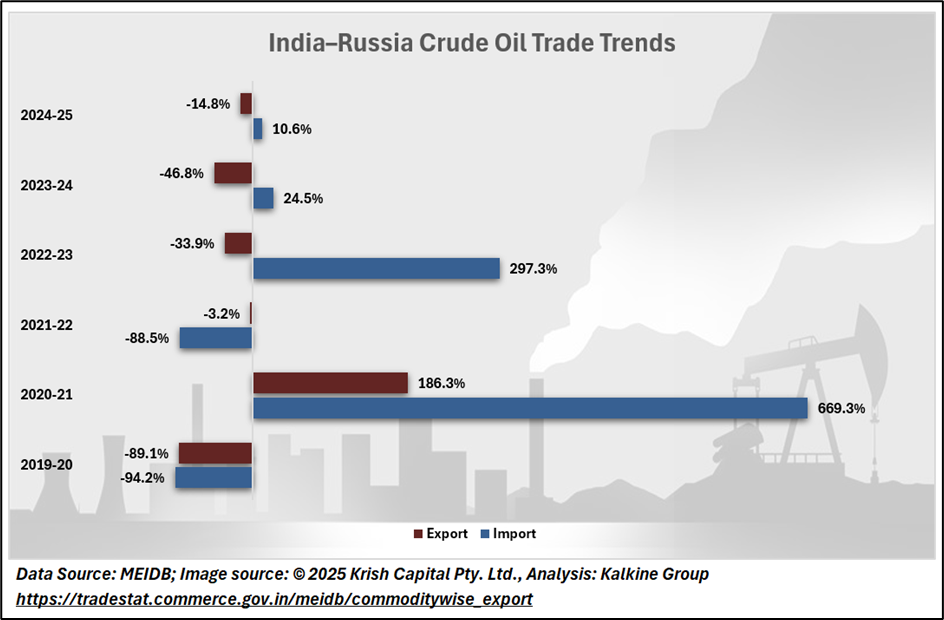

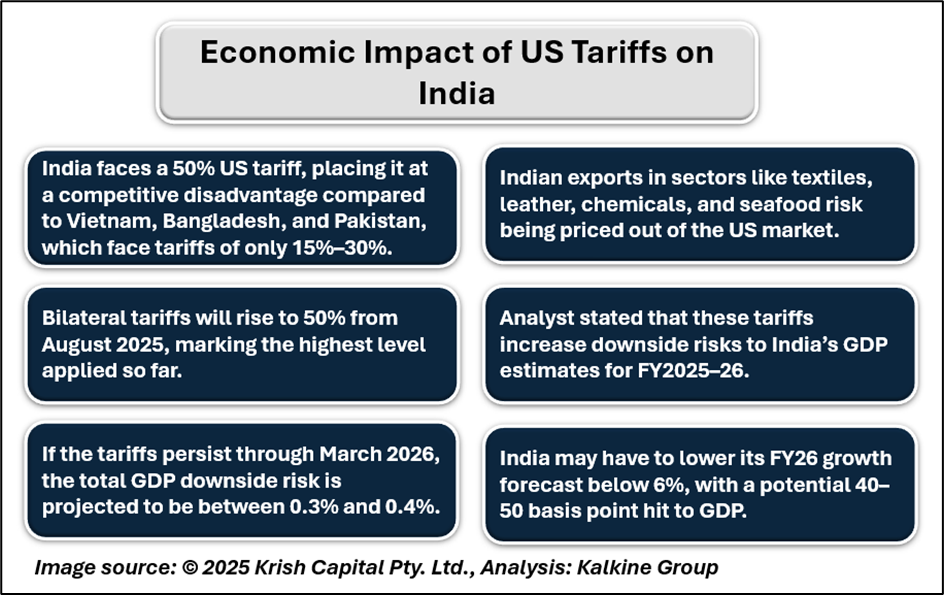

In a sharp escalation of trade tensions, US President Donald Trump has imposed an additional 25% tariff on Indian imports, raising the total levy to 50% on select goods. This move follows India's continued purchase of discounted Russian crude oil now making up over a third of its imports despite repeated US warnings aimed at isolating Russia economically due to the war in Ukraine.

