Amara Raja Energy & Mobility Ltd. (ARE&M), formerly Amara Raja Batteries Ltd., has reported its Q4 and FY25 results, reflecting a stable yet strategically poised performance. Backed by robust fundamentals and long-term energy transition bets, ARE&M continues to reinforce its leadership in the lead-acid battery segment while gradually scaling its New Energy business vertical.

Financial Snapshot: Steady Performance with Controlled Optimisation

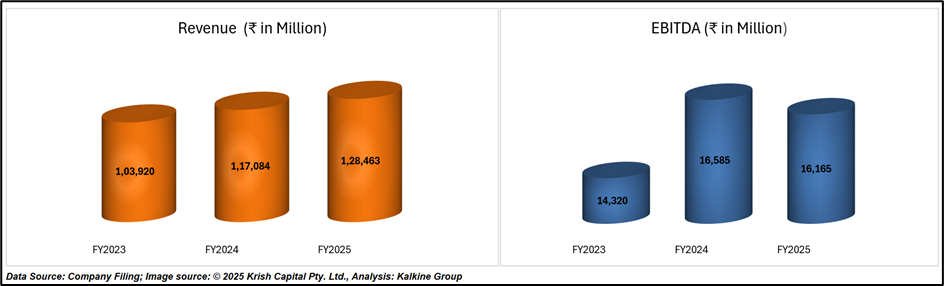

In FY25, Amara Raja Energy & Mobility reported consolidated revenue of ₹12,846.3 crore, reflecting a 9.7% year-on-year increase from ₹11,708.4 crore in FY24. Profit after tax (PAT) rose slightly by 1.1% to ₹944.7 crore, while diluted EPS edged up to ₹51.62 from ₹51.05 in the previous year.

The company's EBITDA margin declined by 160 bps YoY to 12.6% despite healthy top-line growth, largely due to higher operating expenses. EBITDA fell 2.5% to ₹1,616 crore. Yet, a minimal debt profile and efficient capital management ensured a resilient ROCE of ~16% a standout in the energy components space.

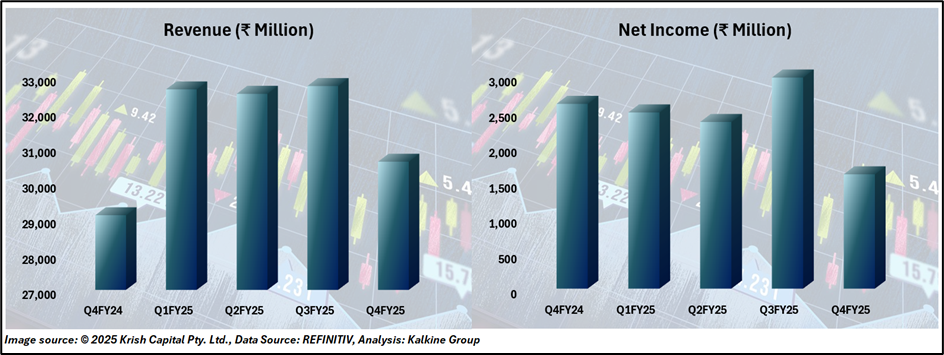

In Q4 FY25, Amara Raja Energy & Mobility's consolidated revenue grew by 5.2% year-on-year to ₹3,060.1 crore, while profit after tax (PAT) declined 29.7% YoY to ₹161.6 crore, reflecting pressure from higher costs and muted export demand. EBITDA margin compressed to 11.1% from 14.1% a year earlier, reflecting transitionary pressures due to new investments and subdued export demand. The exceptional income booked earlier in the year (₹111.1 crore) from insurance claims cushioned the full-year results.

