The United States' imposition of a 50% tariff on copper imports is reverberating through global supply chains, raising concerns for India’s emerging electronics and semiconductor sectors. While the tariff primarily targets Chinese and other foreign copper producers to protect U.S. domestic mining and refining, its ripple effects could prove costly for India’s ambitions to become a global chip manufacturing hub.

As India accelerates its semiconductor mission, industry leaders warn that access to high purity copper a crucial input for chips and electronic hardware may become constrained and expensive, slowing investment momentum and increasing manufacturing costs.

Copper Shortfall

Copper is a vital component in nearly every stage of semiconductor and electronics manufacturing from printed circuit boards (PCBs) to power modules, interconnects, capacitors, and chip packaging. India imports a significant portion of its refined copper and nearly all its high-purity copper materials and specialty alloys from abroad.

Domestic producers like Hindustan Copper, Hindalco, and Sterlite Industries have not yet scaled up to manufacture semiconductor-grade copper. This leaves chip assemblers and PCB manufacturers dependent on imports, primarily from China and other East Asian countries.

Trade Pressures

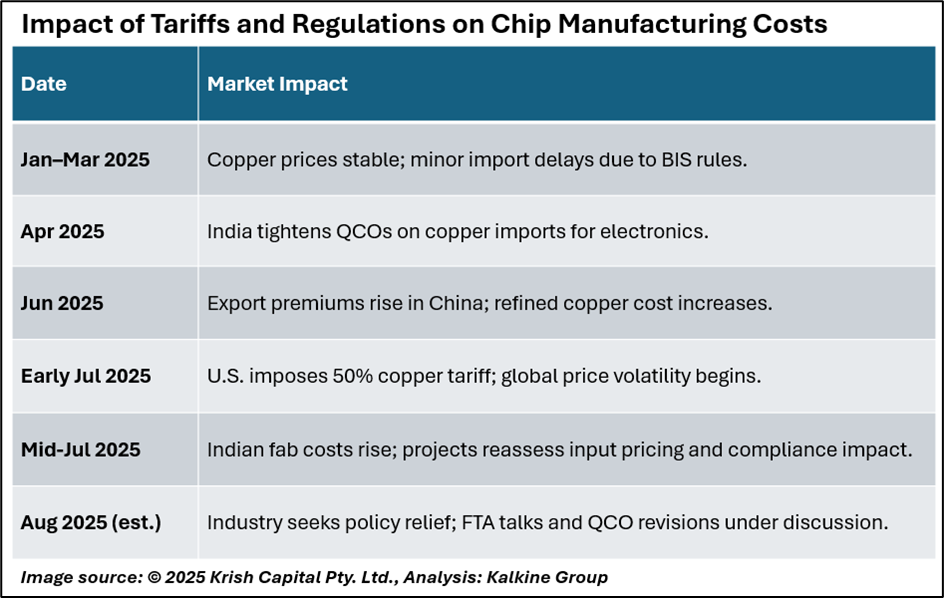

India’s nascent semiconductor industry is particularly sensitive to changes in input costs and regulatory delays. The cost of establishing chip fabrication units (fabs) runs into billions of dollars, with profit margins highly dependent on stable raw material pricing. The new U.S. tariffs, combined with India’s own import regulations like Bureau of Indian Standards (BIS) certifications and Quality Control Orders (QCOs), are compounding industry anxieties. Economists, emphasise that India’s chip strategy must prioritise resilient, cost-efficient copper supply chains alongside fab subsidies.

