ITD Cementation India Limited, a leading construction company, reported exceptional financial performance for Q4 and FY25, showcasing its commitment to growth and operational excellence.

In Q4 FY25, ITD Cementation reported a revenue of ₹2,480 crore, reflecting a healthy 10% year-on-year increase from ₹2,258 crore recorded in the same quarter of FY24. The EBITDA for the quarter stood at Rs 268 crore, reflecting an impressive 11% increase, while Profit After Tax (PAT) reached Rs 114 crore, demonstrating strong profitability. These figures underscore the company’s ability to capitalize on high-value projects and maintain operational efficiency.

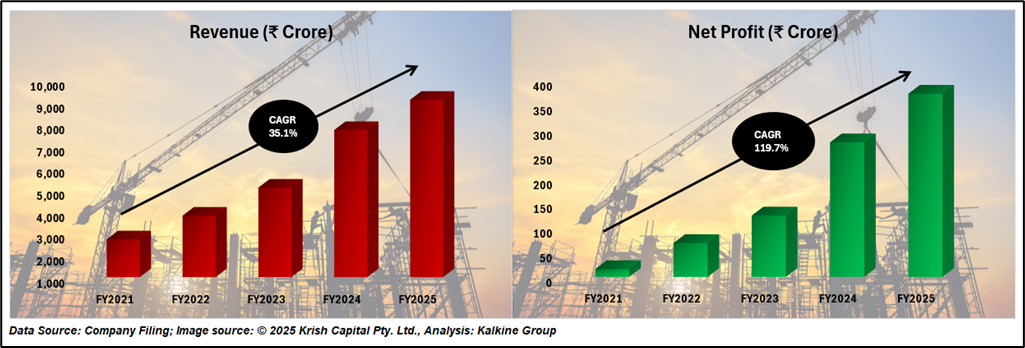

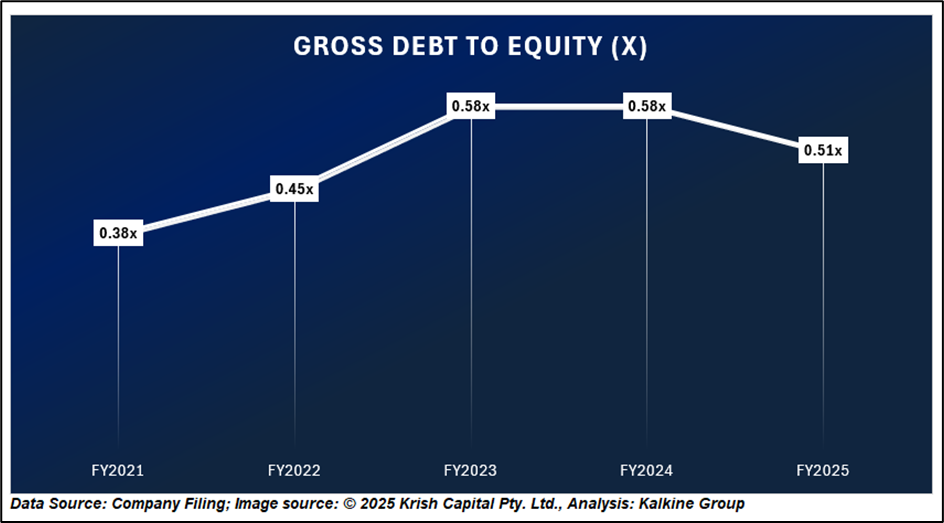

For the full year FY25, ITD Cementation reported a consolidated revenue of Rs 9,097 crore, a 17.9% rise from Rs 7,718 crore in FY24. The EBITDA surged to Rs 923 crore, up 14% from the previous year, and PAT climbed to Rs 373 crore, a notable improvement. The gross debt-to-equity ratio remained stable at 0.51x, indicating prudent financial management.

