levels. More importantly, this upward movement marks the 24th consecutive month of expansion, indicating the sector's robust contribution to post-pandemic economic normalization.

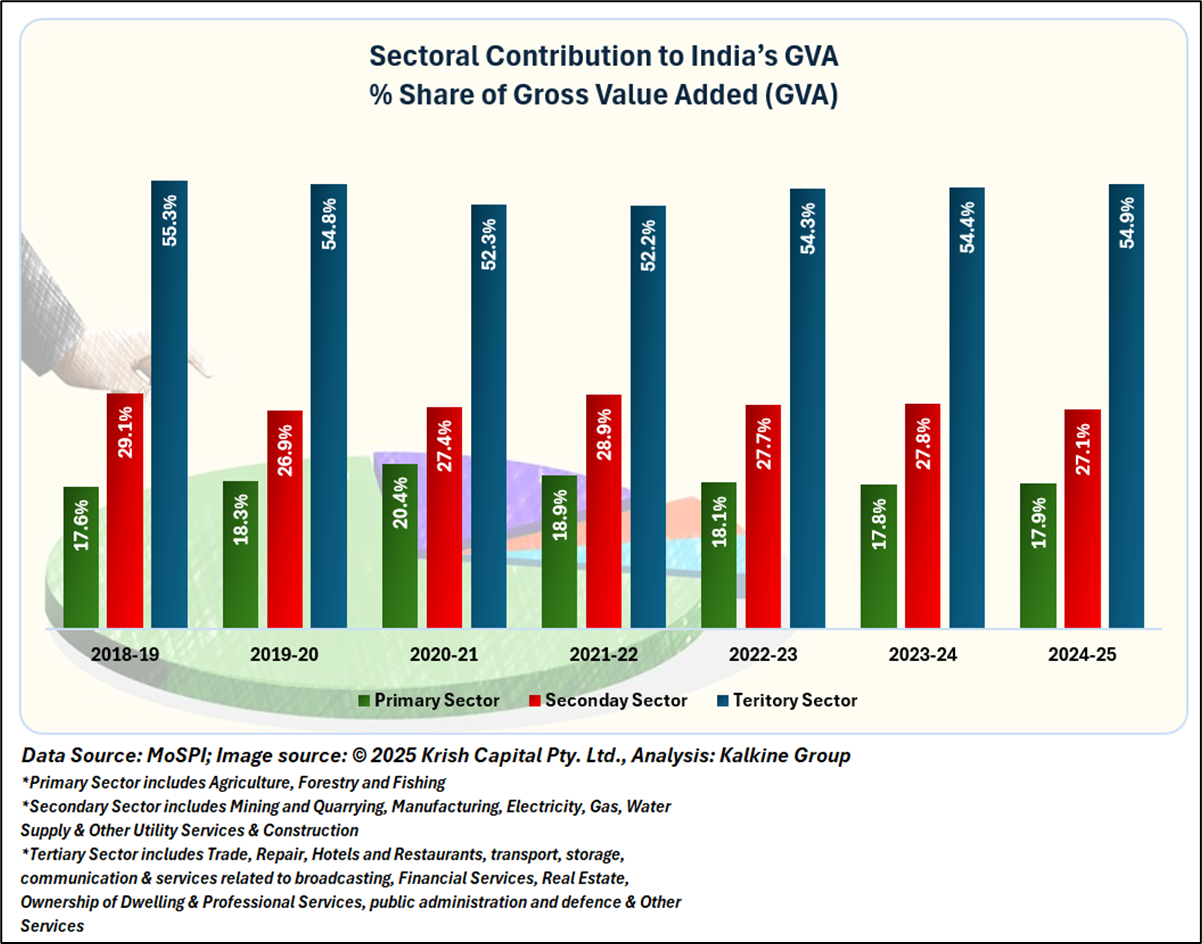

From an economic standpoint, the services sector comprising transport, finance, IT, hospitality, healthcare, and education accounts for over 50% of India’s gross value added (GVA). Growth in this sector helps balance weaknesses in agriculture or industry and supports job creation, consumption, and fiscal revenues. The June PMI figures indicate that the services sector may remain a key driver of India’s GDP growth, even as global challenges persist.

