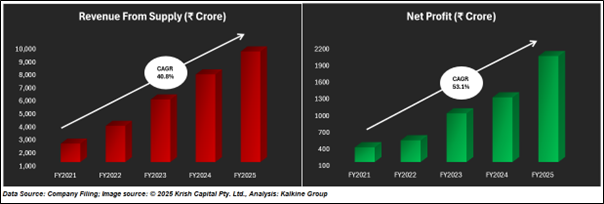

Adani Green Energy Ltd (AGEL) announced its Q4 and full-year FY25 results on April 28, 2025, highlighting exceptional financial momentum fuelled by substantial capacity expansion. In Q4FY25, the company saw a 37% YoY increase in power supply revenue, reaching ₹2,666 crore, up from ₹1,941 crore in Q4FY24. On a full-year basis, revenue climbed 23% to ₹9,495 crore, compared to ₹7,735 crore in FY24 primarily driven by the addition of 3.3 GW of new greenfield renewable capacity.

Profitability remained robust across the board. EBITDA from power supply rose 22% to ₹8,818 crore, reflecting strong operational efficiencies and cost controls. Net profit after tax saw a sharp 58.8% rise, reaching ₹2,001 crore, while cash profit increased 22% year-on-year to ₹4,871 crore, up from ₹3,986 crore in FY24.

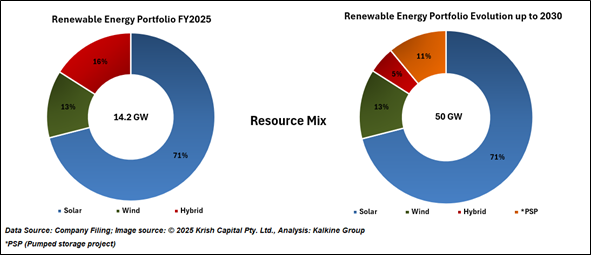

In FY25, Adani Green Energy generated 27,969 million units (MU) of electricity, registering a robust 28% year-on-year growth. This was led by contributions from solar (16,738 MU), wind (3,834 MU), and hybrid (7,397 MU) assets. The company boosted its operational capacity by 30%, reaching 14,243 MW, fuelled by 3,309 MW in greenfield additions. Notable installations included 1,460 MW of solar and 599 MW of wind in Khavda, Gujarat; 1,000 MW of solar in Rajasthan; and 250 MW in Andhra Pradesh. The company remains committed to its ambitious target of achieving 50 GW of renewable capacity by 2030.

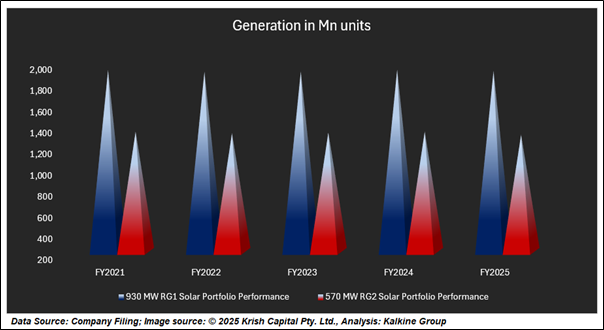

Adani Green Energy’s two key solar portfolios, RG1 and RG2, demonstrated strong operational performance in FY25. The 930 MW RG1 portfolio generated 1,900 million units (MU) of electricity, while the 570 MW RG2 portfolio produced 1,299 MU. RG1 reported a revenue from power supply of ₹1,000 crore, up from ₹959 crore in FY24. Similarly, RG2 recorded ₹511 crore in revenue, compared to ₹495 crore in the previous year. The consistent revenue growth and stable generation efficiency across both portfolios reflect the company’s effective asset utilization and robust solar performance.

Clarity Amid Controversy: U.S. Bribery Allegations Dismissed

Addressing concerns raised by recent U.S. legal proceedings, AGEL disclosed that an independent review cleared its executives of any wrongdoing in connection with bribery allegations. The company categorically denied the accusations and anticipates no material impact on its operations or governance structure. In a sign of continued board confidence, Vneet Jaain has been reappointed as Managing Director for a five-year term, reinforcing leadership stability at a critical growth phase.

Technical Analysis

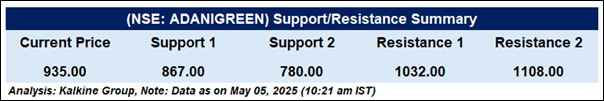

Adani Green Energy is signalling a potential trend reversal, supported by an ascending trendline from its March lows, indicating accumulation. The stock is trading above the 51-day EMA at ₹934.23, which now acts as dynamic support. The RSI (14) at 52.41 reflects improving bullish momentum. Sustained price action above the EMA and trendline could confirm a breakout, while any breakdown below these levels may hinder further upside in the near term.

Outlook

Adani Green Energy is in a strong position after reporting impressive Q4FY25 results, characterized by substantial revenue growth, increased profitability, and notable capacity expansion. The resolution of U.S. bribery allegations, with no wrongdoing found, removes a key concern. Continued leadership stability and improving technical indicators further support a positive long-term outlook for the company amid its ambitious renewable growth targets.