The Reserve Bank of India (RBI), in its June 6, 2025, Monetary Policy Committee (MPC) meeting, implemented a set of impactful policy measures aimed at stimulating the economy and reversing the recent credit growth slowdown. With inflation remaining well within target, the central bank has taken a more aggressive stance to support growth without compromising price stability.

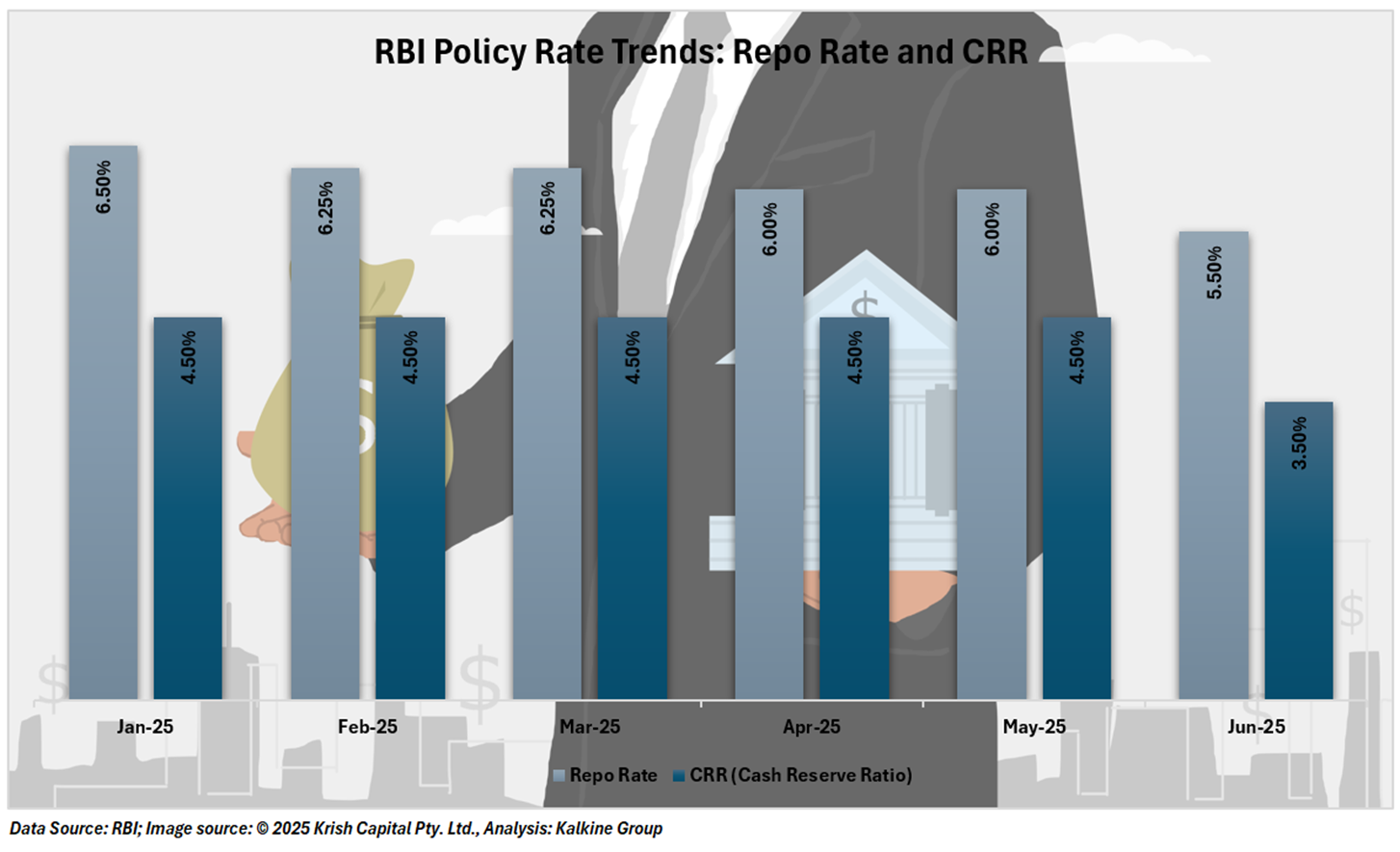

Key Policy Moves: Repo Rate and CRR Reduced: In an unexpected move, the Reserve Bank of India (RBI) lowered the repo rate by 50 basis points, reducing it from 6.0% to 5.5%. This marks the third rate cut in 2025, amounting to a total reduction of 100 basis points so far this year. The repo rate serves as the key policy rate at which the RBI provides short-term funding to commercial banks. A reduction in this rate typically leads to lower borrowing costs across the economy, impacting everything from home loans to business financing.

The Reserve Bank of India has also decided to cut the Cash Reserve rate (CRR) by 100 base points, reducing it from 4.5% to 3.5%. This reduction will be executed in four equal stages starting on September 6, 2025.