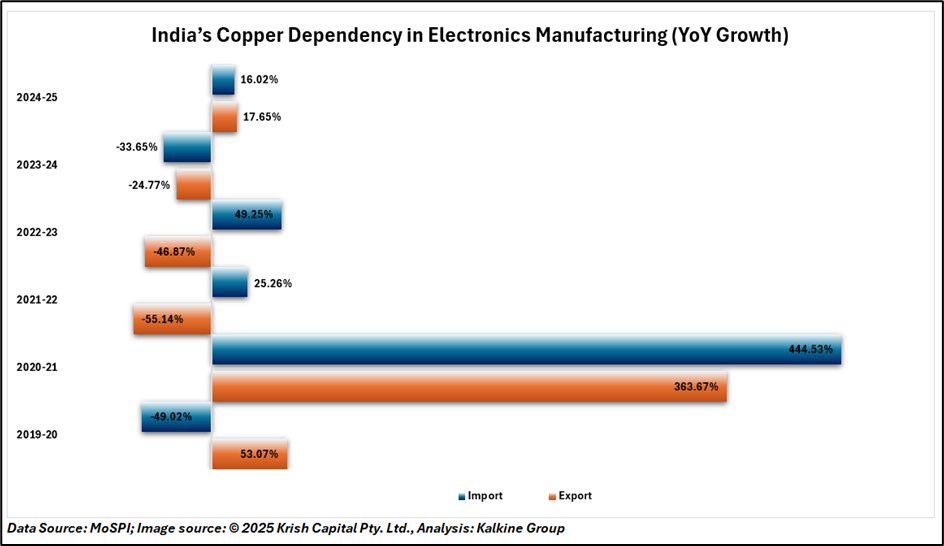

According to trade data, India exported about USD 2 billion in copper and copper products in FY2024–25, with USD 360 million going to the U.S. The American market is India’s third-largest copper export destination, following Saudi Arabia and China. While some decline in U.S. demand could be absorbed locally, the broader concern remains the impact on inbound copper shipments required for high-tech manufacturing.

Policy Shift Needed

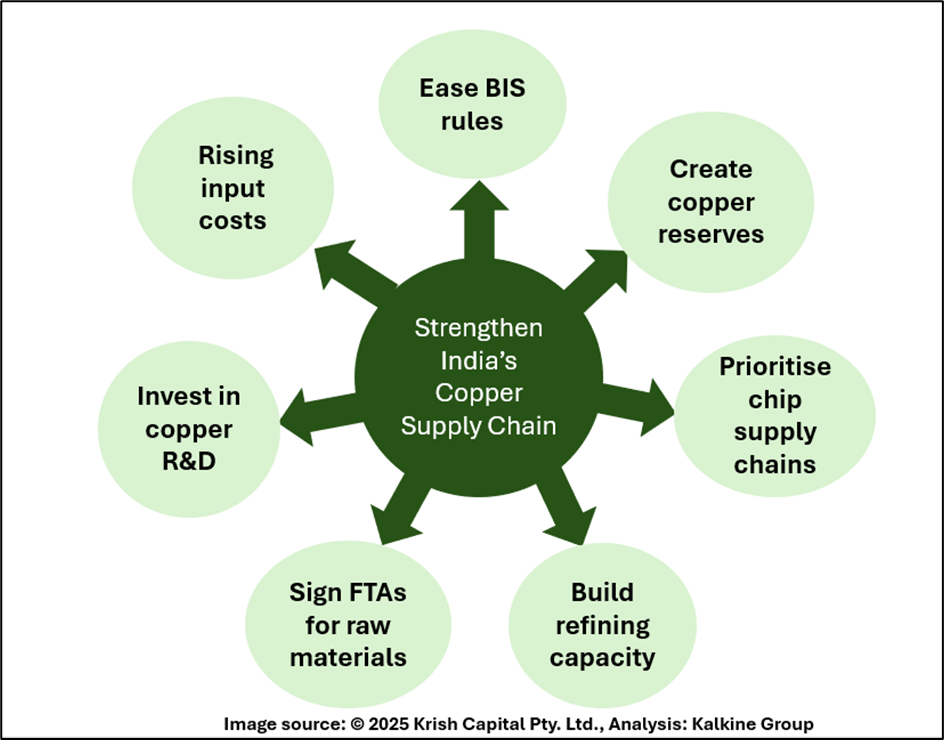

Industry experts argue that India’s semiconductor strategy must now incorporate a comprehensive raw materials policy. This includes encouraging domestic production of high-purity copper through public-private partnerships, easing import restrictions, and possibly negotiating free trade agreements (FTAs) to secure supply.

Economists stress that chip independence requires uninterrupted access to critical raw materials, urging India to prioritise strategic copper imports until domestic capacity is established. They warned that policy missteps, such as imposing QCOs or tariffs on critical imports without creating viable domestic alternatives, could disrupt India’s fragile electronics manufacturing base. For now, most of the specialty copper wires, foils, and alloys used in semiconductor-grade equipment are made by a handful of producers abroad.

Conclusion

India’s semiconductor ambitions face a serious test as copper often overlooked becomes a bottleneck. While the U.S. tariff targets its domestic goals, its global consequences are far-reaching. For India to stay competitive and attract global investment into its semiconductor ecosystem, it must urgently address material dependencies and build a resilient supply foundation starting with copper.