Nestlé India is set to play an increasingly significant role in the global operations of the Swiss food and beverage giant. As outgoing Chairman and MD Suresh Narayanan prepares to step down, he highlights India’s growing importance, citing its economic stability, consumer potential, and strategic value. With rising investments and long-term expansion plans, the company is positioning India as a core growth engine through 2030.

India’s Strategic Role

As Suresh Narayanan prepares to step down as Chairman and Managing Director of Nestlé India at the end of July, he leaves behind a company deeply entrenched in the Indian market. In a recent interview, Narayanan described India as a “key driver of growth for the future,” citing the country’s economic and political stability, expansive consumption base, and strong consumer engagement with Nestlé’s brands.

India currently ranks among Nestlé SA’s top ten global markets. It is the largest global market for the Maggi brand and the second largest for KitKat, showcasing the success of localised brand adaptation. According to Narayanan, Nestlé’s “think global, act local” philosophy has enabled the company to tailor its offerings to Indian tastes and preferences, reinforcing brand loyalty.

Investment Commitment

Over the last decade, Nestlé India has significantly increased its capital investment. From around 2% of sales, investment levels have risen to nearly 10% equating to over ₹6,000 crore (approximately USD 720 million). These funds have been directed toward capacity expansion, manufacturing upgrades, digitisation, and product innovation.

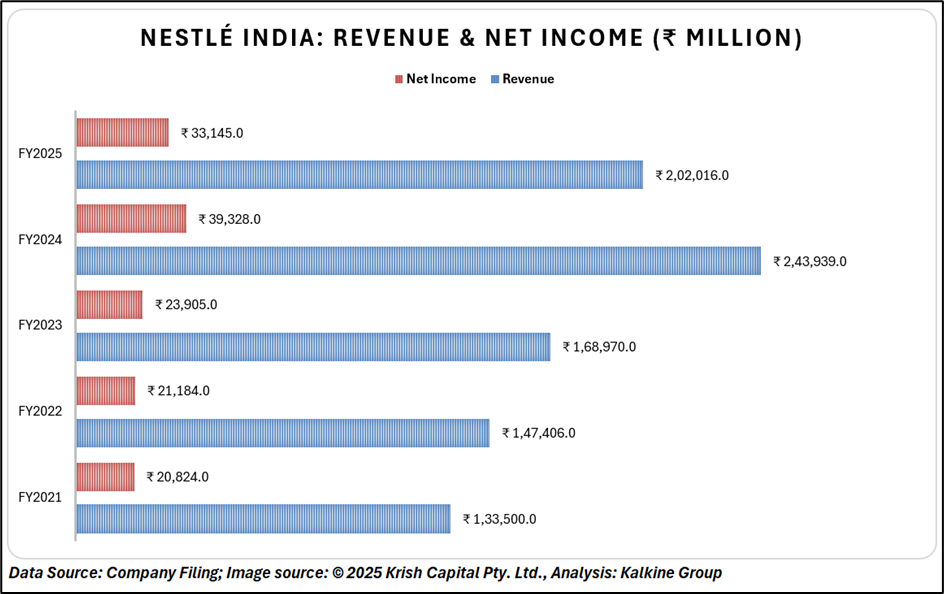

Narayanan credits this continued investment not just to the performance of the Indian operations but to the broader confidence that Nestlé SA has in the Indian market. Despite recent headwinds such as urban consumption slowdowns impacting the FMCG sector, Nestlé India has maintained a 10–11% CAGR over the last ten years and aims to return to double-digit growth as the consumption cycle revives.

Expansion Strategy

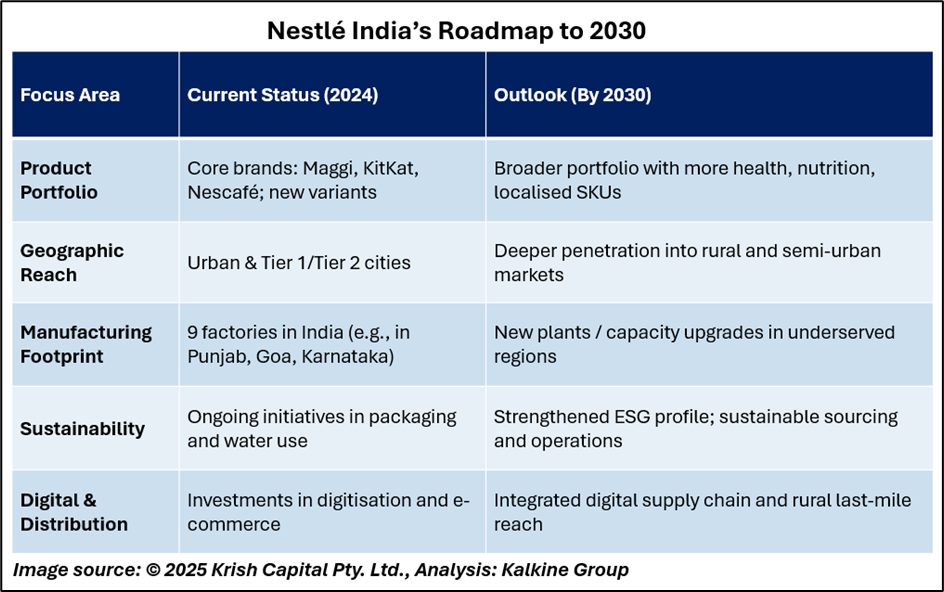

Looking forward, Nestlé India’s strategy involves expanding beyond its existing footprint both in terms of product offerings and geographic reach. Narayanan envisions the company becoming a "much deeper and more stable entity" by 2030, with a wider manufacturing presence and a stronger product portfolio. Growth will also be driven by penetration-led volume expansion, a model that has worked successfully for the company over the past decade.

India’s domestic demand profile makes it particularly appealing from a long-term business perspective. With a growing middle class and urbanisation trends accelerating, Nestlé sees an opportunity not just to grow in volume but to enhance its value proposition by investing in quality and innovation. The company also aims to build sustainability leadership in India, aligning with global environmental goals while catering to a locally sensitive market.

Conclusion

As Nestlé India prepares for leadership transition, the company remains confident in its growth outlook. Backed by consistent investment and strong brand affinity, India stands out not only as a major revenue contributor but as a strategic market shaping Nestlé’s global future. With its plan to deepen reach and product range while leveraging local relevance, Nestlé India appears positioned to sustain its momentum well into the next decade.