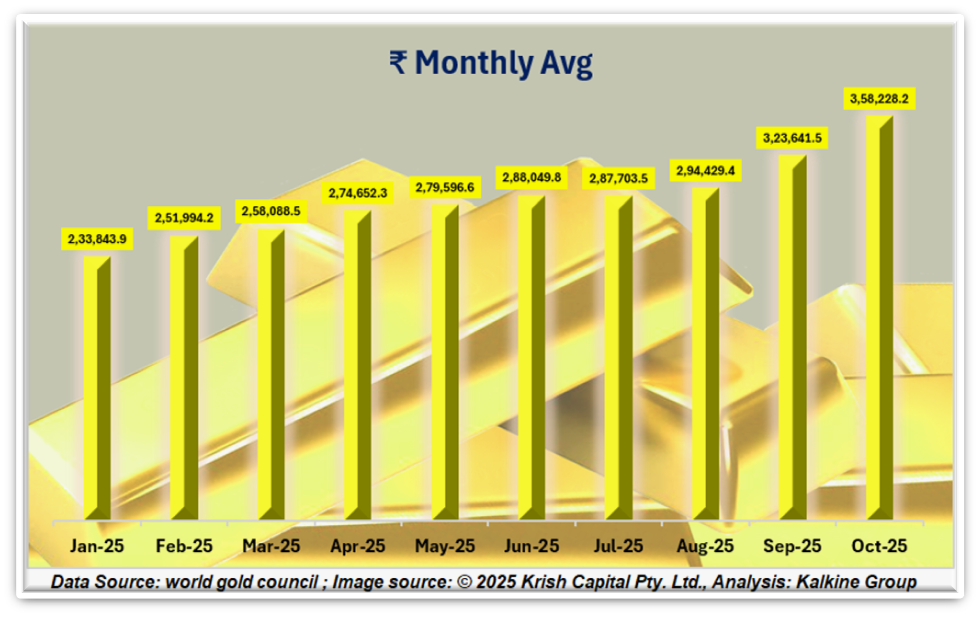

Gold prices in India continued their upward momentum through 2025, driven by macroeconomic uncertainty and favourable investor demand. Monthly averages show that the gold price rose from ₹2,33,844 per 10g in January to ₹3,58,228 in October 2025. Notable gains were observed in June (₹2,88,050), September (₹3,23,642), and October (₹3,58,228), reflecting domestic demand and international market influences.

Quarterly averages mirror this trend: Q1 2025 averaged ₹2,47,687 per 10 g, Q2 at ₹2,80,886, and Q3 reaching ₹3,01,937 per 10 g. This consistent upward movement suggests that the rally is not just a short-term spike but reflects a broader structural trend.

External Triggers: Global Economics & Currency Impact

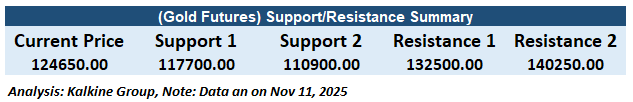

Technical Analysis

Conclusion

India’s gold market has evolved from short-term price triggers to a structurally significant asset class. The rally is supported by safe-haven demand, macroeconomic uncertainty, and rupee depreciation, highlighting gold’s enduring appeal. Monthly and quarterly trends demostrates consistent growth, while technical levels suggest continued investor interest. As global economic volatility persists, gold is poised to maintain its position as a key reference point in India’s commodities market.