Expansion & Capex: Betting Big on Giga-Scale Energy

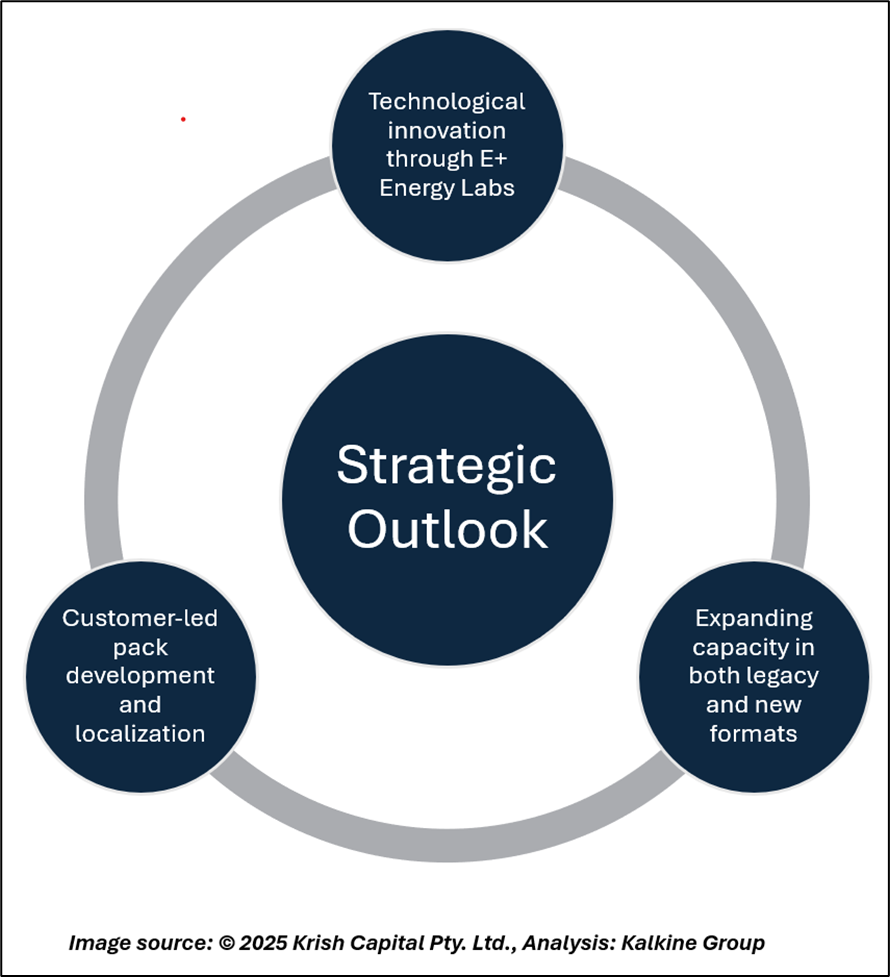

ARE&M’s foray into lithium-ion batteries is anchored by a ₹9,500 crore capex plan over five years. The 16 GWh Giga-cell plant and 1.5 GWh mobility pack facility at Divitipally are expected to begin operations by Q2/Q3 FY26. A Customer Qualification Plant (CQP) is already in progress to validate and optimize product development for future cell chemistries including NMC and LFP.

Global Reach & Brand Power

ARE&M exports to over 60 countries, with international revenue contributing ~13% of total sales. The company enjoys a premium brand recall with ‘Amaron’, ‘PowerZone’ and ‘Quanta’ in both B2C and institutional markets. It aims to establish presence in 80 countries by FY30, with a focus on Europe, MEA and APAC.

Technical Analysis

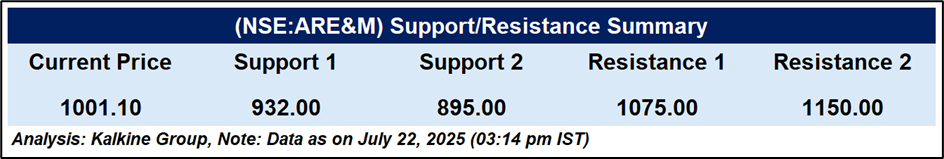

ARE&M's stock is trading above key horizontal support levels at INR 932.00 and INR 895, forming a bullish candlestick pattern that signals strength in current trend. The 14-day Relative Strength Index (RSI) is at 58.52, reflects sustained positive momentum with next resistance levels seen at INR 1075 and INR 1150.

Conclusion

Amara Raja Energy & Mobility combines stable financials with strategic investments in green energy. Despite periphery pressures, its strong core business, expanding global reach, and giga- scale lithium intentions position it well for long- term growth. Technically flexible, the stock offers a compelling near- term occasion amid India’s clean energy metamorphosis.