The Reserve Bank of India’s Monetary Policy Committee (MPC) commenced its three-day meeting in Mumbai to review India’s key interest rates, with the policy decision scheduled for Friday, June 6, 2025. The meeting comes against the backdrop of easing inflation, which has dropped below the central bank’s medium-term target of 4% for the first time in months.

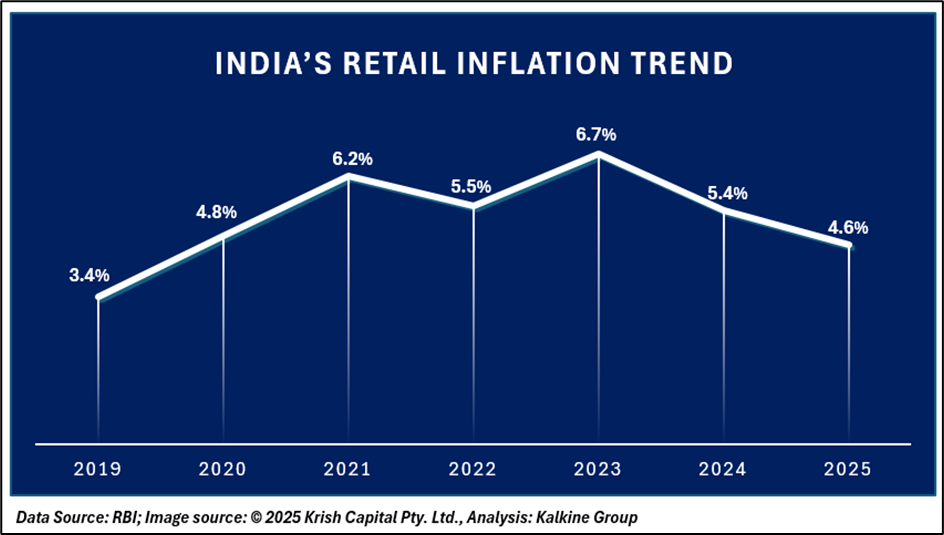

As per the Ministry of Statistics and Programme Implementation, India's retail inflation eased to a six-year low of 3.16% in April 2025, falling from 3.34% recorded in March. This decline was driven by multiple contributing factors:

- Easing Food Prices: Softer prices for vegetables, cereals, and edible oils supported by a strong rabi harvest and improved supply chains played a central role.

- Favourable Base Effect: Last year’s higher prices made the year-on-year comparison appear more modest.

- Stable Crude Oil Prices: International oil prices remained steady, helping reduce imported inflation pressures.

- Slower Core Inflation: Core inflation (excluding food and fuel) showed weaker momentum across sectors such as healthcare, education, and housing.

- Government Intervention: Policy actions like export restrictions on select food items and strategic release of foodgrain stocks also helped stabilise prices.

Previous Rate Cuts and Monetary Response

The current MPC meeting follows two successive repo rate cuts earlier in 2025. The RBI lowered the policy rate by 25 basis points in February, from 6.5% to 6.25%, and implemented another 25-bps reduction in April, bringing the rate to 6%.

RBI Governor Sanjay Malhotra, who chairs the MPC, justified the April decision as a balanced response to macroeconomic conditions, aiming to support growth without compromising inflation stability. The RBI's strategy so far reflects a cautious attempt to ensure inflation expectations remain well-anchored while addressing signs of slowing credit demand and private investment.

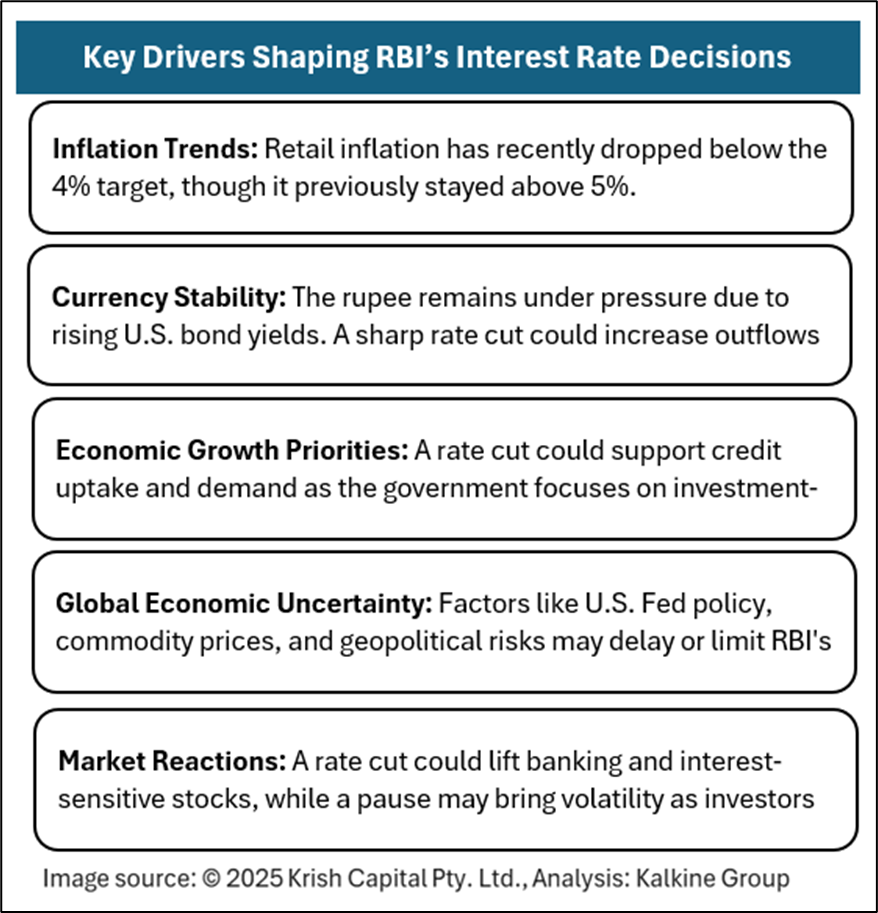

Key Factors Influencing RBI’s Interest Rate Decision

The Reserve Bank of India's stance on rate cuts will depend on a range of economic indicators, both from within the country and from global developments.

The RBI’s policy move will aim to strike a careful balance between supporting economic growth and ensuring macroeconomic stability in the face of evolving domestic and global conditions.

Conclusion

As the RBI's Monetary Policy Committee concludes its deliberations, all eyes are on the central bank’s next move amid a rare window of easing inflation and subdued core price pressures. With retail inflation now below the 4% target and past rate cuts already in motion, the RBI faces a crucial opportunity to further stimulate growth while maintaining financial discipline. However, given global uncertainties and the need to preserve price stability, any decision is likely to reflect a measured and data-driven approach. The outcome of this meeting will serve as a key signal of the RBI’s forward-looking policy direction in a dynamically shifting economic landscape.