In its latest bi-monthly policy review on August 6, 2025, the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) opted to keep the repo rate unchanged at 5.5%, continuing with its neutral stance. This decision comes amid evolving macroeconomic conditions, including easing inflation and stable economic growth indicators. Rate-sensitive sectors such as banking, non-banking financial services, real estate, and automobiles witnessed muted trading in response to the announcement.

Inflation Outlook

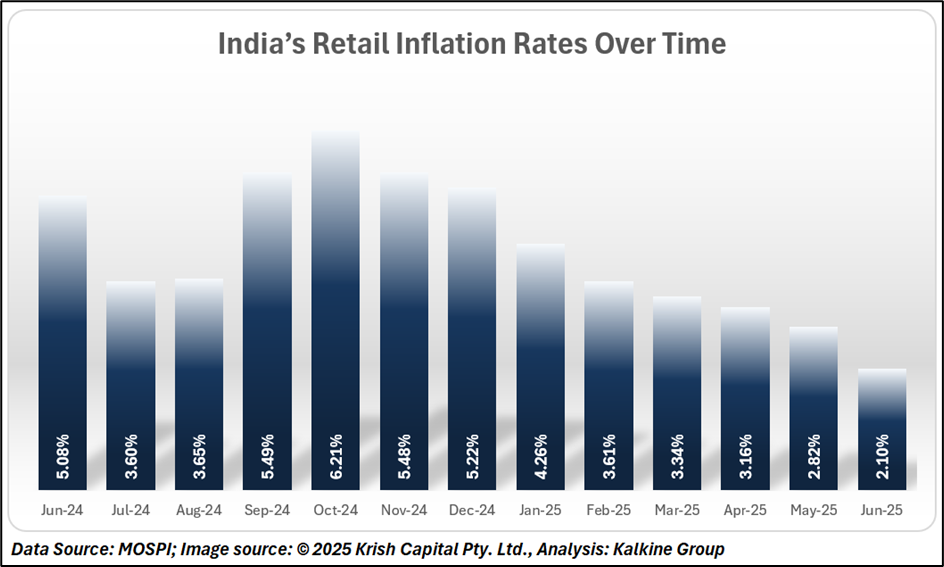

The central bank revised its consumer price index (CPI) inflation projections downward for most of the financial year 2025–26 (FY26), indicating a reduction in near-term inflationary pressures. Headline inflation for the year is now pegged at 3.1%, down from 3.7% earlier. The downward revision is most pronounced in Q2FY26, where inflation is forecast at 2.1%, compared to the prior estimate of 3.4%. Q3FY26 is projected at 3.1%, down from 3.9%, while the Q4 forecast remains unchanged at 4.4%. For Q1FY27, inflation is estimated to rise to 4.9%, hinting at a potential uptick in price levels.

RBI Governor Sanjay Malhotra noted that while core inflation remains steady at around 4%, food and energy prices continue to pose risks. He added that "retail inflation is likely to see an uptick in the last quarter of FY26," in line with most analyst expectations.

GDP Growth

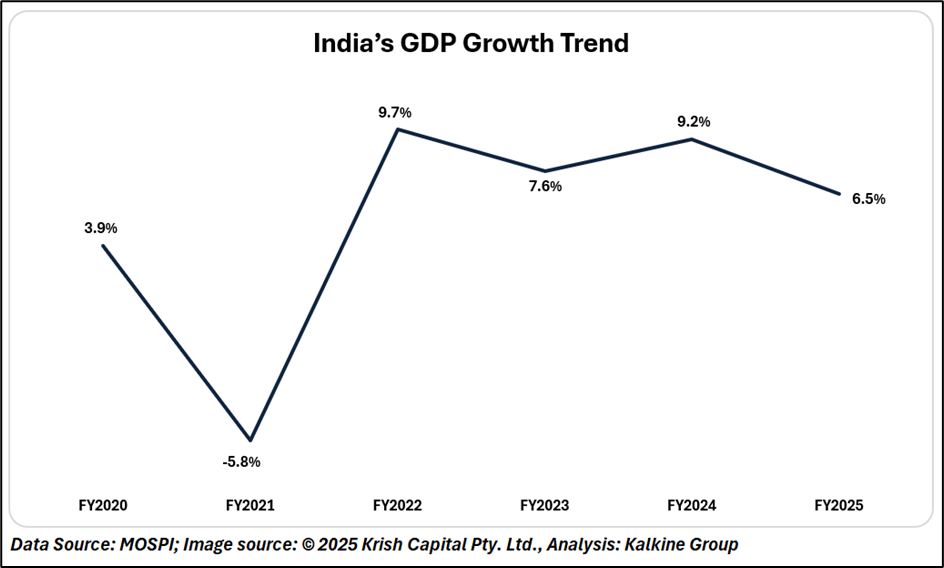

On the economic growth front, the RBI retained its real GDP growth forecast for FY26 at 6.5%, suggesting confidence in the Indian economy’s resilience. Quarterly projections remained unchanged, with growth expected at 6.5% in Q1, 6.7% in Q2, 6.6% in Q3, and 6.3% in Q4.

The Governor highlighted that domestic growth "is evolving along the lines of our assessment," though some high-frequency indicators reflected mixed signals during May and June. He emphasised that India’s long-term economic outlook remains favourable due to "inherent strengths, decent fundamentals, and comfortable buffers."

Markets Reaction

Financial markets reacted with caution to the unchanged policy. The Bank Nifty slipped slightly, indicating a muted investor response in the absence of major surprises. Most analysts had expected a “dovish pause” this time, particularly after three successive rate reductions totaling 100 basis points in recent meetings.

The RBI’s neutral policy stance reflects a wait-and-see approach, aiming to balance the ongoing disinflation trend with the necessity to sustain growth. This careful positioning considers potential risks from external shocks, fiscal challenges, and geopolitical uncertainties.

Conclusion

The RBI’s decision to maintain the repo rate at 5.5% underscores its cautious approach amid easing inflation and stable growth. With inflation forecasts lowered and GDP outlook intact, the central bank signals confidence in macro stability while remaining vigilant to emerging risks, opting for policy continuity over aggressive moves.