Oil prices declined on Tuesday, retreating from a 2% surge seen the day before. Brent crude slipped by 21 cents to $69.37 per barrel, while West Texas Intermediate (WTI) dropped 24 cents to $67.69. The dip was driven by heightened U.S. The decline followed two major developments U.S. tariff escalation under former President Donald Trump’s revived “America First” policy, and a larger-than-expected output hike by OPEC+ for August.

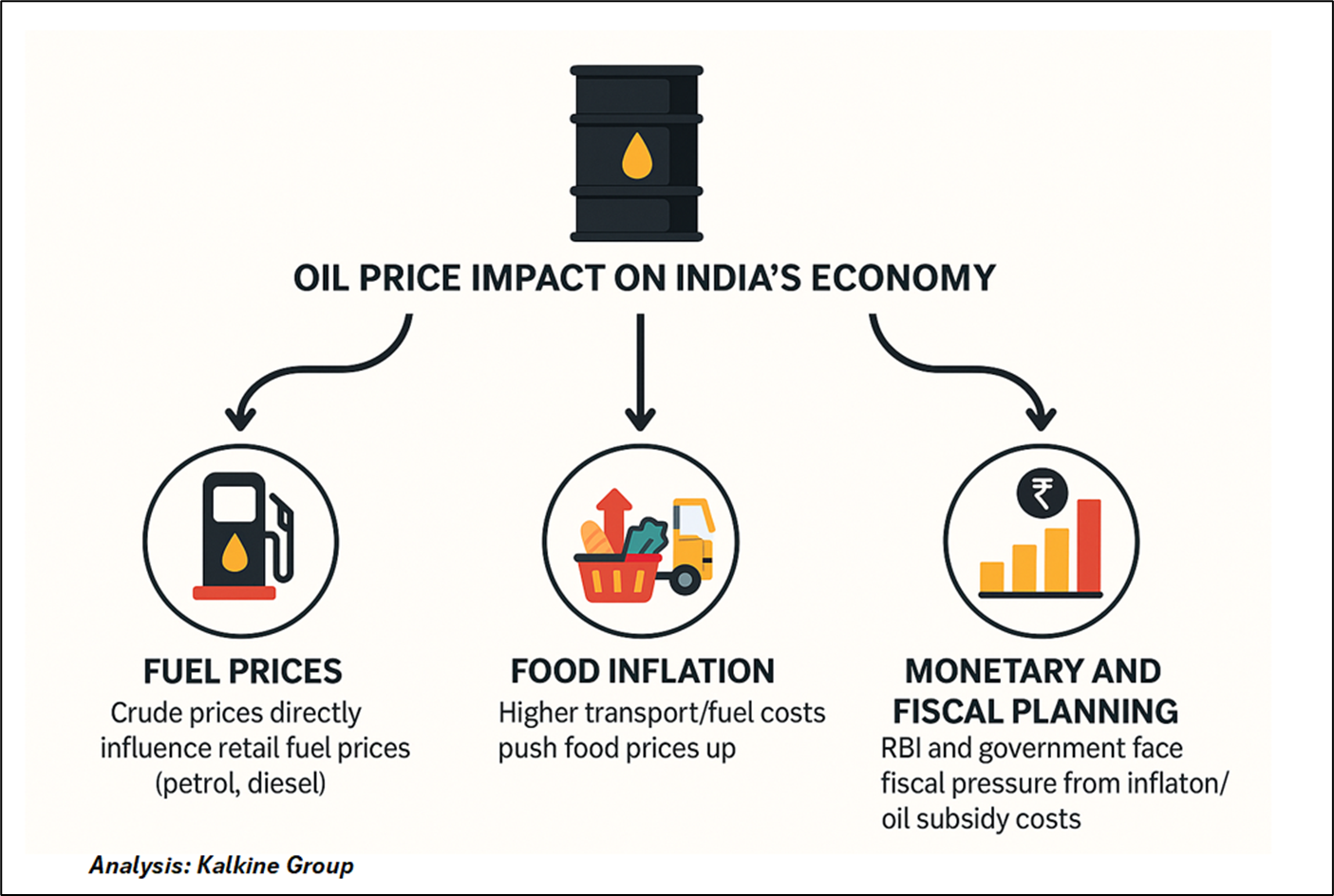

For India, the world’s third-largest oil importer, this easing in crude prices offers near-term relief. Lower oil prices reduce import bills, help manage inflation and offer room for the Reserve Bank of India (RBI) to maintain its policy stance. However, the underlying reasons behind the price movement pose medium-term economic risks.