Despite the aggressive rate cut, the RBI maintained a neutral policy stance. This suggests it is not committed to further tightening or easing in the near term. The central bank aims to strike a balance between encouraging growth and managing inflation expectations. This flexibility allows the RBI to respond to emerging economic data, especially as global conditions remain uncertain.

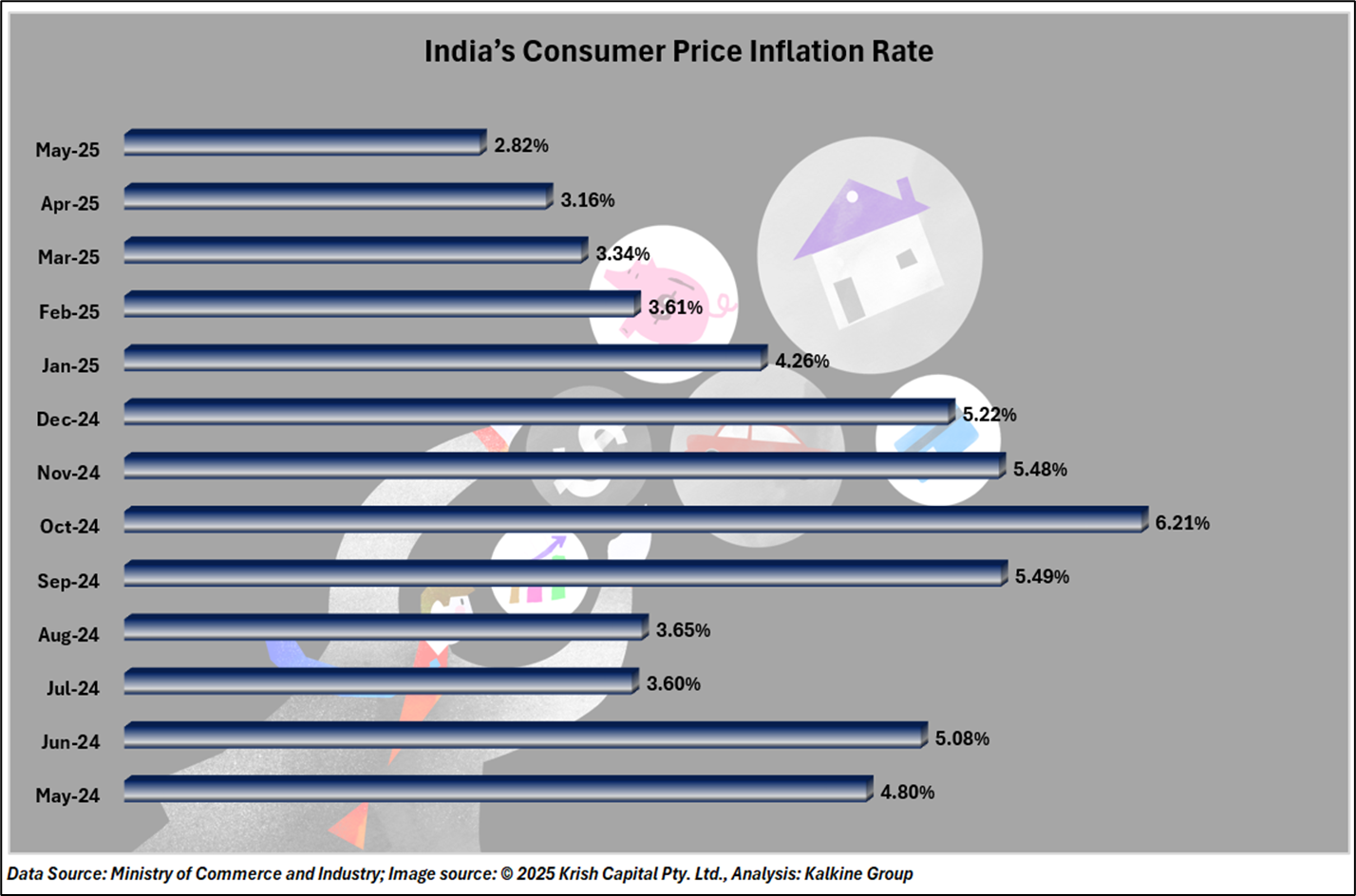

Inflation Outlook Remains Supportive: Retail inflation dropped to a 6 Year low of 3.16% in April 2025. In response to this downward trend, the Reserve Bank of India (RBI) has revised its inflation projection for FY26 to 3.7%, down from the earlier estimate of 4%. This revised forecast remains well within the RBI’s mandated inflation range of 2% to 6%, and close to its medium-term target of 4%.

The decline in inflation enhances the purchasing power of consumers and provides the RBI with greater room to lower interest rates without triggering a price surge. A stable inflation environment is key to sustaining lower rates and encouraging spending.