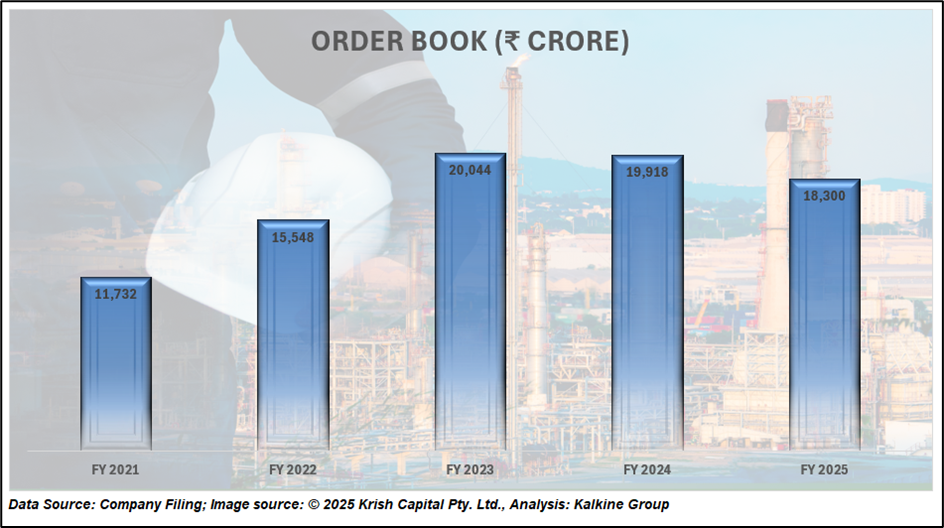

The company’s robust order book of Rs 18,300 crore as of March 31, 2025, provides multi-year revenue visibility. ITD Cementation secured orders worth Rs 7,174 crore in FY25, including marquee projects like the Near Shore Reclamation for Vadhvan Port (Rs 1,648 crore) and a multistoried commercial building in Uttar Pradesh (Rs 1,641 crore). The diversified order book spans maritime structures (34.6%), industrial buildings (24.4%), and urban infrastructure (18%), reflecting a balanced portfolio.

ITD Cementation’s operational excellence is further evidenced by its presence across 13 Indian states, one union territory, and international projects in Sri Lanka and Bangladesh. Its clientele includes government (50%), public sector undertakings (8%), and private sectors (42%), ensuring a broad revenue base. The company’s focus on safety and quality earned it the International Safety Award 2023 for its Project Seabird.

With a legacy of over 90 years, ITD Cementation continues to prioritize customer satisfaction, employee welfare, and environmental responsibility. Its strategic focus on technology and R&D positions it as a leader in India’s construction sector, poised for sustained growth.

Technical Analysis

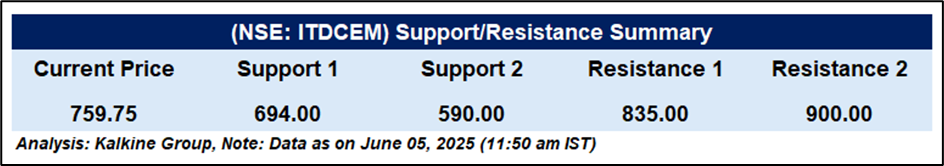

ITD Cementation India Ltd (NSE: ITDCEM) has been in a strong uptrend since May 2025, following a breakout from a prolonged consolidation phase. The stock is currently trading well above its 51-period EMA (₹616.57), highlighting sustained bullish momentum. The 14-period RSI stands at 72.17, indicating overbought territory, which could lead to a short-term pullback or sideways movement. However, there are no immediate signs of bearish divergence, and the RSI continues to support the current price strength. Investors and traders should keep an eye on any potential loss of momentum or a breach of the EMA as key signals.

Outlook

ITD Cementation India Ltd presents a strong growth outlook, backed by robust financials, a ₹18,300 crore order book, and operational excellence. With a stable debt profile and strategic project wins, it is well-positioned for sustained growth. The stock is trading near its all-time high, supported by bullish technical and strong investor confidence, signaling continued upside potential.