Over the past decade, India has experienced remarkable growth in the mutual fund sector, with Systematic Investment Plans (SIPs) playing a crucial role in this shift. What was once a market primarily driven by conventional investment avenues has now evolved into a more diverse and investor-friendly environment. The mutual fund industry, particularly through the increasing adoption of SIPs, has undergone substantial expansion.

What Are Mutual Funds and SIPs?

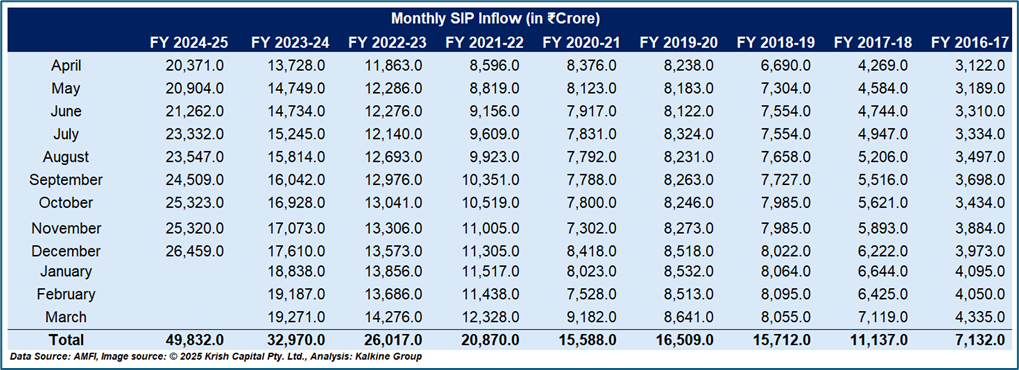

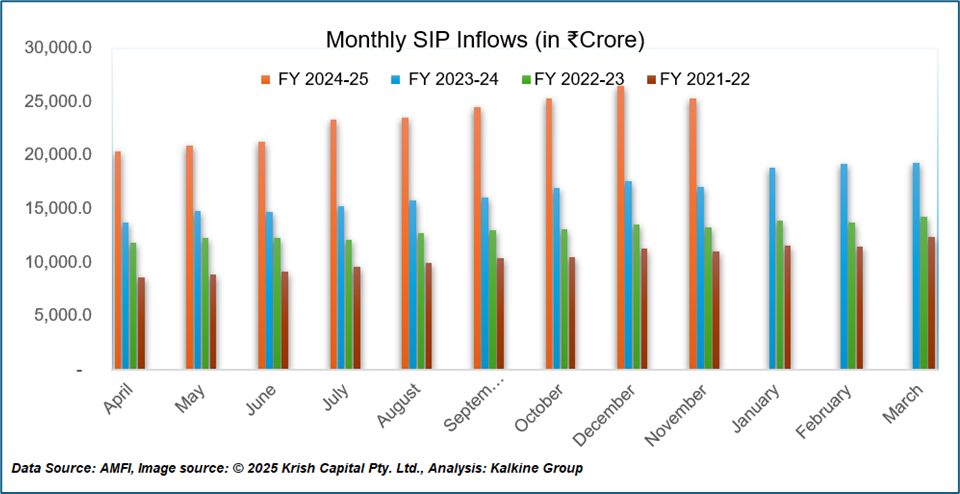

Monthly SIP Inflows: A Testament to Growing Investor Confidence

SIP inflows have grown from ₹3,122 crore in FY 2016-17 to ₹20,371 crore in FY 2024-25, a 6.5x increase. By December 2024, cumulative inflows for the fiscal year reached ₹49,832 crore, surpassing previous years’ total inflows. This growth reflects India's improving macroeconomy and rising retail investor participation. Despite the challenges of FY 2020-21, SIP inflows remained stable, showcasing investor resilience. December 2024 recorded the highest monthly inflow at ₹26,459 crore, highlighting sustained SIP momentum.