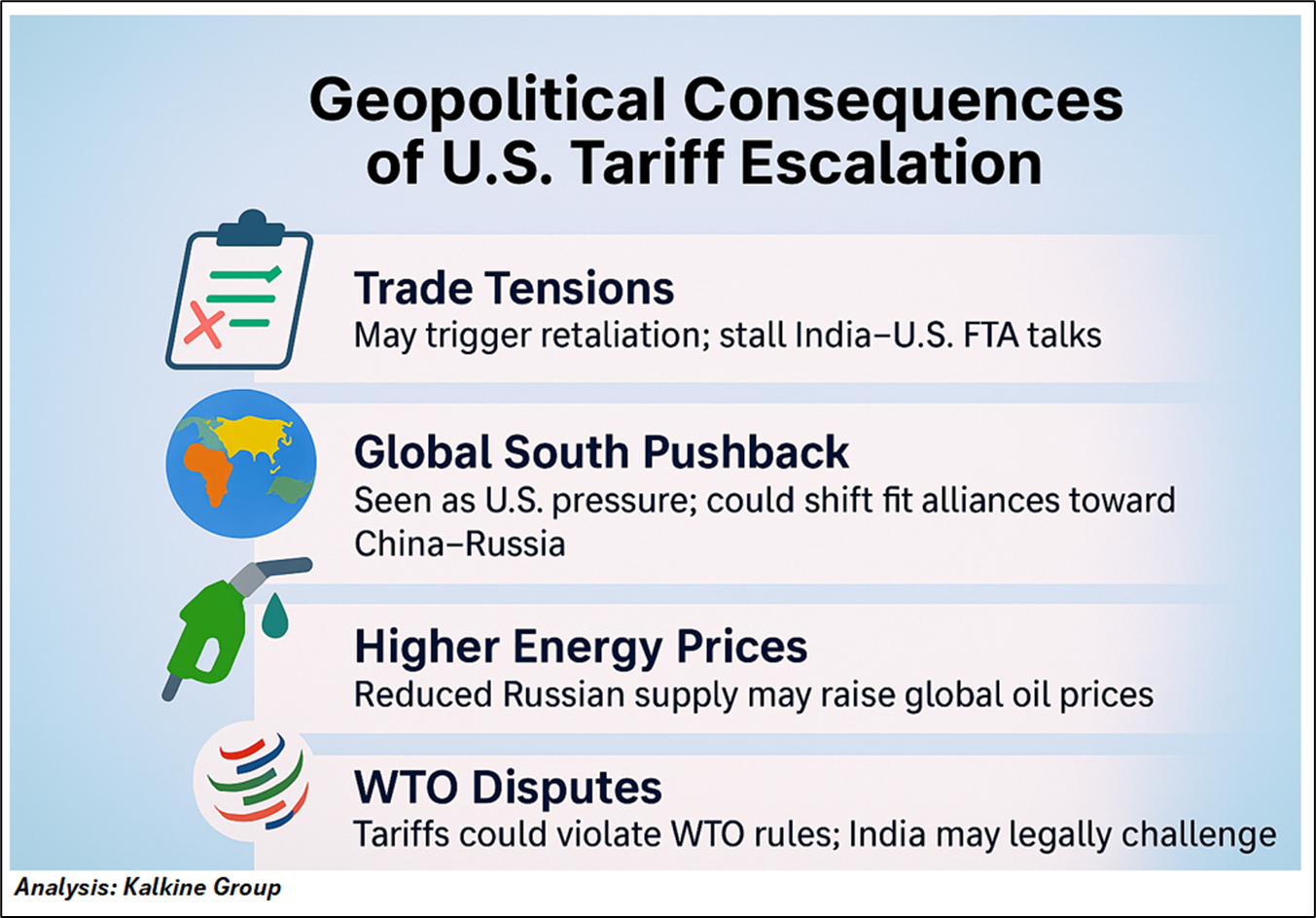

Trump’s aggressive tariff plan targeting nations trading with Russia directly affects India, a key buyer of discounted Russian crude. Meanwhile, OPEC+’s decision to raise output by 548,000 barrels per day (bpd) also changes the global supply dynamics. While a potential increase in supply typically exerts downward pressure on prices, concerns over U.S. trade penalties create new uncertainties for oil flows and India’s overall export trajectory.

