The United States has moved decisively to implement 50% tariffs on Indian exports, effective August 27, 2025, marking the most severe trade action ever targeted at India. The escalation follows President Donald Trump’s executive order penalizing India for its continued imports of Russian crude, linking sanctions enforcement directly to bilateral trade.

Scale of Exposure

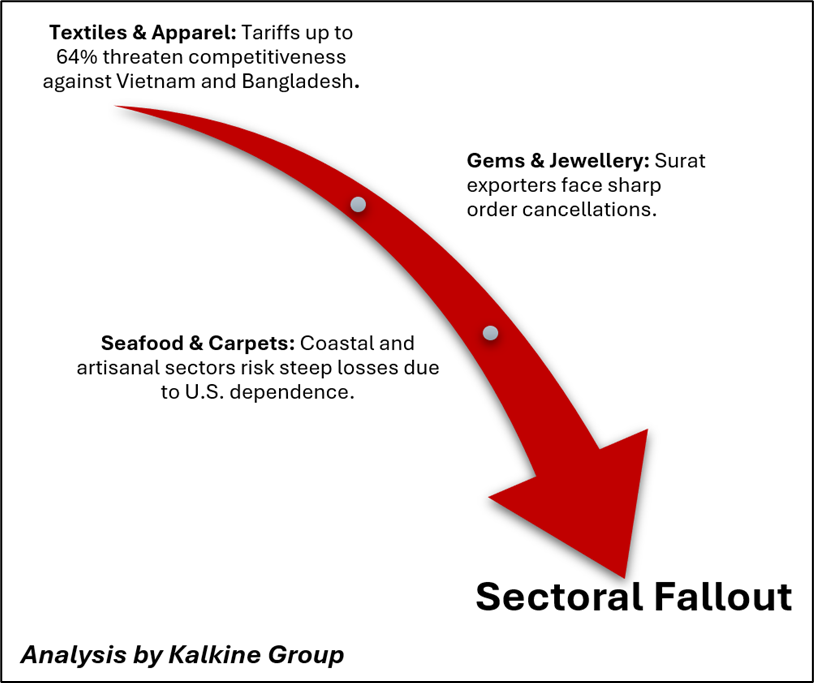

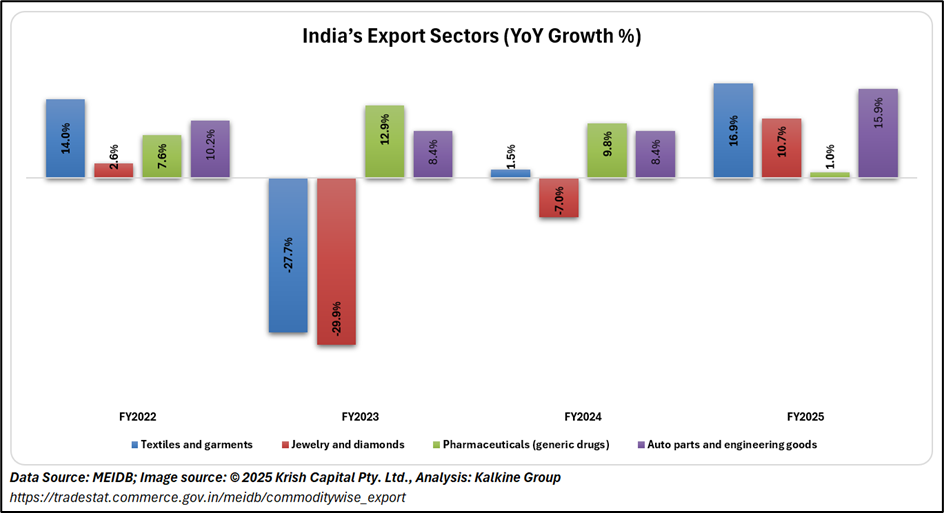

According to the Global Trade Research Initiative (GTRI), nearly 66% of India’s exports to the U.S., worth $60.2 billion, now face a prohibitive 50% tariff. Another 30% ($27.6 billion) remain duty-free, while 4% ($3.4 billion) attract a 25% levy. Exporters warn that shipments in key sectors apparel, textiles, gems & jewellery, shrimp, carpets, and furniture could plunge by up to 70%, wiping out nearly $29 billion in trade and threatening hundreds of thousands of jobs.

The Federation of Indian Export Organisations (FIEO) estimates that around 55% of India’s U.S.-bound shipments ($47–48 billion) will be rendered uncompetitive almost overnight.