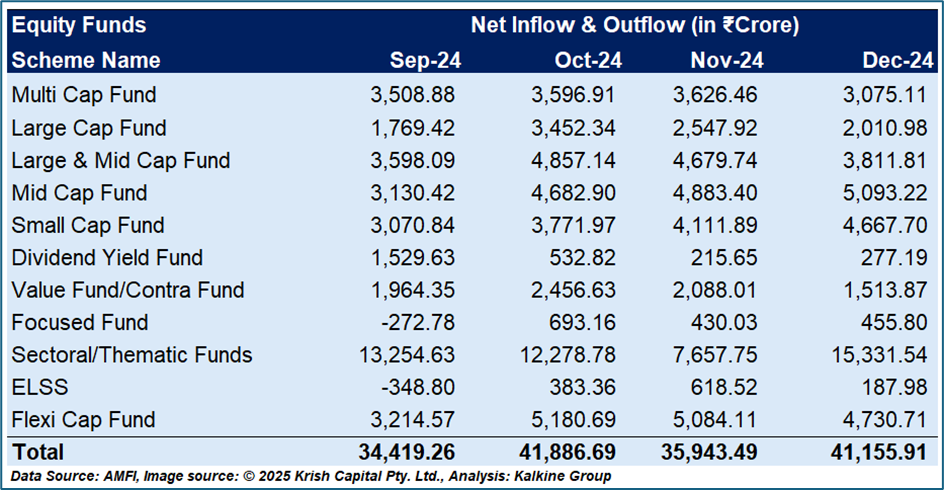

Equity Funds: Net Inflow & Outflow and Performance

Sectoral and Thematic Funds Lead the Way- Sectoral and thematic funds consistently attracted the highest inflows, reaching ₹15,331.54 crore in December 2024, reflecting an increasing interest in specialized investments focused on sector-specific opportunities.

Strong Performance in Mid Cap and Small Cap Funds

- Mid Cap Funds saw inflows increase to ₹5,093.22 crore in December 2024.

- Small Cap Funds garnered ₹4,667.70 crore, highlighting retail investor confidence in high-growth potential sectors.

Flexi Cap Funds Maintain Consistency with their diversified investment approach, attracted ₹5,180.69 crore in October 2024, appealing to both conservative and aggressive investors due to their flexibility.

Dividend Yield and ELSS Funds Face Challenges

- Dividend Yield Funds experienced declining inflows, with ₹277.19 crore in December 2024, indicating reduced interest in income-focused investments.

- ELSS (Equity-Linked Savings Schemes) saw fluctuating interest, reflecting changing tax-saving strategies among investors.

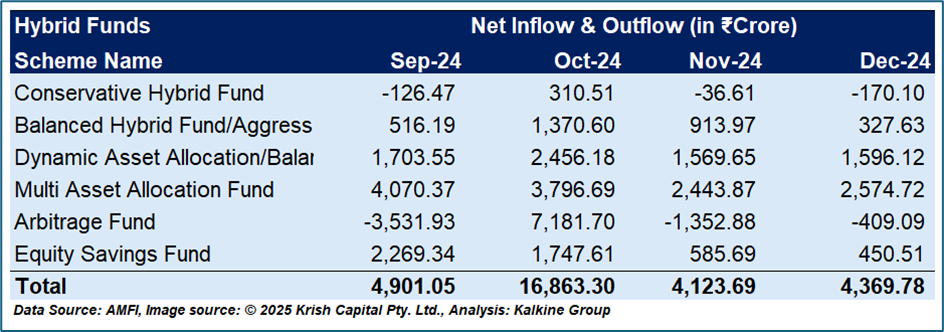

Hybrid Funds Net Inflow & Outflow

In the period from September 2024 to December 2024, hybrid funds showed varied inflows and outflows across different categories, with the Dynamic Asset Allocation/Balanced Advantage Fund leading the way in inflows, reaching ₹2,456.18 crore in October 2024.

