India saw a sharp contraction in net foreign direct investment (FDI) inflows in May 2025, driven by increased repatriation of capital by overseas investors and a decline in fresh inflows, according to the RBI’s latest monthly Bulletin.

FDI Declines

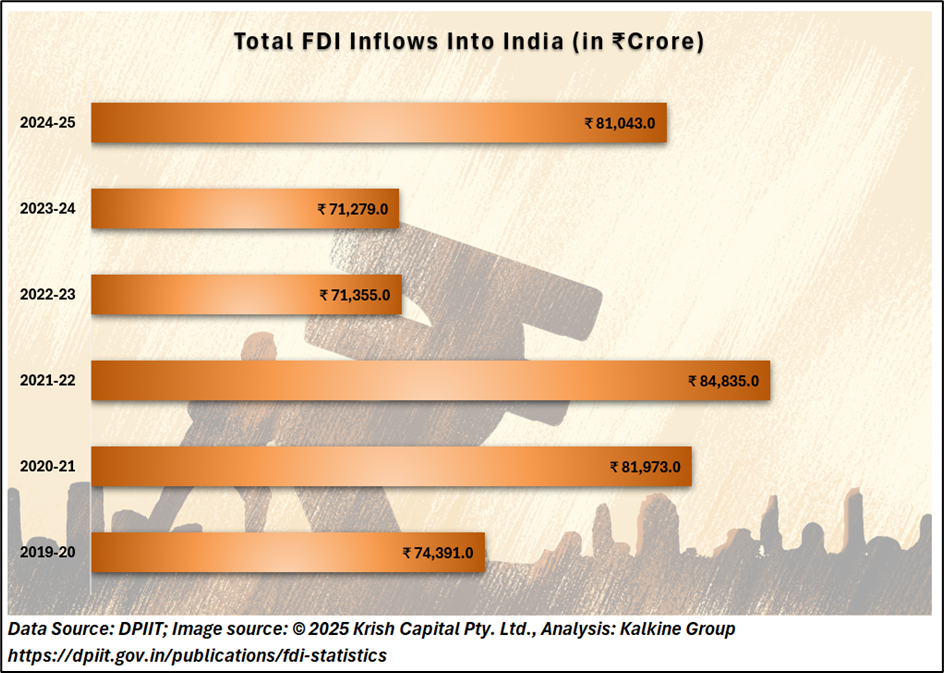

Net FDI into India dropped by 98% YoY to just USD 35 million in May 2025. This marks a dramatic decline compared to USD 3.2 billion received in May 2024. On a sequential basis, net inflows were 99% lower than April, reflecting a significant retreat by foreign investors. A key contributor to this decline was the 24% rise in repatriation, which touched USD 5 billion during the month.

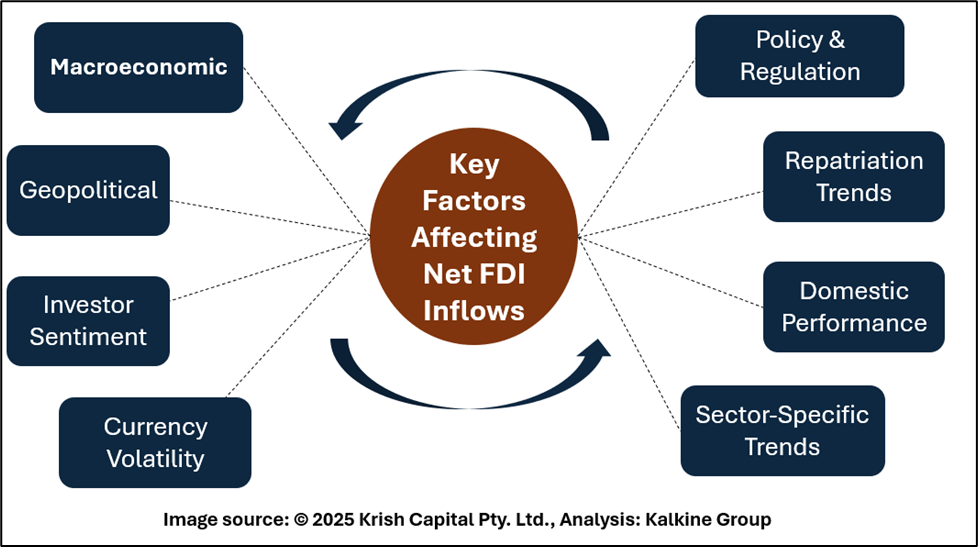

In contrast, gross FDI inflows fell by 11% YoY to USD 7.2 billion, indicating weaker interest from global investors. Experts attribute the uptick in repatriation to profit-booking amid global economic uncertainty, tighter monetary conditions, and evolving regulatory environments. Outward FDI also increased modestly to USD 2.1 billion, up from USD 1.8 billion in the same month last year. This points to Indian companies’ ongoing global expansion, even as net inbound investment slows.