Crude Consequences

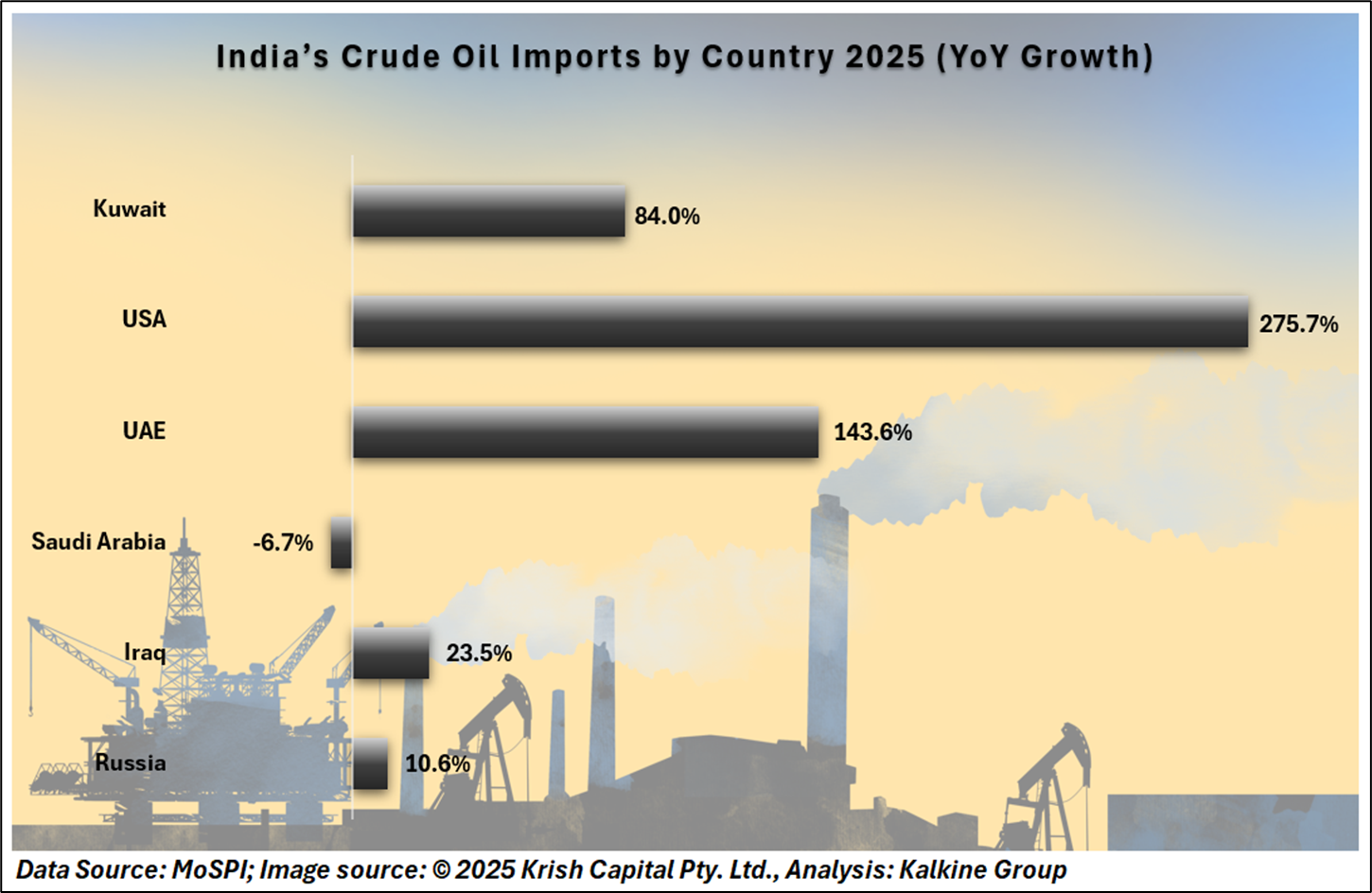

The U.S. legislation proposes tariffs as high as 500% on imports from countries engaged in direct or indirect trade with Russia’s energy sector including oil, gas, coal, and uranium. While not yet enacted, this measure could significantly impact India, which imports over a third of its crude oil needs from Russia.

India’s reliance on discounted Russian oil has helped manage inflation and the trade deficit, but new U.S. tariffs could penalize Indian exports if purchases continue. Reducing imports raises fuel costs, while continuing risks export losses both pressuring inflation and trade balance, possibly requiring policy shifts or tariff negotiations.

Oil Outlook

OPEC+ plans to raise oil output by 548,000 bpd in August and 550,000 bpd in September, though actual increases mainly led by Saudi Arabia have lagged. For India, higher supply may ease crude prices, but shortfalls and geopolitical tensions could trigger volatility. U.S. travel demand and speculative buying may also keep prices elevated. India’s inflation-sensitive economy continues to face risks as climbing oil prices drive up fuel, food, and transportation costs. While energy diversification offers some cushion, abrupt policy moves by OPEC or renewed U.S. sanctions could disrupt fiscal discipline and pressure monetary policy.

