Anand Rathi Wealth Limited (NSE: ANANDRATHI) reported strong results for the quarter and half year ending 30 September 2025 (Q2 & H1 FY26), further solidifying its status as a top contender in India’s wealth management sector. The firm achieved healthy revenue growth, improved profitability, and sustained expansion of its assets under management (AUM), underlining its operational resilience and focused execution.

Financial Performance

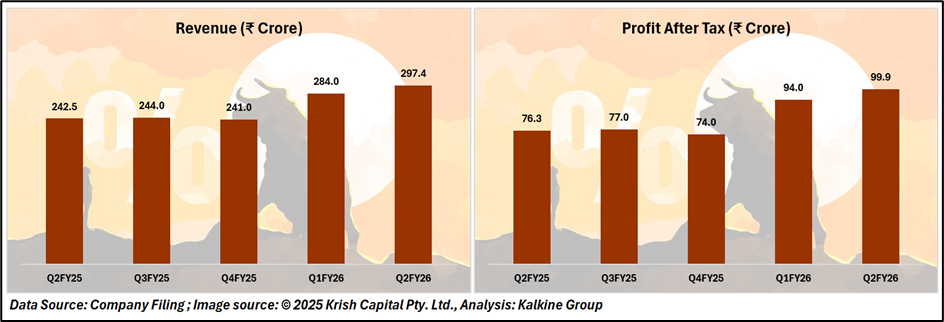

During Q2 FY26, the company’s revenue from operations increased 22.6% year-on-year (YoY) to ₹297.4 crore, compared to ₹242.5 crore in the same period last year. Total income grew 23.1% YoY to ₹307.2 crore, supported by healthy traction across mutual funds, structured products, and advisory solutions.

Profit before tax (PBT) climbed 31.3% YoY to ₹134.2 crore, reflecting operational efficiency and strong cost discipline. Net profit (PAT) rose 30.9% YoY to ₹99.9 crore, with PAT margin improving to 32.5% from 30.6% a year ago.

For H1 FY26, the company posted 19.5% YoY growth in total revenue to ₹591.4 crore, while PAT advanced 29.4% YoY to ₹193.8 crore, delivering an impressive, annualized ROE of 45.5% a hallmark of its scalable, asset-light business model.

Employee costs rose 14% YoY to ₹124.9 crore, driven by expansion in advisory teams and client management capabilities. Other expenses increased 26.6% YoY to ₹48.1 crore, reflecting higher spending on digital upgrades and business development. Nevertheless, higher fee-based income helped offset these costs, supporting margin improvement.

Business and Operational Highlights

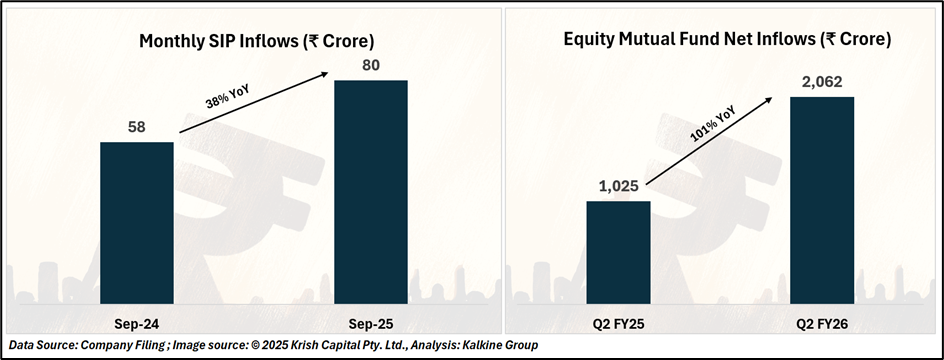

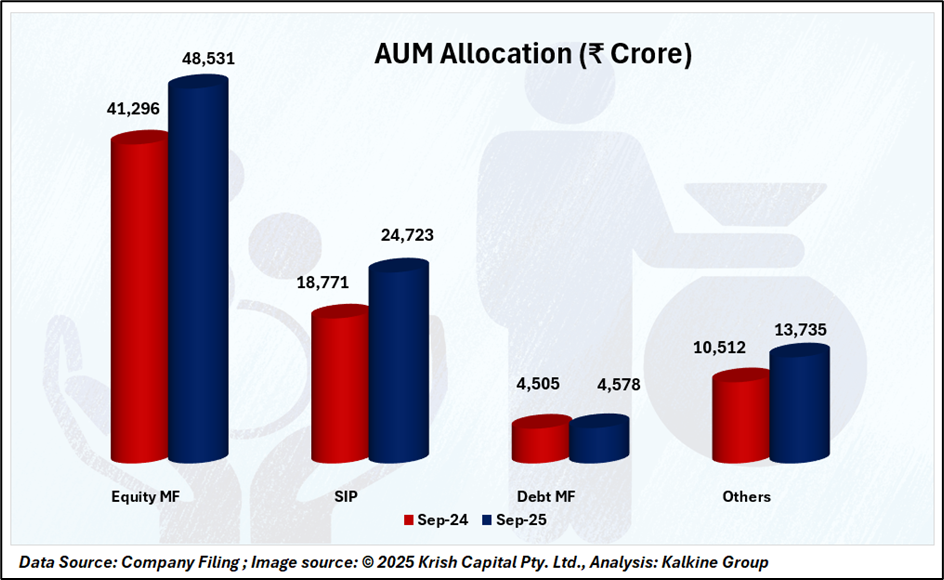

The company’s AUM expanded 22% YoY to reach ₹91,568 crore, supported by strong inflows across equity and structured product segments. Monthly SIP inflows stood at ₹3,002 crore in Q2 FY26, marking a 29% YoY rise, while equity mutual fund inflows more than doubled to ₹2,062 crore.

The relationship manager (RM) network increased to 386, collectively managing 12,781 active client families with an average AUM per RM of ₹231 crore. The firm’s strategic focus on HNI and UHNI clients continues to yield results clients with portfolios exceeding ₹50 crore now contribute 27.8% of total AUM, up from 13.9% in FY20.

Outlook

Anand Rathi Wealth, managing assets exceeding ₹91,000 crore and capturing around 2.33% of the industry’s equity inflows, is strategically positioned to capitalize on the rapid expansion of India’s wealth management sector.

Technical Analysis

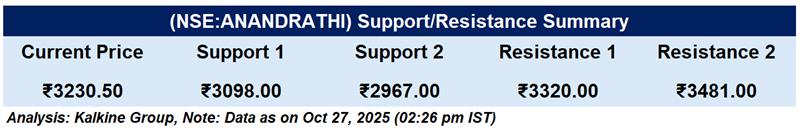

Anand Rathi Wealth Ltd rose 3.76% to ₹3,230.50, extending its uptrend and staying well above the 51-day EMA at ₹2,911.36, indicating continued bullish momentum. The RSI at 66.47 reflects strong positive sentiment without overbought pressure. Immediate support is placed near ₹3,000, while resistance is seen around ₹3,300.

Conclusion

Anand Rathi Wealth’s strong Q2 FY26 performance underscores its robust business fundamentals and scalability. With consistent AUM growth, superior profitability metrics, and steady client expansion, the company is well positioned to sustain long-term momentum and strengthen its leadership in India’s rapidly evolving wealth management industry.