Sectoral Inflows

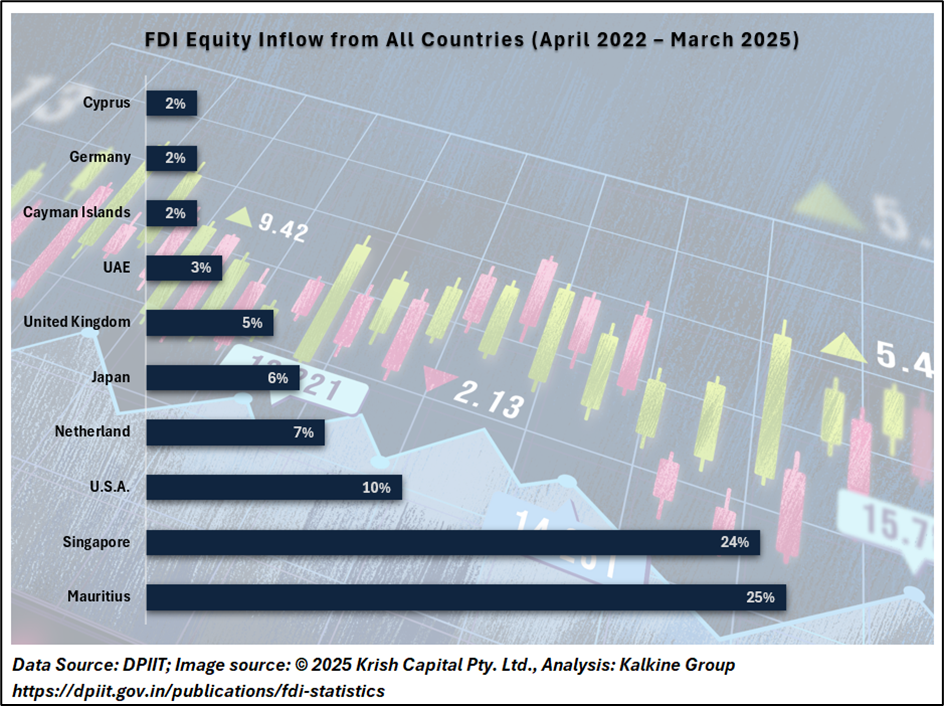

Despite the decline in net FDI, a few countries continued to account for the bulk of incoming investment. As per RBI data, over 75% of India’s total FDI inflows in May 2025 originated from four key countries — Singapore, Mauritius, the United Arab Emirates, and the United States.

On a sectoral basis, manufacturing, financial services, and computer services attracted the highest FDI inflows. This suggests that while overall investor sentiment has weakened, interest in core service and industrial sectors remains intact.

In terms of outward FDI, the main destination countries were Mauritius, the United States, and the UAE, with sectors such as transport, storage and communication services, manufacturing, and financial, insurance and business services seeing the most activity.

Reserves Stability

In contrast to the sharp decline in net FDI, portfolio investments posted net inflows of USD 1.6 billion in May, reversing the outflow trend seen in the same month last year. This indicates that foreign institutional investors (FIIs) remained relatively more active in equity and debt markets than in long-term direct investments.

India’s foreign exchange reserves stood at USD 696.7 billion as of March 2025, providing coverage for more than 11 months of goods imports and 95% of total external debt. While FDI remains a more stable, long-term capital source than portfolio flows, the robust reserves offer a strong cushion against short-term external vulnerabilities.

Conclusion

The 98% drop in net FDI inflows raises short-term concerns about India’s investment attractiveness amid changing global dynamics. While this appears to be driven more by higher profit repatriation than a collapse in incoming capital, the trend signals caution among global investors.

From a macroeconomic perspective, the resilience of foreign exchange reserves and positive portfolio flows provide some stability. However, a sustained slowdown in FDI could impact India’s medium-term growth, especially in capital-intensive sectors. Policymakers may need to focus on regulatory clarity, ease of doing business, and investor confidence-building measures to attract long-term foreign capital in the months ahead.