India’s equity markets are poised for one of the most active primary market seasons of FY25, with ten major companies gearing up to raise over ₹40,000 crore through initial public offerings (IPOs) by the end of November, according to people familiar with the matter.

Primary Market Enters High-Gear

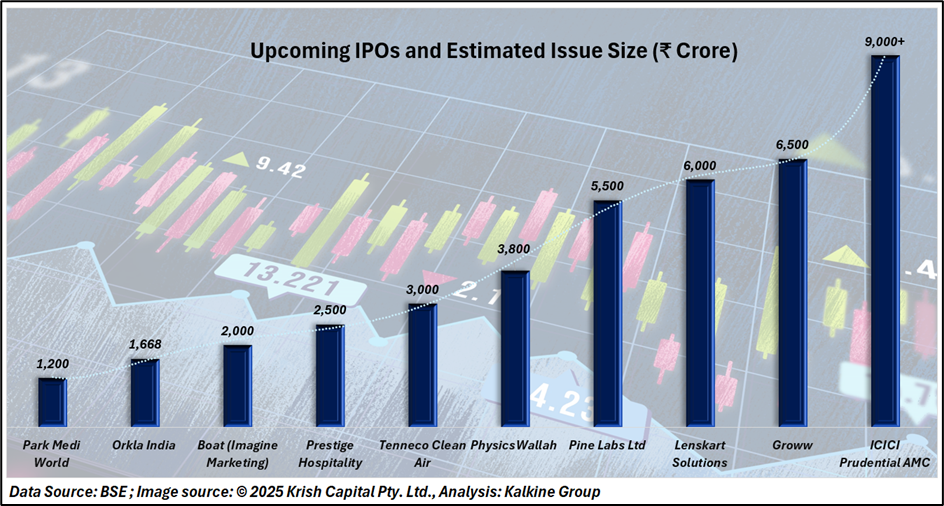

The upcoming lineup features some of the most awaited names of 2025 — Billionbrains Garage Ventures (parent of Groww), Lenskart Solutions, ICICI Prudential AMC, Pine Labs, PhysicsWallah, Tenneco Clean Air, Prestige Hospitality, Orkla India (maker of MTR Foods), Boat, and Park Medi World (operator of Park Hospitals).

This vibrant IPO pipeline highlights a stark contrast between a cautious secondary market and a buoyant primary market, driven by robust institutional participation and sustained retail enthusiasm for consumer and technology-led businesses.

Orkla India to Kickstart the IPO Season

The fundraising cycle begins with Orkla India, whose issue opens between October 29 and 31, with anchor book bidding on October 28.

Valued at ₹1,668 crore, the IPO is a pure offer for sale in the price band of ₹695–₹730 per share.

Market observers expect Orkla India’s listing to set the tone for the IPO season, supported by the strong brand equity of MTR Foods and the company’s consistent performance in the fast-moving consumer goods (FMCG) space.

Big Fundraisers: Groww, Lenskart, and ICICI AMC

Among the marquee offerings, Billionbrains Garage Ventures (Groww) aims to raise around ₹6,500 crore, while Lenskart Solutions targets ₹6,000 crore through a mix of fresh issue and offer for sale. Both issues are expected to allocate roughly 10% to retail investors.

In the financial space, ICICI Prudential AMC could emerge as one of the largest fundraisers in this phase, with an estimated issue size of ₹9,000 crore. The asset manager’s strong brand recall and leadership position are likely to draw substantial institutional interest.

Tech, Consumer, and Healthcare Firms in the Queue

The upcoming IPO list reflects diverse sectoral participation. Fintech player Pine Labs is eyeing an IPO worth around ₹5,500 crore, while edtech major PhysicsWallah plans to raise approximately ₹3,800 crore, continuing the investor interest in India’s growing education technology market.

Meanwhile, Tenneco Clean Air targets a ₹3,000 crore issue, Prestige Hospitality aims for ₹2,500 crore, and Boat seeks around ₹2,000 crore to strengthen its product and distribution network. Healthcare operator Park Medi World, running the Park Hospitals chain, plans to raise about ₹1,200 crore for expansion.

IPO Market Outshines Secondary Market Volatility

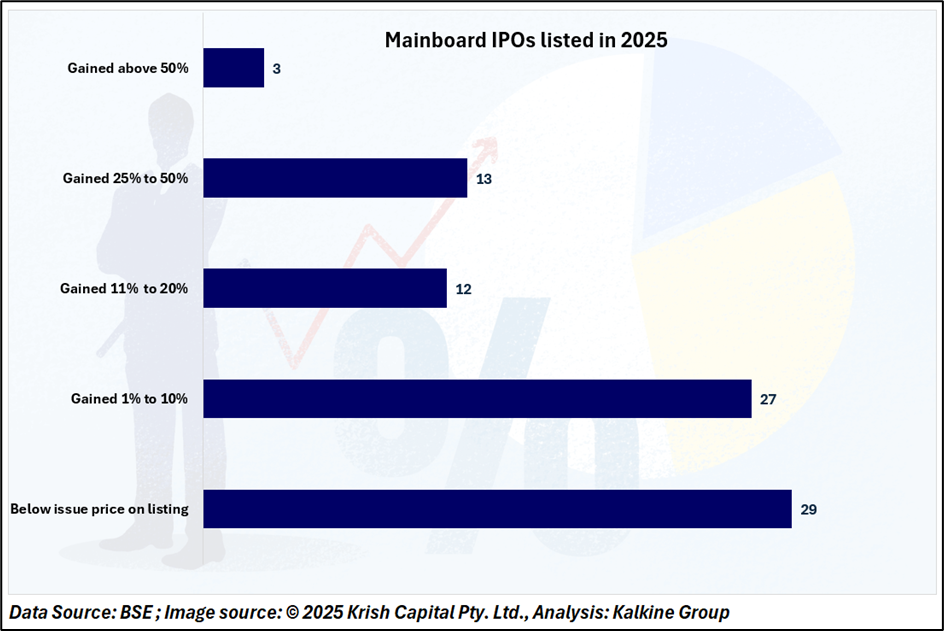

Despite the choppiness in broader equities, India’s IPO market remains remarkably resilient. So far in 2025, 88 companies have gone public, mobilising ₹1.24 lakh crore in total.

Conclusion

India’s IPO market is set for a record phase, showcasing strong investor confidence and sectoral diversity despite secondary market volatility. With marquee names leading a ₹40,000 crore fundraising wave, the primary market continues to demonstrate depth, resilience, and growing maturity in India’s evolving capital market landscape.