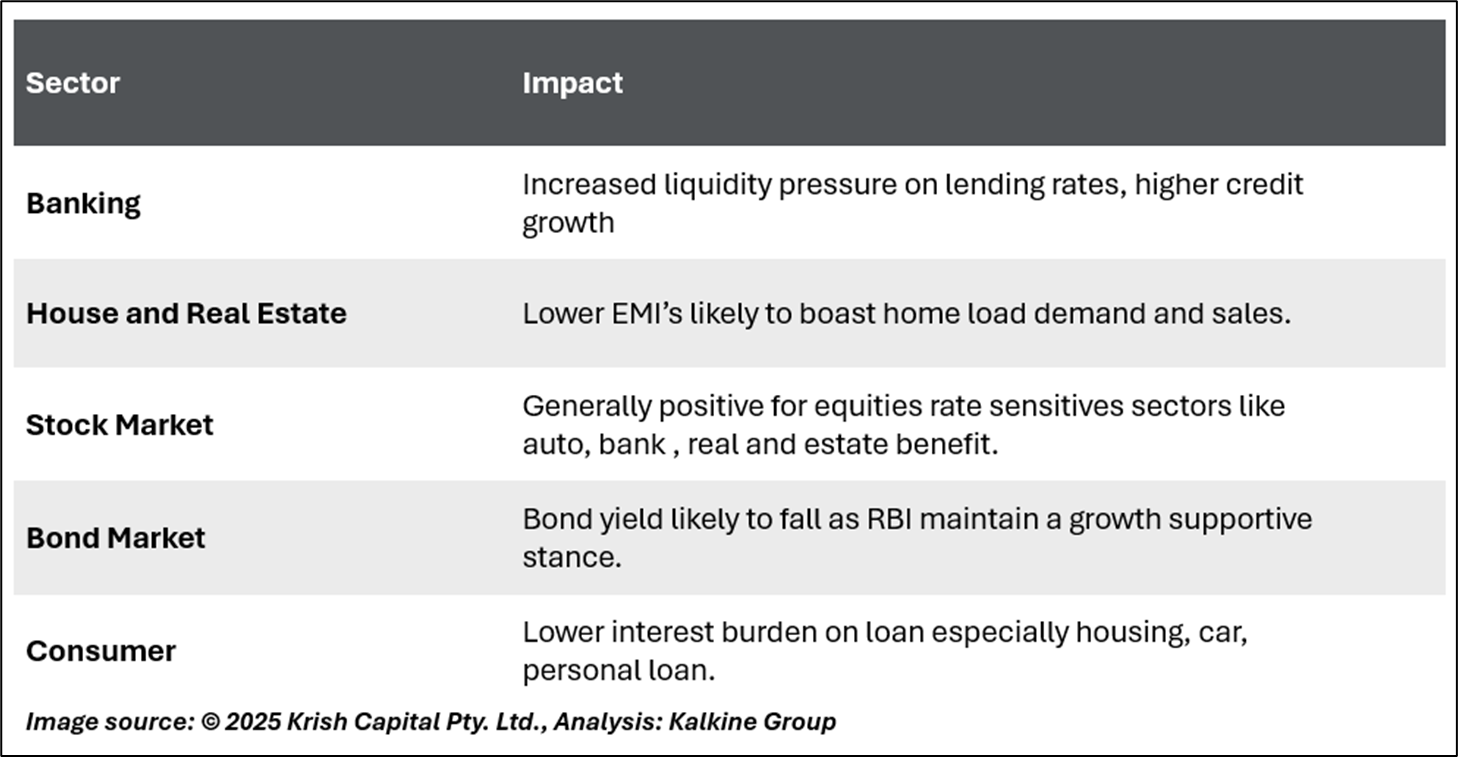

Reviving Credit Growth in FY26: India Ratings and Research (Ind-Ra) anticipates that these policy measures will help revive bank credit growth, which had declined to 9.9% in April 2025. With lower borrowing costs and improved liquidity conditions, Ind-Ra forecasts a rebound in credit growth to between 13% and 13.5% in FY26. Sectors likely to benefit include housing, real estate, and small businesses, where demand had weakened due to high lending rates and tighter liquidity. While lending to non-banking financial companies (NBFCs) and the retail sector may moderate, the RBI's actions are set to support private capital expenditure a key driver of sustainable growth.

Conclusion

The RBI's recent policy actions reflect a strategic shift toward growth revival. By lowering the cost of funds and injecting liquidity, the central bank is enabling banks to extend credit more freely. The combination of low inflation, improved liquidity, and falling interest rates creates a conducive environment for economic activity to pick up pace. If implemented effectively, these measures could mark a turning point in India's credit cycle supporting both consumer confidence and private sector investment as FY26 progresses.