The Reserve Bank of India (RBI) has reduced the repo rate by 25 basis points after a unanimous decision by the Monetary Policy Committee (MPC). At the same time, the RBI kept its policy stance neutral, while indicating a greater focus on growth due to current economic uncertainties.

The central bank stated that inflation has eased more than earlier expected. This has created space to support economic activity without risking price stability. The RBI added that future rate decisions will depend on incoming economic data.

Focus on Growth Conditions

The rate cut reflects concerns around growth conditions, both globally and within India. The RBI noted that uncertainties related to global demand and financial conditions remain. As a result, policy decisions will continue to balance growth needs with inflation control. The RBI also indicated that the current inflation-growth balance leaves room for another rate cut if conditions allow.

Liquidity Support Measures

To support liquidity in the financial system, the RBI announced additional measures. These include government bond purchases worth ₹1 lakh crore through open market operations.

The central bank also introduced a $5 billion foreign exchange swap with a three-year maturity. These steps are intended to ensure sufficient liquidity in the banking system and support smooth transmission of policy rates.

Inflation Forecast Revised Lower

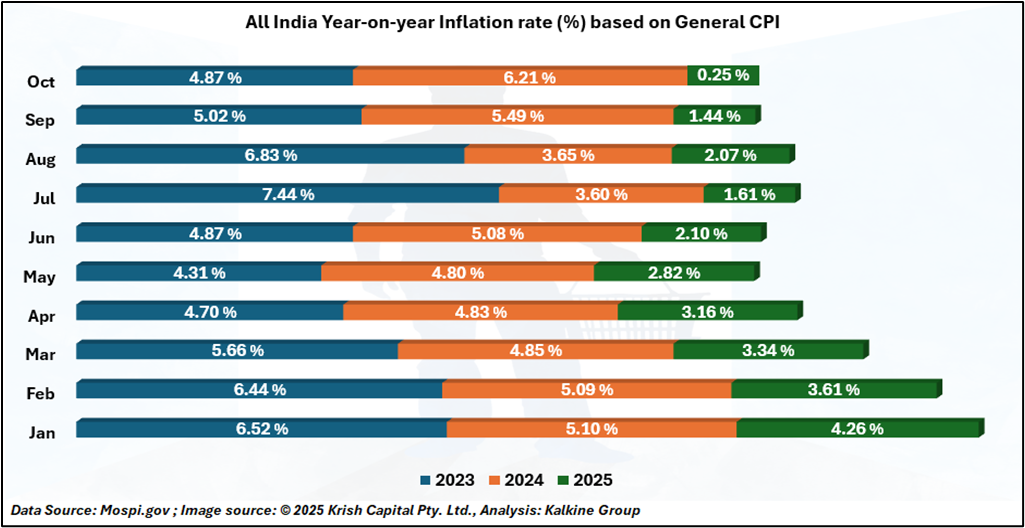

The RBI has sharply reduced its inflation forecast for FY26. The full-year CPI inflation estimate has been lowered to 2 percent from the earlier projection of 2.6 percent. Inflation for the first half of FY26 is now expected to remain around or below the 4 percent level, which is within the RBI’s tolerance range.

Quarter-wise Inflation Projections

For the second half of the fiscal year, inflation forecasts have been cut significantly. The

RBI now expects inflation in the third quarter of FY26 at 0.6 percent, compared to 1.8 percent projected earlier. Inflation in the fourth quarter of FY26 is now estimated at 2.9 percent, reduced from the previous estimate of 4 percent.

Reasons for Lower Inflation

The RBI Governor said that core inflation has moderated and is expected to remain stable going forward. Lower food prices, easing global commodity costs, and better crop prospects have helped improve the inflation outlook. These factors have reduced upward pressure on prices across key categories.

Conclusion

The RBI’s decision to cut the repo rate reflects its growing confidence that inflation risks have eased, giving it room to support economic growth. With inflation forecasts revised sharply lower and liquidity conditions strengthened through bond purchases and forex swaps, the central bank has created a supportive environment for recovery without compromising price stability. Going ahead, the RBI is likely to stay data-dependent, balancing growth support with inflation control, and keeping the option open for further easing if economic conditions warrant.