Bitcoin surged past the USD 123,000 mark for the first time ever on July 14, driven by growing optimism around upcoming US regulatory decisions and strong institutional inflows. The world’s largest cryptocurrency has now gained over 103% in the past year and nearly 30% in 2025 alone, reflecting heightened interest from both retail and institutional participants.

Regulatory Momentum

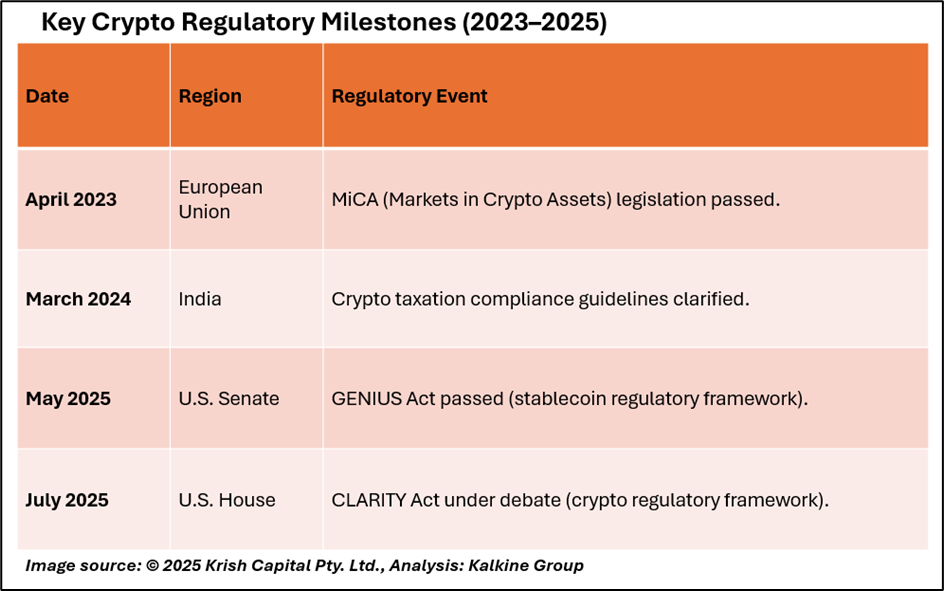

Investor sentiment has been lifted by expectations around ‘Crypto Week’ in the US. The House of Representatives is scheduled to review two pivotal bills the Clarity Act, which seeks to establish a formal crypto regulatory framework, and the Genius Act, which focuses on stablecoin governance. Both bills have attracted bipartisan support and are seen as steps toward formalizing the crypto industry.

Former President Donald Trump’s pro-crypto stance has also amplified interest. Labeling himself the “crypto president,” Trump has pledged to make the US a leader in digital assets, adding political momentum to market dynamics. This evolving regulatory landscape represents a shift from earlier scepticism toward a more collaborative approach between governments and blockchain innovators. For Indian regulators monitoring global crypto trends, the US debate could influence future domestic policy decisions.

Institutional Inflows

Institutional participation is at a record high. On July 11, crypto funds saw a single-day inflow of USD 1.23 billion, with Bitcoin ETFs accounting for USD 1.03 billion of that figure. Long-term holders, or “accumulation addresses,” amassed over 248,000 BTC (around USD 29.5 billion) in July alone well above monthly averages signalling sustained buying activity.

Meanwhile, open interest in crypto options is rising, and market skew has turned negative, indicating rising bullishness. However, exchange net flows show more Bitcoin entering centralized exchanges, which may signal investors are beginning to lock in profits. While these trends reinforce positive sentiment, analysts warn of short-term risks, the analyst suggest that increasing leverage and high-profit positions could expose the market to sharp corrections.

