As India’s IPO market gains momentum with increasing listings from domestic firms and multinationals, High Net-Worth Individuals (HNIs) are emerging as a critical investor class. With the ability to invest larger sums, HNIs gain early access to high-potential companies during their public offering phase. This article provides a comprehensive guide on how HNIs can apply for IPOs, the key benefits and regulatory aspects, and tax implications.

HNI IPO Overview

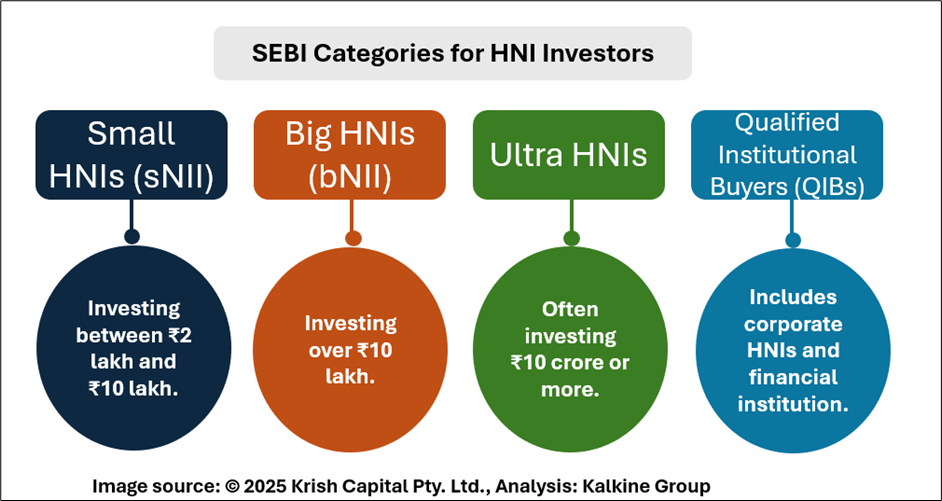

The Securities and Exchange Board of India (SEBI) defines an HNI (or Non-Institutional Investor, NII) as anyone applying for shares worth more than ₹2 lakh in an IPO. SEBI earmarks 15% of the IPO issue size for this category, reflecting the importance of HNI participation.

This classification helps streamline IPO allocation and ensures broader participation across investor types. By reserving a specific portion for smaller and larger HNIs, SEBI promotes fairness and reduces concentration risk. Understanding these categories allows investors to align their IPO strategy with eligibility, allotment probability, and regulatory guidelines for more informed decision-making.

Application Workflow

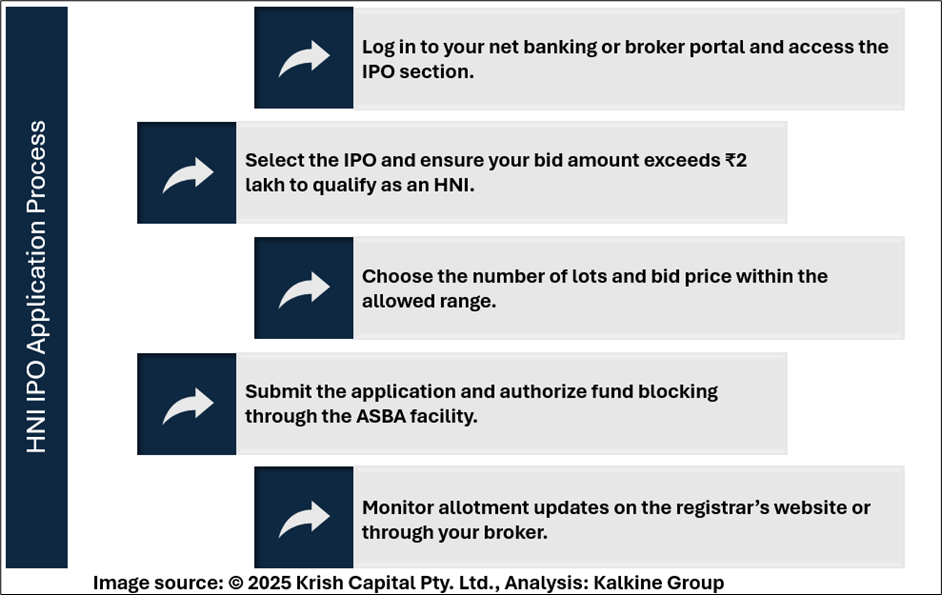

Applying for an IPO under the HNI category involves a structured and time-sensitive process that differs from the retail route. The Application Supported by Blocked Amount (ASBA) mechanism is mandatory for HNIs, ensuring the invested amount remains in the applicant’s account and is only debited upon allotment. This system protects capital, maintains transparency, and avoids premature fund transfers.

The key documents required for an HNI IPO application include a PAN Card, Income Tax Returns for the last two years, a Net Worth Declaration, recent Bank Statements, an HNI Indicator Form (if applicable), and a bank account linked to a valid Demat account these collectively verify the investor's identity, financial eligibility, and regulatory compliance.

Applicants should also be aware that HNI bids tend to close earlier typically by 4 PM on the final day of the IPO. Hence, submitting the bid early is advised to avoid technical issues or last-minute errors. A well-timed application not only secures participation but may also improve chances of allotment, especially in oversubscribed offers.

Maximising IPO Gains

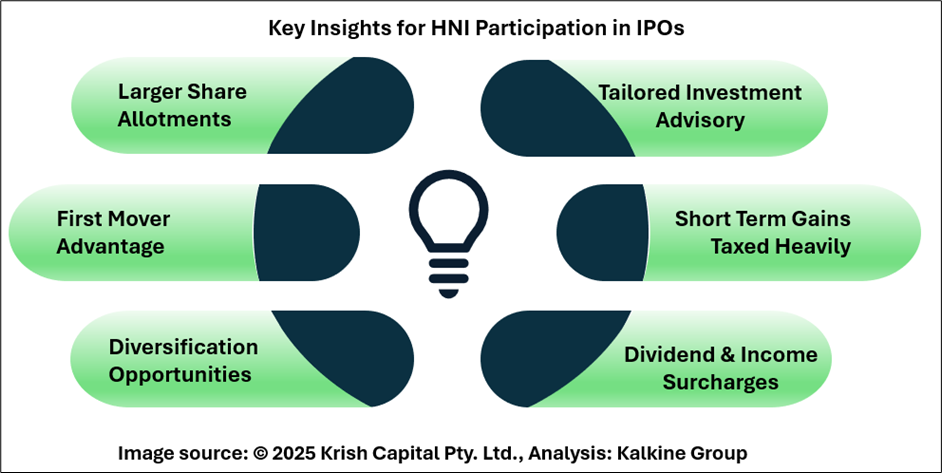

High Net Worth Individuals (HNIs) benefit from larger IPO allotments and early access to high-potential companies. This advantage, supported by strategic advisory, allows them to invest at favourable valuations and diversify across sectors and instruments like equity and hybrids.

However, maximising gains requires understanding applicable tax implications. Short-term capital gains (within 12 months) are taxed at 20%, while long-term gains above ₹1.25 lakh attract a 12.5% tax. Dividend income is taxed per income slab, with surcharges of 10–15% for high earners. Staying informed on these rules helps HNIs optimise post-listing returns and plan effective, tax-efficient exit strategies for wealth preservation.

Conclusion

HNIs contribute significantly to IPO demand and pricing dynamics. With proper documentation, early bidding, and ASBA-enabled applications, they can maximize allocation chances. While the opportunity for early-stage investment returns is attractive, HNIs should remain vigilant of regulatory norms, market volatility, and tax implications when investing under this category.