Over the past year, Bharat Electronics Limited (NSE:BEL) has seen its stock rise by more than 45% as of 5 November 2025. This increase reflects continued market interest in the company’s operational performance and financial metrics. Despite broader market fluctuations, the stock has remained resilient, supported by steady revenue growth, consistent profitability, and stable margins. While past stock performance is not a predictor of future returns, the recent trend indicates sustained investor confidence.

Quarterly Performance

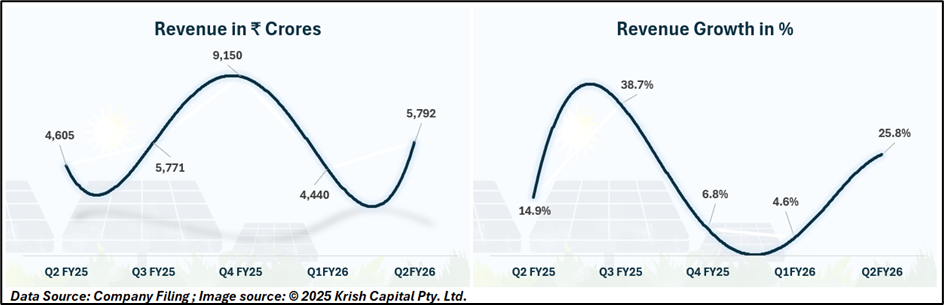

For the quarter ended 30 September 2025 (Q2 FY26), BEL reported consolidated revenue of ₹5,792 crore, marking a 25.8% year-on-year increase. Sequentially, revenue grew from ₹4,440 crore in Q1 FY26, reflecting ongoing progress across the company’s defence and electronic system projects.

Operating Metrics

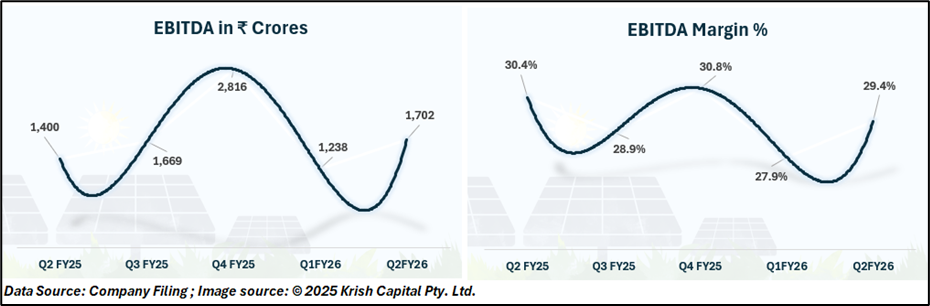

Total expenses for Q2 FY26 stood at ₹4,090 crore, compared with ₹3,201 crore in the previous quarter. Earnings before interest, tax, depreciation, and amortisation (EBITDA) were ₹1,702 crore, against ₹1,238 crore in Q1 FY26 and ₹1,400 crore in Q2 FY25. The EBITDA margin remained steady at 29.4%, slightly higher than 27.9% recorded in Q1 FY26, and broadly within the company’s recent margin range.

Profitability Trends

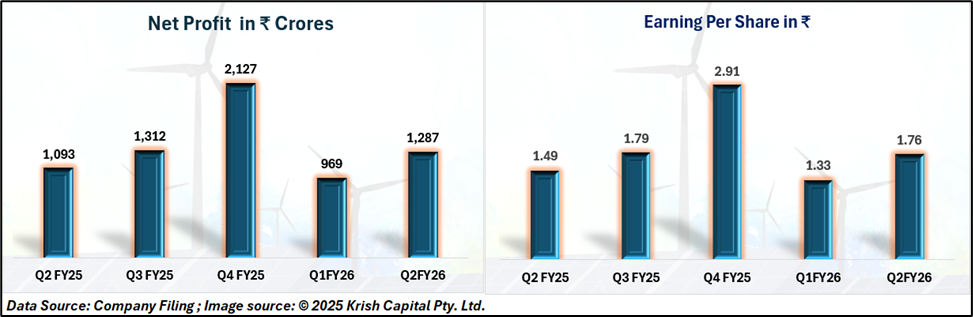

Net profit for the quarter was ₹1,287 crore, up from ₹969 crore in Q1 FY26 and ₹1,093 crore in Q2 FY25. Earnings per share (EPS) stood at ₹1.76, compared with ₹1.33 in the preceding quarter and ₹1.49 in the same period last year. The company recorded EPS growth of 18.1% year-on-year.

Five-Quarter Comparison

BEL’s revenue over the last five quarters has ranged between ₹4,440 crore and ₹9,150 crore. The company recorded its highest revenue in Q4 FY25 at ₹9,150 crore. Revenue growth moved from 14.9% in Q2 FY25 to 25.8% in Q2 FY26. Expenses have followed a similar trend, rising from ₹3,205 crore in Q2 FY25 to ₹4,090 crore in Q2 FY26.

EBITDA margins have remained between 27.9% and 30.8%, showing consistency across quarters. The company’s operating metrics indicate a stable cost structure and sustained profitability.

Outlook and Positioning

BEL’s financial position remains supported by consistent earnings, controlled expenditure, and balanced margins. The company continues to operate across multiple defence and electronics programs, maintaining a steady revenue base and profitability trend heading into the second half of FY26.

Conclusion

Bharat Electronics’ Q2 FY26 results reflect stable operational and financial performance across key indicators. Revenue, profit, and margins have remained consistent over recent quarters, supported by disciplined expense management and project execution. As the company enters the latter half of FY26, it continues to maintain a strong financial base, steady earnings visibility, and a consistent performance trend within its core defence electronics segment.