Axis Bank is adding 50 new private bankers to its team as part of a push to serve India’s growing population of wealthy individuals. With more high-net-worth and ultra-high-net-worth clients emerging, the demand for personalized financial and investment services is rising. The bank’s move comes at a time when many wealthy clients are seeking expert advice to grow and protect their assets.

Expanding Across Cities

The bank has expanded its presence to 52 cities from 30 last year. This expansion is not just focused on big cities; it also targets tier-2 and tier-3 towns, where wealth is increasing rapidly. By reaching smaller cities, Axis Bank can tap into a growing market of affluent clients who previously had limited access to private banking services.

Strengthening Burgundy Private

The new hires will join Axis Bank’s private banking unit, Burgundy Private, which currently has 250 bankers. Burgundy Private manages about 2.5 trillion rupees for more than 15,000 ultra-rich clients, each with at least 50 million rupees to invest. The additional bankers will help provide more personalized services, from investment advice to wealth planning, ensuring that clients receive the attention and guidance they need.

India’s Wealth Growth Story

India’s wealth management industry is expected to grow rapidly, with assets projected to double to $2.3 trillion by 2029, up from $1.1 trillion in 2024. This growth is being fueled by strong stock market performance, private equity and venture capital investments, and record-setting initial public offerings. Every year, tens of thousands of new millionaires are emerging, driving demand for professional wealth management services.

Plans for New Funds from GIFT City

Axis Bank is also planning to launch multiple funds in early 2026 from Gujarat International Finance Tec-City (GIFT City), India’s low-tax financial hub. The bank aims to offer in-bound funds for non-resident Indians and wealthy domestic clients, using both feeder and direct fund structures. In addition, outbound funds will allow investments in global equities and dollar-denominated structured products, providing clients with more options to diversify and grow their wealth.

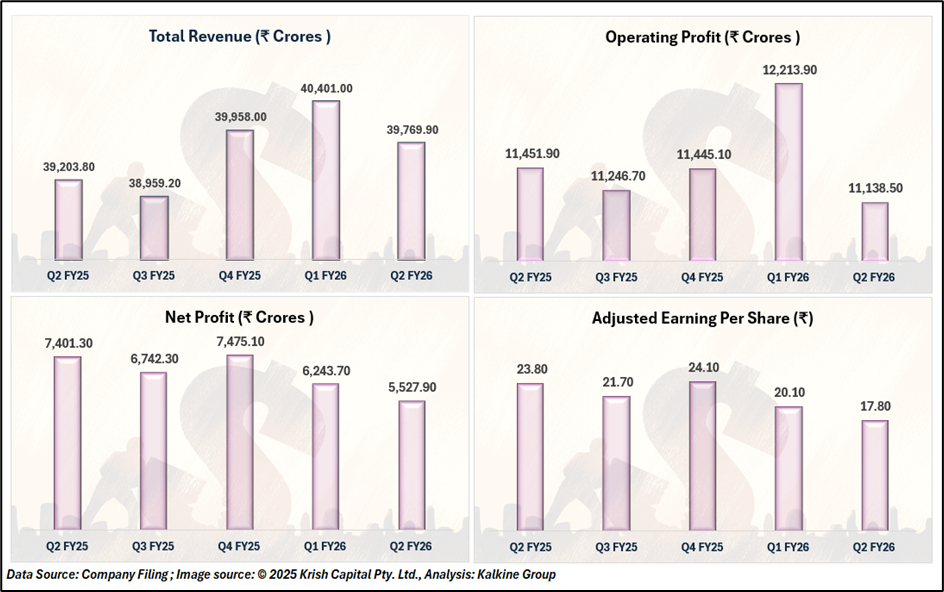

Simple Quarterly Financial Summary

The company’s total revenue stayed broadly stable between Q2 FY25 and Q2 FY26, moving from 39,203.8 to 39,769.9, with the highest level seen in Q1 FY26 at 40,401. Operating profit remained steady but peaked in Q1 FY26 at 12,213.9 before falling to 11,138.5 in Q2 FY26. Net profit showed a downward trend after Q4 FY25, falling from 7,475.1 to 5,527.9 in Q2 FY26. Similarly, adjusted EPS declined from 24.1 in Q4 FY25 to 17.8 in Q2 FY26.

Focused on India’s Wealth Boom

With wealth in India growing fast, Axis Bank is positioning itself to serve more clients while offering a full spectrum of financial services. The bank’s hiring spree and plans for new funds show its commitment to supporting the country’s affluent population. By expanding its team and offerings, Axis Bank aims to provide tailored financial solutions that help clients achieve their investment goals and secure their wealth for the future.

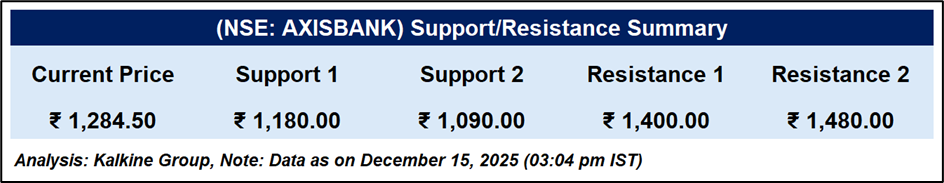

Technical Analysis

Axis Bank is trading near INR 1,284.50, holding above its 51-day SMA, indicating a positive short-term trend. The RSI around 60.30 reflects moderate momentum without overbought conditions. Price action remains constructive, with support near INR 1,090, while resistance is seen around the recent highs near INR 1,480.

Conclusion

Axis Bank’s strategy highlights its focus on capturing the opportunities created by India’s rising wealthy population. With an expanded team, new funds, and comprehensive services, the bank is prepared to meet the evolving needs of its high-net-worth and ultra-high-net-worth clients while staying competitive in a rapidly growing industry.