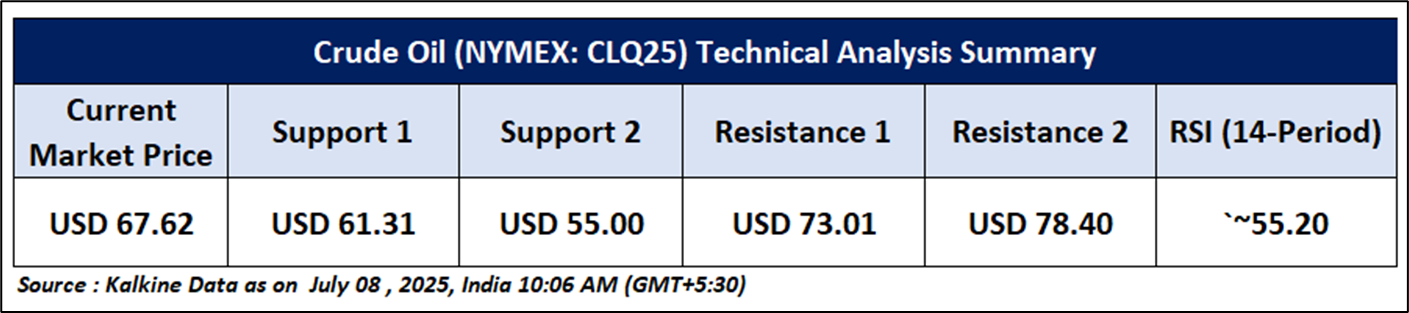

Technical Analysis

Light Crude August futures are showing signs of short-term consolidation after a sharp rally in late June. Despite the recent pullback, the price continues to trade above key support near $64, maintaining its higher-low structure. The RSI (14) stands at 55.20, easing from overbought territory but still indicating underlying bullish strength. The recent surge in momentum, followed by a healthy cooldown, suggests potential for another leg higher if support holds. A break above $73.01 could revive upward momentum, while a dip below $61.31 may invite further profit booking. Overall trend remains cautiously bullish above support.

Conclusion

India may benefit temporarily from the dip in oil prices, but underlying geopolitical and trade developments present deeper risks. Rising U.S. tariff threats and uncertain OPEC+ output could disrupt energy flows, pressure inflation, and challenge fiscal stability. Sustained vigilance and strategic policy responses will be essential to safeguard India’s economic interests amid evolving global oil market dynamics.