Demand-Led Expansion and Cost Dynamics

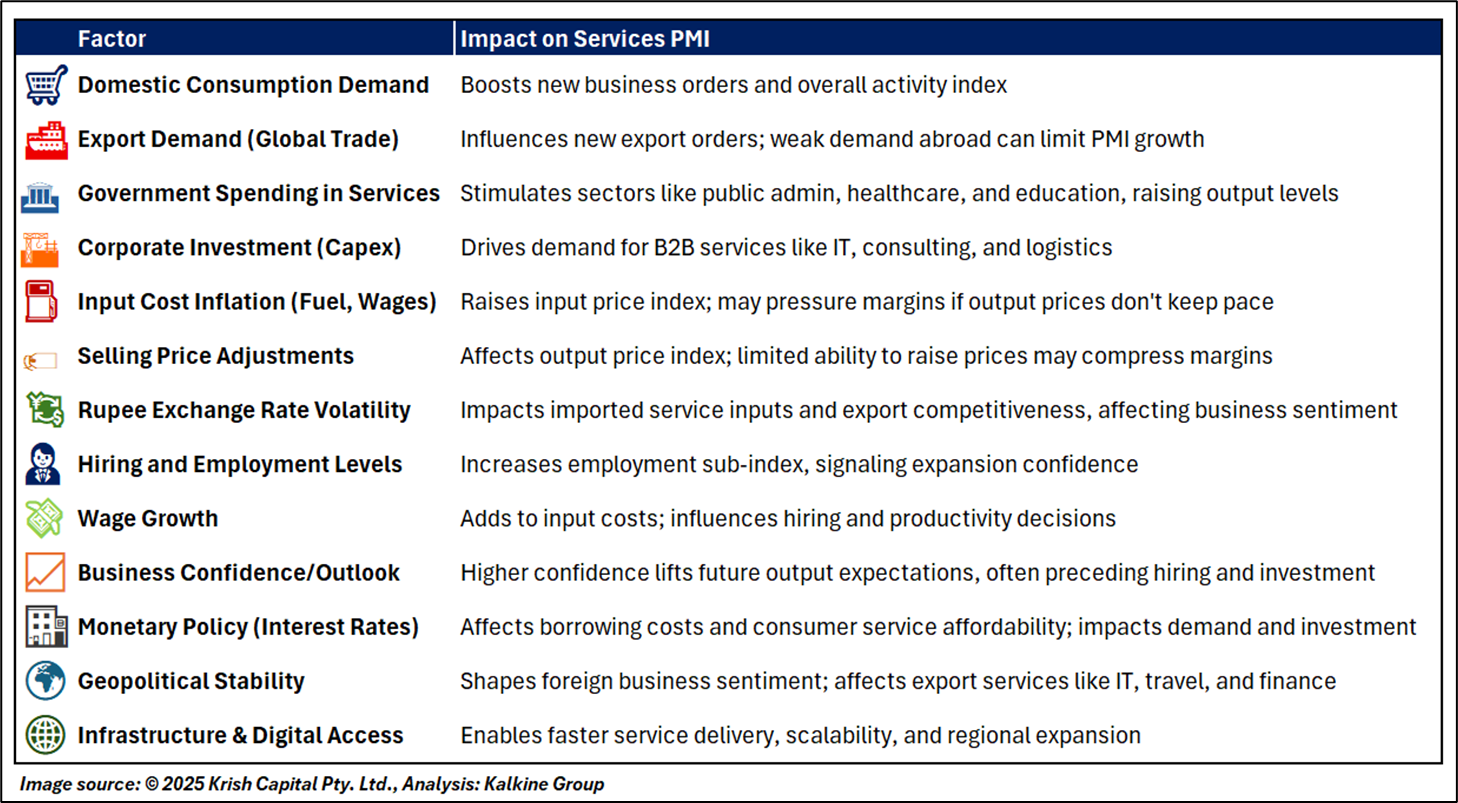

A key driver of the June PMI increase was a surge in new business orders, reflecting a resilient domestic consumption environment. Anecdotal evidence from the survey indicated strong client demand across consumer services and business support functions. However, foreign demand saw only modest growth, indicating that while global services trade remains sluggish, India’s domestic economic fundamentals remain healthy.

The economic impact of increasing input costs was also significant. Input price inflation accelerated in June, largely driven by higher labor, fuel, and transportation costs. Yet, service providers only marginally raised output charges, suggesting a conscious decision to absorb cost pressures to maintain competitiveness. This may support continued demand in the short term but could weigh on service sector margins if cost pressures persist.

The input-output price gap has widened for the third straight month, potentially impacting profitability. Still, the ability of firms to maintain business volume despite cost inflation shows underlying strength in consumer purchasing power and enterprise confidence.

Employment Outlook and Policy Implications

The services sector also reported modest job creation in June, continuing a six-month trend of net employment additions. Although hiring remains measured, gradual gains point to growing business confidence and improved growth outlook. The Business Expectations Index remained strong, with more than 20% of firms anticipating higher activity over the next 12 months.

From a policy lens, sustained expansion in services may influence monetary policy decisions. The Reserve Bank of India (RBI), which held rates steady at its last meeting, may interpret the decent PMI reading as a sign of continued domestic strength, reducing the need for immediate rate cuts. However, persistent cost pressures and uneven external demand could temper inflation expectations and keep the RBI cautious.

Additionally, a booming services sector creates fiscal space for the government, as indirect tax collections (such as GST on services) improve. Higher services output can also support urban consumption, employment, and ancillary industrial activity, reinforcing the economy's internal growth engines amid global volatility.

Conclusion

India’s services sector continues to anchor economic momentum, with strong domestic demand, steady employment gains, and resilient output growth. Despite rising input costs and subdued external demand, the sector’s expansion highlights robust fundamentals. As global uncertainties persist, sustained services growth will be crucial in supporting GDP, fiscal health, and overall macroeconomic stability in the near term.