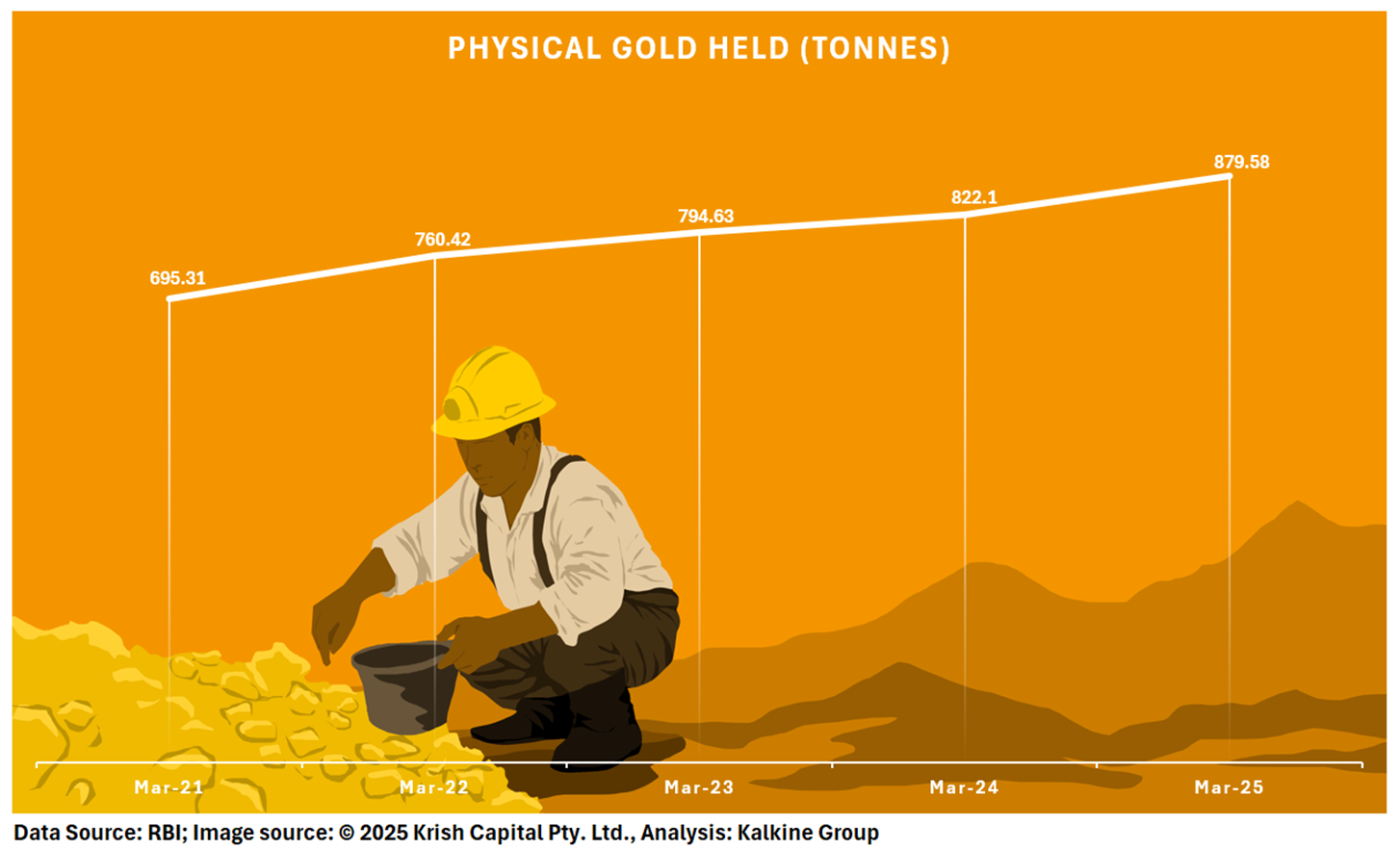

The Reserve Bank of India (RBI) has significantly ramped up its gold holdings in recent years, reflecting a clear shift in its reserve management approach. As of March 2025, the Reserve Bank of India held 879.58 tonnes of physical gold, marking a 26.5% rise from 695.31 tonnes in March 2021. The value of these holdings soared to ₹6.68 lakh crore ($78.18 billion), reflecting both increased accumulation and higher global gold prices. This shift underscores the RBI’s strategic move to reduce reliance on dollar-denominated assets and strengthen its portfolio with globally recognized non-sovereign stores of value.

What Lies Ahead?

Further Accumulation Likely: With global risks persisting, the RBI may continue building its gold reserves. India could move toward matching the gold-to-reserve ratios seen in countries like China and Russia, both of which have strategically increased gold exposure.

Potential for Monetisation: Growing reserves could support the government’s broader aim to revamp gold monetisation schemes and explore gold-backed financial instruments for bilateral trade or liquidity management.

Portfolio Rebalancing: As global interest rates soften and bond yields fall, gold may offer relatively better returns and risk mitigation. The RBI is expected to maintain its strategy of recalibrating its portfolio in line with evolving global financial dynamics.

A Global Trend with Strategic Implications: India’s move mirrors a larger global pattern. In 2023 alone, central banks worldwide added over 1,000 tonnes of gold, a record high, according to the World Gold Council. This reflects a clear shift toward currency-neutral and geopolitically safe assets.

Conclusion

The RBI’s growing gold reserves underscore a calculated strategy to enhance monetary resilience and reduce systemic risks. In a world marked by economic fragmentation and shifting power dynamics, gold offers the central bank a timeless advantage: trust, liquidity, and security. As India’s global economic footprint expands, a robust gold-backed reserve position strengthens its stature both financially and geopolitically.