Kotak Mahindra Bank has completed the due diligence process for acquiring the government’s stake in IDBI Bank, according to sources familiar with the development. The review covered a detailed assessment of the bank’s loan portfolio, exposure profile, provisioning norms, and overall asset quality to evaluate its financial health and operational strength.

The development marks a key milestone in the government’s strategic disinvestment programme for IDBI Bank, which aims to attract high-quality investors while ensuring long-term institutional stability.

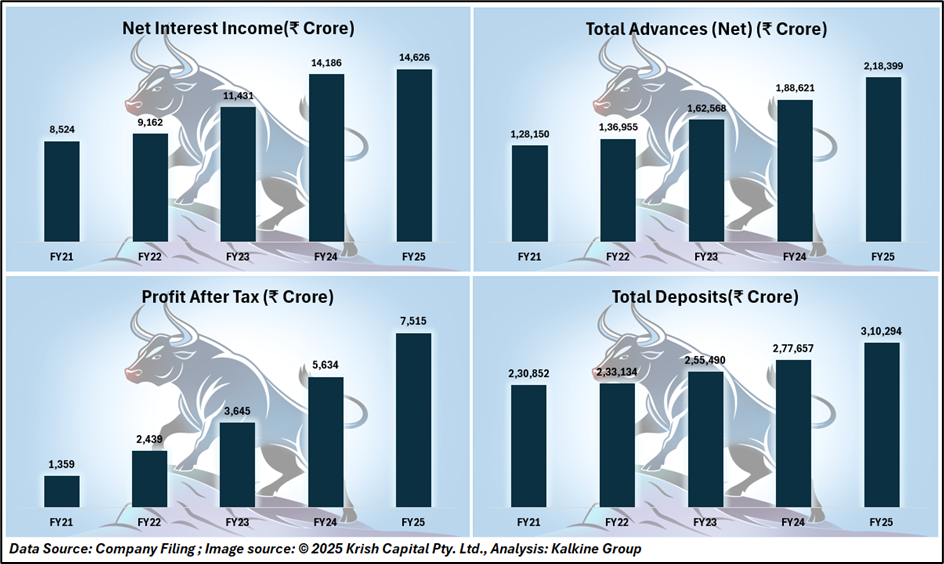

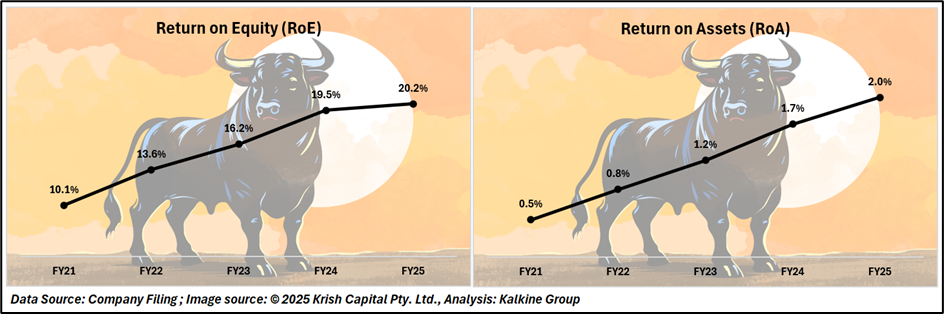

Strengthened Fundamentals Enhance Investor Appeal

In recent years, IDBI Bank has demonstrated a robust turnaround, supported by improved profitability, better asset quality, and a stronger capital base. The bank has also deepened its retail franchise, enhanced digital capabilities, and reinforced governance practices — factors that have significantly boosted investor confidence.

These improvements position IDBI Bank as an asset in India’s banking sector, appealing to both domestic and international bidders.

Competitive Bidding Landscape

Kotak Mahindra Bank’s participation adds a strong domestic dimension to the competitive process, which also includes global investors such as Oaktree Capital Management and Fairfax Financial Holdings, both of whom have completed their due diligence. Fairfax already holds a 40% stake in CSB Bank, underlining its ongoing interest in the Indian financial sector.

Sources indicate that Emirates NBD has withdrawn from the race following its acquisition of RBL Bank, leaving Kotak as the sole domestic contender.

Valuation and Timeline

The government and Life Insurance Corporation of India (LIC) jointly hold around 94% of IDBI Bank, with the proposed transaction expected to involve a controlling stake of approximately 60.72%. The deal could value the bank between USD 8 billion and USD 10 billion.

The Department of Investment and Public Asset Management (DIPAM) launched the formal process in October 2022, and final financial bids are expected to be invited in the coming quarter. The government aims to conclude the transaction by the end of FY26.

Technical Analysis

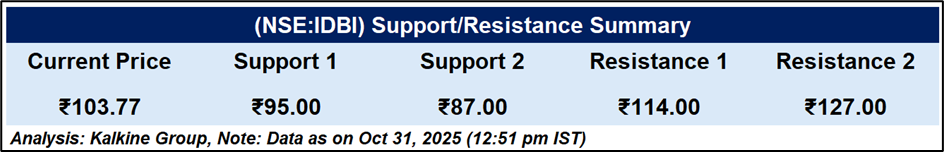

IDBI Bank jumped 6% to ₹103.77, extending its uptrend with strong volume. The stock trades well above the 51-day EMA at ₹93.86, indicating strong bullish momentum. RSI at 68.7 suggests near-overbought conditions. Immediate resistance is seen at ₹107.50, with support around ₹95, keeping short-term bias positive.

Conclusion

IDBI Bank’s improving fundamentals, coupled with strong investor interest and the government’s push for strategic disinvestment, position it for a value-accretive outcome. With Kotak Mahindra Bank leading domestic interest and robust market momentum, the deal’s completion could mark a transformative step for India’s banking consolidation and capital market confidence.