Domestic Policy Response

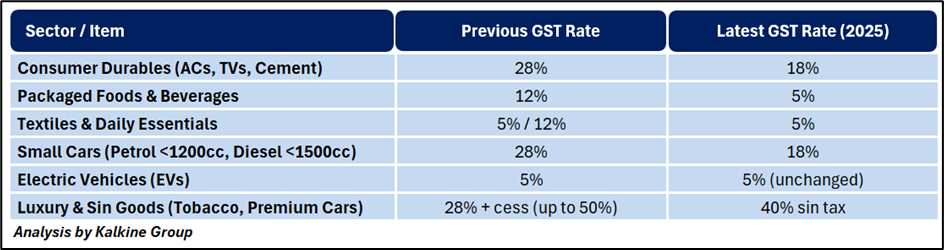

Prime Minister Narendra Modi has renewed the emphasis on Swadeshi, encouraging citizens to support Indian-made products under the motto “buy Indian, be vocal for local.” In parallel, the GST Council has introduced select rate reductions to stimulate domestic demand, while the Reserve Bank of India has assured additional liquidity measures and credit facilitation, particularly aimed at exporters navigating current pressures. These measures underscore a pivot toward domestic demand as a growth buffer, even as external trade shocks mount.

A key reform step is the simplification of GST slabs, where multiple categories have been shifted to lower rates to stimulate demand and improve affordability:

Strategic and Diplomatic Undercurrents

The tariffs carry implications beyond economics. With China openly backing India and calling the U.S. a “bully,” the issue is likely to feature during Modi’s upcoming meetings at the Shanghai Cooperation Organization (SCO) summit. Analysts warn that punitive U.S. action risks weakening New Delhi’s alignment with Washington at a time when Indo-Pacific cooperation is considered critical.

Investor Outlook

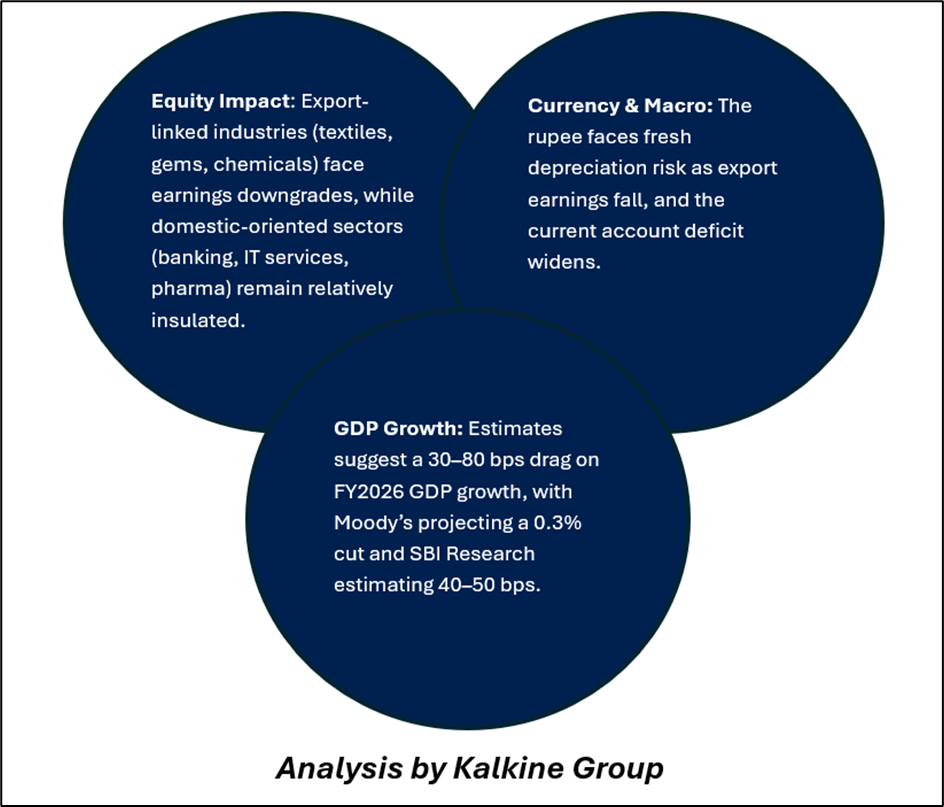

For investors, the tariff shock reshapes the landscape:

The Road Ahead

India’s response may avoid outright retaliation, but a recalibration of trade alliances is already underway. Diversification toward ASEAN, the Middle East, and Africa, coupled with renewed emphasis on domestic manufacturing and consumption, will form the backbone of New Delhi’s strategy. For global investors, the episode underscores how geopolitical trade risks are reshaping emerging market narratives.

Conclusion

The U.S. tariffs mark a turning point in India’s trade trajectory, threatening key export sectors and testing economic resilience. While domestic policy support and GST reforms provide some cushion, India’s longer-term strategy will hinge on diversifying markets, strengthening self-reliance, and balancing geopolitical alignments amid escalating global trade tensions.