The board of Federal Bank has approved a preferential issue of up to 27.3 crore warrants, raising ₹6,196.5 crore via its affiliate Asia II Topco XIII Pte Ltd. a group entity of global private‐equity firm Blackstone Group. Each warrant will entitle conversion into one fully paid equity share (face value ₹2) at a price of ₹227 (inclusive of a ₹225 premium). On full conversion, the investor will hold approximately 9.99% of the bank’s paid‐up share capital. The issuance is subject to shareholder and regulatory approvals.

In tandem, the board granted the investor a special right to nominate one non-executive director on the bank’s board, effective upon full conversion of the warrants and the investor holding a minimum 5% stake of paid-up capital. An Extraordinary General Meeting (EGM) has been convened for 19 November 2025, with record date for e-voting set as 12 November 2025.

This capital raise signals Blackstone’s strong conviction in the bank’s future providing a significant buffer to the bank’s capital base and enabling acceleration of growth initiatives.

Financial Performance & Operational Highlights

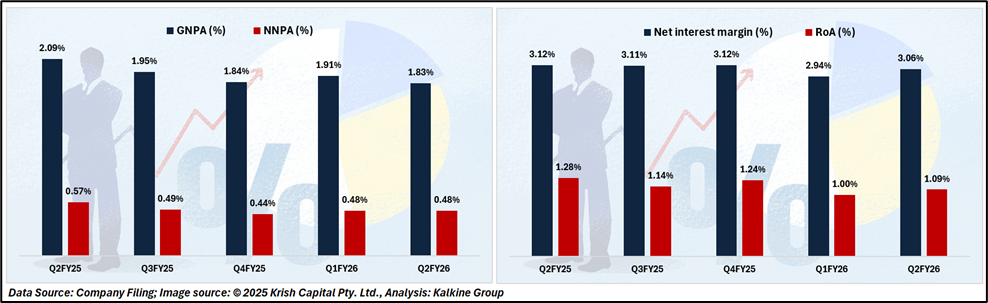

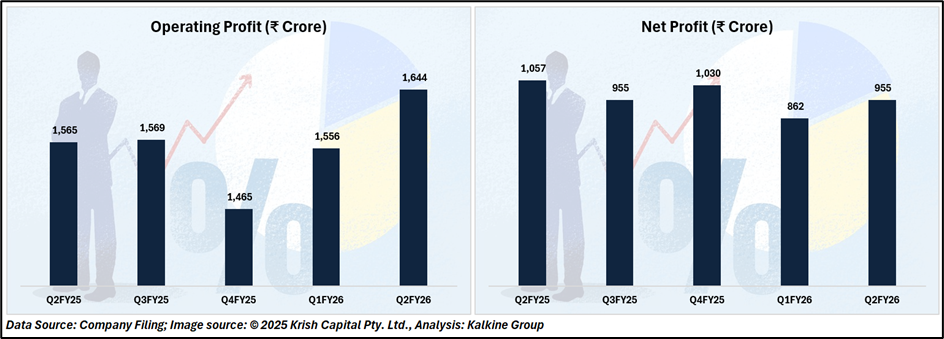

Federal Bank reported a robust set of operating results for the quarter ended September 30, 2025, underscored by record highs in core income streams and sustained strength in its liability franchise, despite marginal bottom-line pressure from increased provisions.

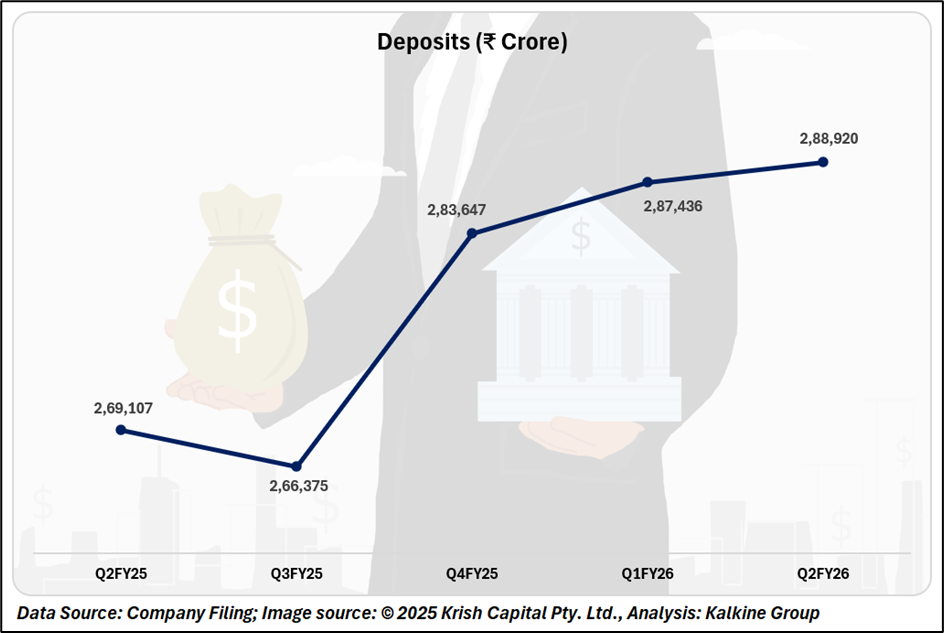

Deposits grew 7.4% year-on-year to INR 2,88,920 crore in Q2FY26, up from INR 2,69,107 crore in Q2FY25.

Strategic Implications & Investor Takeaways

- Fresh equity and board-nomination rights strengthen growth prospects and governance.

- Improved capital adequacy supports expansion in retail, SME, and digital banking.

- Q1 profit dip reflects provisioning pressures, warranting credit-cost monitoring.

- Warrant conversion and potential premium could drive re-rating if earnings and asset quality hold.

- Current ROE and cost-income metrics suggest scope for margin improvement and investor confidence.

Technical Analysis

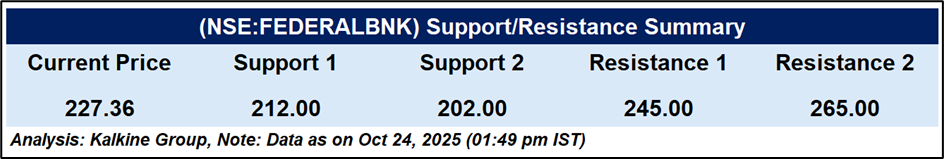

Federal Bank hit an all-time high of ₹232.20 and is currently trading at ₹227.36, well above its 51-day EMA of ₹204.69. Strong bullish momentum is evident, though the RSI at 78.83 signals overbought conditions, hinting at possible short-term profit booking. Recent volume surges confirm robust buying interest, supporting the ongoing uptrend.

Conclusion

Federal Bank’s preferential issue to Blackstone strengthens capital and governance, supporting growth in retail, SME, and digital banking. Q2FY26 operating performance remains robust despite provisioning pressures. Technically, the stock shows strong momentum above its 51-day EMA, though overbought RSI suggests potential short-term profit booking amid continued investor interest.