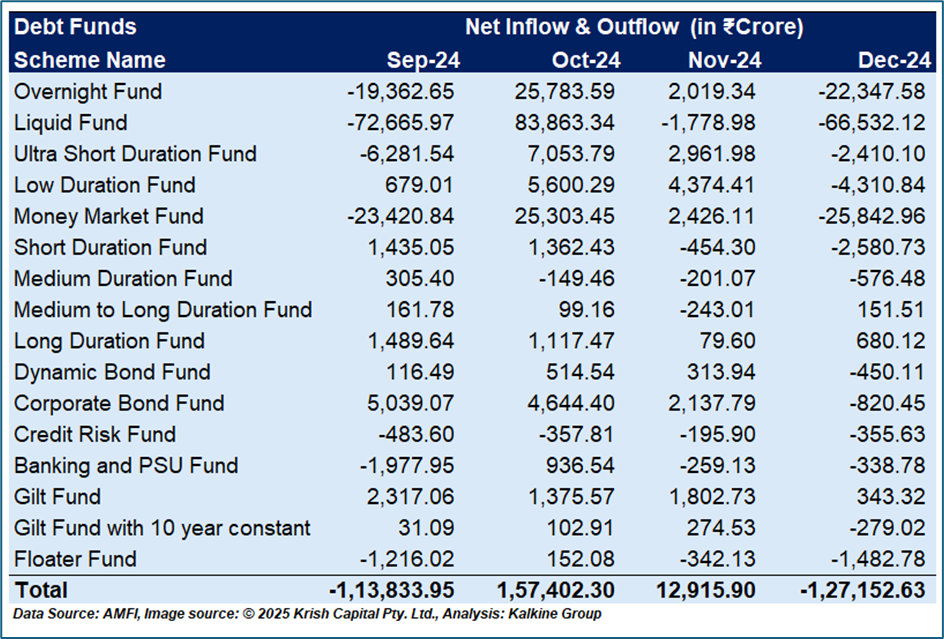

Debt Funds Net Inflow & Outflow

Over the period from September 2024 to December 2024, debt funds experienced significant fluctuations in inflows and outflows. The Liquid Fund saw the highest inflow of ₹83,863.34 crore in October 2024, while Overnight Funds experienced the highest outflow of ₹19,362.65 crore in September 2024. Overall, the total net inflow for the period stood at ₹1,57,402.30 crore in October 2024, but by December 2024, it ended with a net outflow of ₹1,27,152.63 crore.

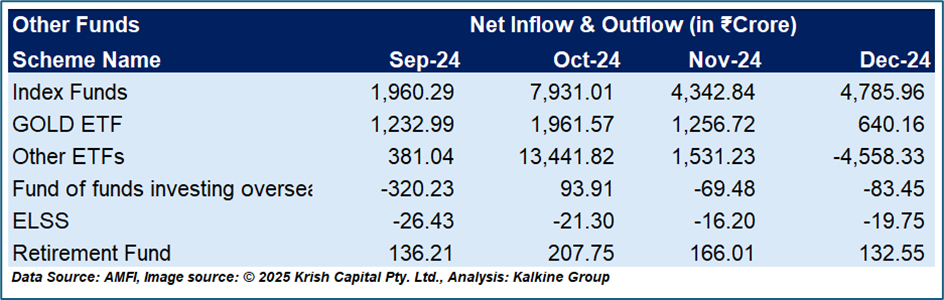

Other Funds Net Inflow & Outflow

From September 2024 to December 2024, Index Funds saw the highest inflows, with ₹7,931.01 crore in October 2024, while Other ETFs experienced the largest outflow of ₹4,558.33 crore in December 2024. Gold ETFs maintained consistent inflows, reaching ₹1,961.57 crore in October 2024. Meanwhile, ELSS and Fund of Funds Investing Overseas recorded slight outflows across the period, signaling reduced investor interest in these segments.

The monthly SIP net inflow reached a record ₹26,459 crore in December 2024, surpassing the previous month’s inflow of ₹25,320 crore in November 2024. This growth reflects a continued strong interest in systematic investing, even amid market fluctuations. As a result, the SIP AUM (Assets Under Management) reached ₹13,63,137 crore in December 2024, demonstrating the increasing participation of retail investors and their growing confidence in mutual funds as a long-term investment option. This surge in SIP investments highlights the resilience of the Indian investor base and the growing shift toward disciplined, consistent investing.

Factors Driving Mutual Fund and SIP Growth

Outlook for Mutual Funds and SIPs in India

The outlook for mutual funds and SIPs in India is highly positive, driven by key factors like increasing investor participation, supported by financial literacy and digital platforms. With India’s growing middle class and higher disposable incomes, SIPs are becoming a popular option for wealth building. Government initiatives like ELSS and SEBI reforms further boost mutual fund growth. Digital tools such as robo-advisors and SIP calculators make investing easier and more accessible. SIPs continue to appeal for their resilience during market volatility, while interest in ESG and thematic funds reflects a shift towards sustainable investing. As retirement planning awareness grows, mutual funds are emerging as a preferred choice for long-term savings. With technological advancements and changing investor preferences, mutual funds and SIPs are poised for continued growth in India.

Conclusion

The mutual fund and SIP landscape in India has evolved significantly over the past decade, driven by increasing investor participation, government support, and digital advancements. The remarkable growth in SIP inflows, coupled with the rise of sector-specific and thematic funds, reflects a growing investor confidence in market-linked products. Despite challenges, mutual funds, particularly SIPs, continue to gain traction as a long-term investment option. With a focus on financial literacy, technological innovation, and evolving investor preferences, the future of mutual funds and SIPs in India looks promising, offering ample opportunities for both new and seasoned investors.