India Impact

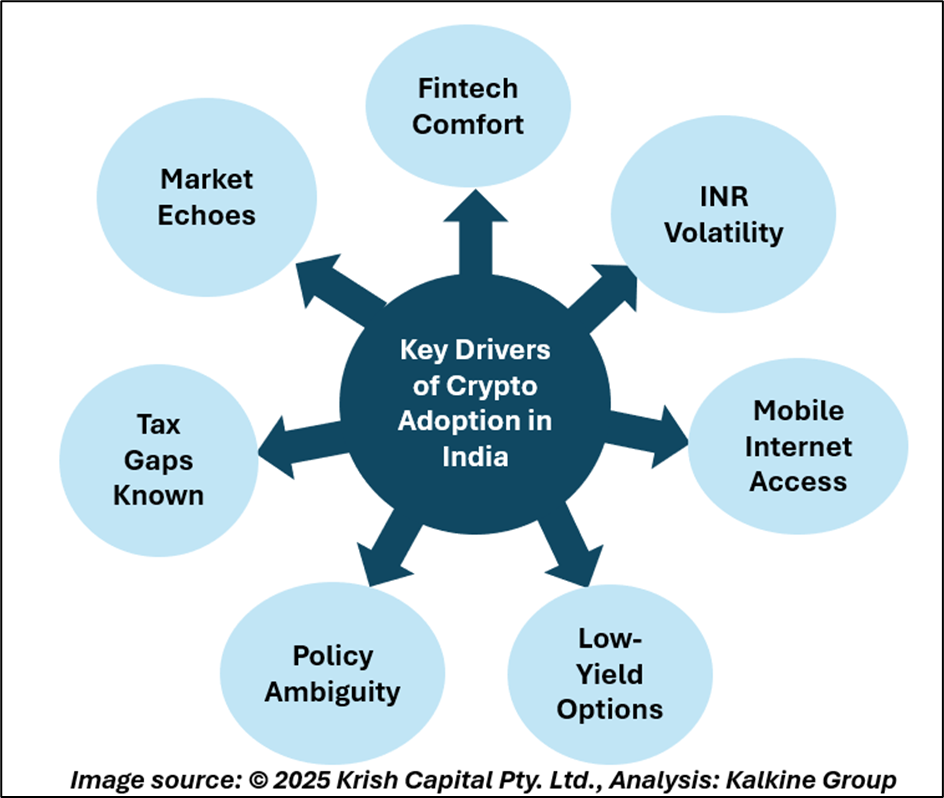

The Bitcoin rally has renewed interest among Indian crypto investors, particularly considering upcoming policy developments globally. With the Reserve Bank of India still cautious on cryptocurrencies and the government exploring the future of digital assets through a CBDC, global regulatory clarity may help shape India’s next steps.

Crypto adoption in India, especially among the younger demographic, remains high despite a 30% tax regime. If US policy brings clearer classification and accountability to the sector, Indian exchanges and policymakers may feel pressure to revisit current frameworks to stay globally competitive.

Technical Analysis

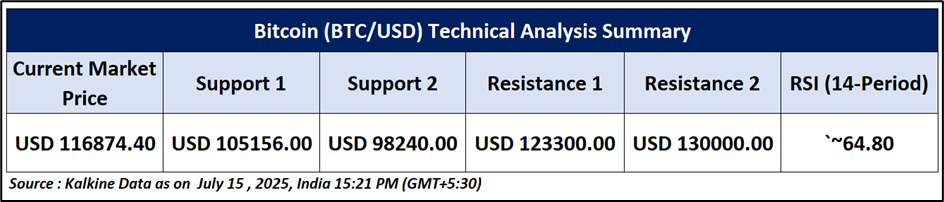

Bitcoin (BTC/USD) witnessed a sharp intraday pullback after testing the $120,000 level, ending the session at $116,874.40, down 2.52%. The rejection near this psychological barrier indicates profit-taking and emerging resistance. Still, the overall structure remains bullish, with BTC holding well above its 51-day EMA at $108,060.80, confirming medium-term strength. The RSI at 64.98 suggests healthy momentum, though nearing overbought territory. A sustained close above $123,300 may open the door to fresh highs, while a drop below $111,985 could trigger a corrective move toward the $105,156–$98,240 support zone in the near term.

Conclusion

Bitcoin’s surge above the USD 123,000-mark signals deepening institutional support and a growing shift in global regulatory narratives. However, with leverage levels rising and profit-taking increasing, short-term volatility may persist. For Indian investors and regulators, these global shifts provide important cues as the country considers its long-term crypto strategy.