The initial round of tariffs takes effect on August 7, with an additional 25% surcharge to be implemented after a 21-day period. Most Indian exports will be subject to the new duties, except for a limited list of exemptions. The White House confirmed the move less than 14 hours before the first phase was set to begin.

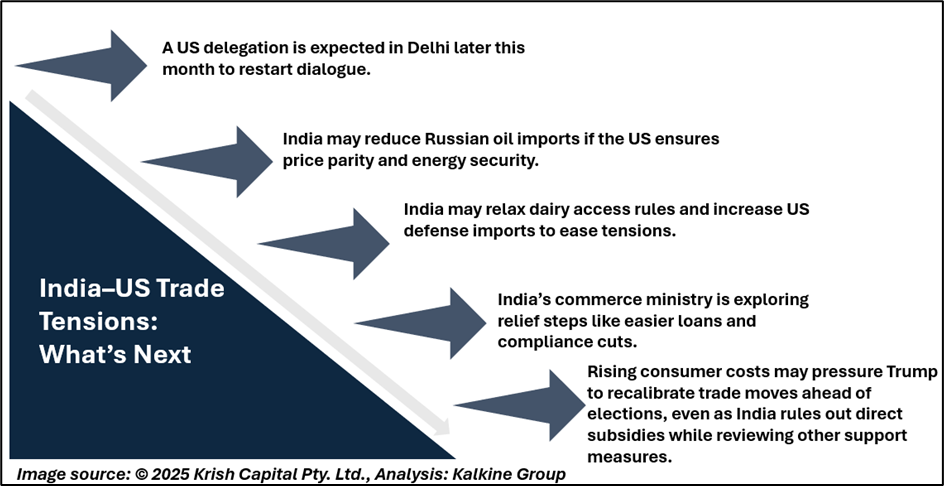

The decision signals growing U.S. frustration over India’s continued defense ties with Russia, particularly its interest in acquiring Su-57 fighter jets. Washington views the tariff pressure as a means to steer India toward American defense alternatives such as the F-35. India, meanwhile, maintains that its imports of discounted Russian oil have helped stabilize global energy prices. The tariff escalation threatens to strain a key strategic partnership at a time when the U.S. sees India as an essential counterbalance to China in the Indo-Pacific region.

Geopolitical Rift

India, a key US strategic partner in the Indo-Pacific and the ninth-largest trading partner of the US in 2024, exported goods and services worth over USD 86 billion to America last year. The doubling of tariffs threatens to wipe out billions in annual trade and could significantly destabilize an alliance the US has long nurtured as a counterbalance to China’s regional influence.

Washington’s tariff hike has alarmed diplomats and business leaders alike, with Indian exports like auto parts, textiles, and electronics vital to U.S. supply chains. Analysts caution the move could raise input costs, fueling inflation and squeezing American manufacturers and consumers. As borrowing costs remain high, the added pressure may curb spending and economic momentum posing risks for the U.S. economy in the lead-up to a contentious election year.

Export Relocation

The steep tariffs have rattled India’s export sectors, especially the gem and jewellery industry, which has voiced serious concerns about the viability of continuing shipments to the US. Many Indian manufacturers are now exploring options to set up units in lower-tariff jurisdictions such as Dubai and Mexico, which could serve as export bases to the US and cushion the impact.

Industry insiders warn that if viable workarounds aren't quickly found, the export-dependent businesses could face severe downturns, job losses, and closure of units that have long served the American market.

Conclusion

Trump’s latest tariff decision underscores a sharp shift in Washington’s approach to trade and foreign policy under pressure. By targeting India a longstanding strategic partner with punitive tariffs over its energy and defence dealings with Russia, the US risks triggering unintended economic consequences at home and straining an alliance critical to countering Chinese influence. As geopolitical tensions rise and economic interests clash, the fallout may reverberate across both continents in the months to come.