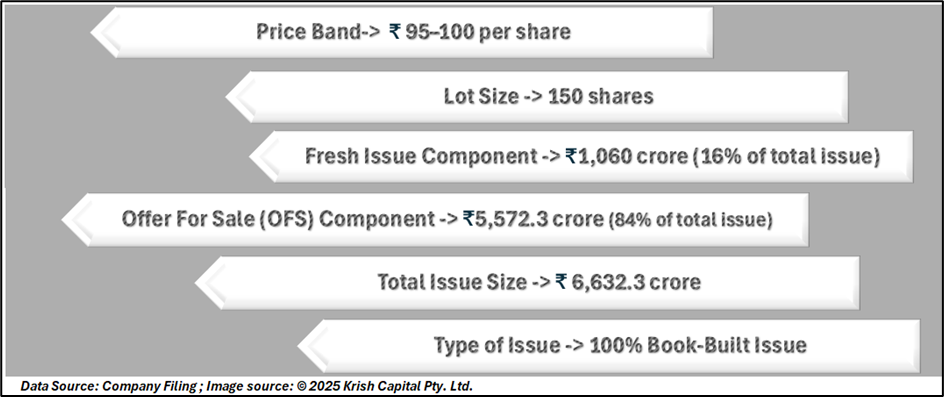

India’s fast-growing online investment platform, Groww (Billionbrains Garage Ventures Ltd), has launched its much-anticipated Initial Public Offering (IPO), marking a major milestone in the country’s digital finance ecosystem. The 100% book-built issue opened for subscription on November 4, 2025, and will close on November 7, 2025. With a price band of ₹95–₹100 per share and a lot size of 150 shares, the offering seeks to raise ₹6,632.3 crore in total, including a fresh issue of ₹1,060 crore (16%) and an offer for sale of ₹5,572 crore (84%).

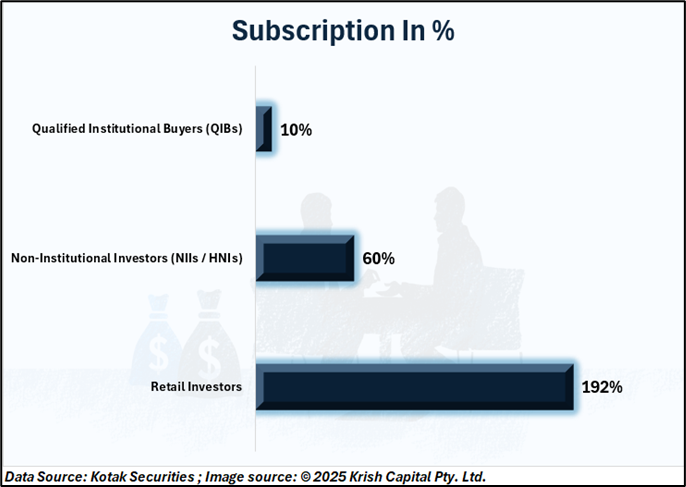

Investor Participation and Overall Subscription 57%

On Day 1, the Groww IPO recorded an overall subscription of 0.57 times (57%), indicating a steady but cautious investor response. The retail investor category saw the highest participation at 1.92 times (192%), while non-institutional investors (HNIs) subscribed 0.6 times (60%) and qualified institutional buyers (QIBs) 0.1 times (10%) of their respective quotas.

Digital Wealth Platform Driving Financial Inclusion

Groww, India’s largest direct-to-customer digital investment platform by active users on the NSE as of June 30, 2025, offers customers access to multiple financial products. Through its app and web platform, users can invest in stocks, mutual funds, derivatives, bonds, and IPOs, and access real-time market tools and insights. It also provides margin trading facilities and personal loans through its subsidiaries.

Groww’s user-friendly technology, data-driven approach, and seamless interface have contributed to rapid adoption among India’s young and first-time investors. The company continues to strengthen its position as a one-stop platform for digital wealth creation.

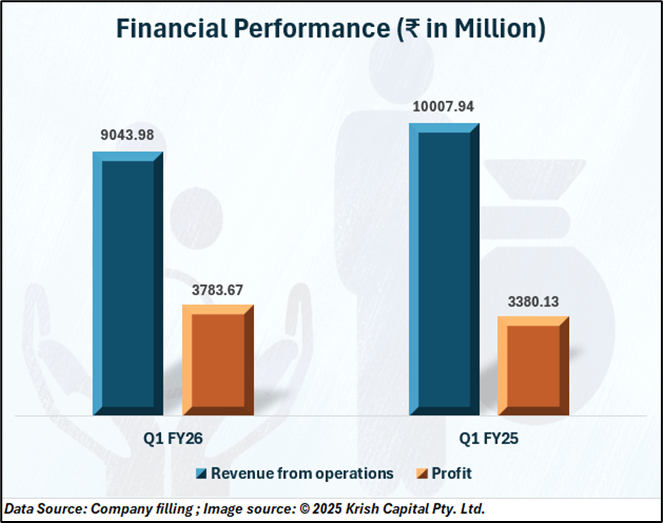

Financial Performance Highlights

Groww’s financial performance reflects strong growth momentum over recent years. In Q1 FY26, the company reported revenue from operations of ₹9,043.98 million, down 9.6% year-on-year from ₹10,007.94 million in Q1 FY25. Total income stood at ₹9,484.71 million, while profit for the period rose 11.9% YoY to ₹3,783.67 million from ₹3,380.13 million a year earlier.

For the full year FY25, revenue surged 49.6% year-on-year to ₹39,017.23 million compared with ₹26,092.81 million in FY24, while net profit improved sharply to ₹18,243.73 million from a loss of ₹8,054.5 million in FY24 — marking a significant turnaround. This improvement underscores stronger operational efficiency and continued customer growth.

Strategic Objectives of the IPO

Groww plans to use the IPO proceeds to drive long-term growth and strengthen its technology base. The funds will be directed towards cloud infrastructure, brand building, and performance marketing, along with capital infusion into its subsidiaries — Groww Creditserv Technology (GCS) and Groww Invest Tech (GIT) — to support lending and margin trading operations. The company will also explore strategic acquisitions and meet general corporate needs.

Conclusion

The Groww IPO’s solid 57% subscription on Day 1, driven mainly by retail investor enthusiasm, signals strong market confidence in the company’s digital-first investment model. As India’s financial landscape continues to digitize, Groww’s focus on technology, innovation, and accessibility positions it well to capture the next wave of retail participation and long-term growth in the fintech sector.