The U.S. decision to exempt generic medicines from President Donald Trump’s newly imposed 100% tariffs on pharmaceutical imports has provided temporary relief to Indian drugmakers. However, the broader sentiment around the pharmaceutical sector remains cautious, with the Nifty Pharma index slipping nearly 2% in Friday’s trade.

Relief, but Not Reassurance

India, the world’s largest supplier of generic medicines to the U.S., faced heightened concerns after Washington announced sweeping tariff measures. While the exemption signals recognition of generics’ critical role in keeping healthcare affordable, the lack of clarity on future exemptions and potential inclusion of specific molecules has left investors jittery.

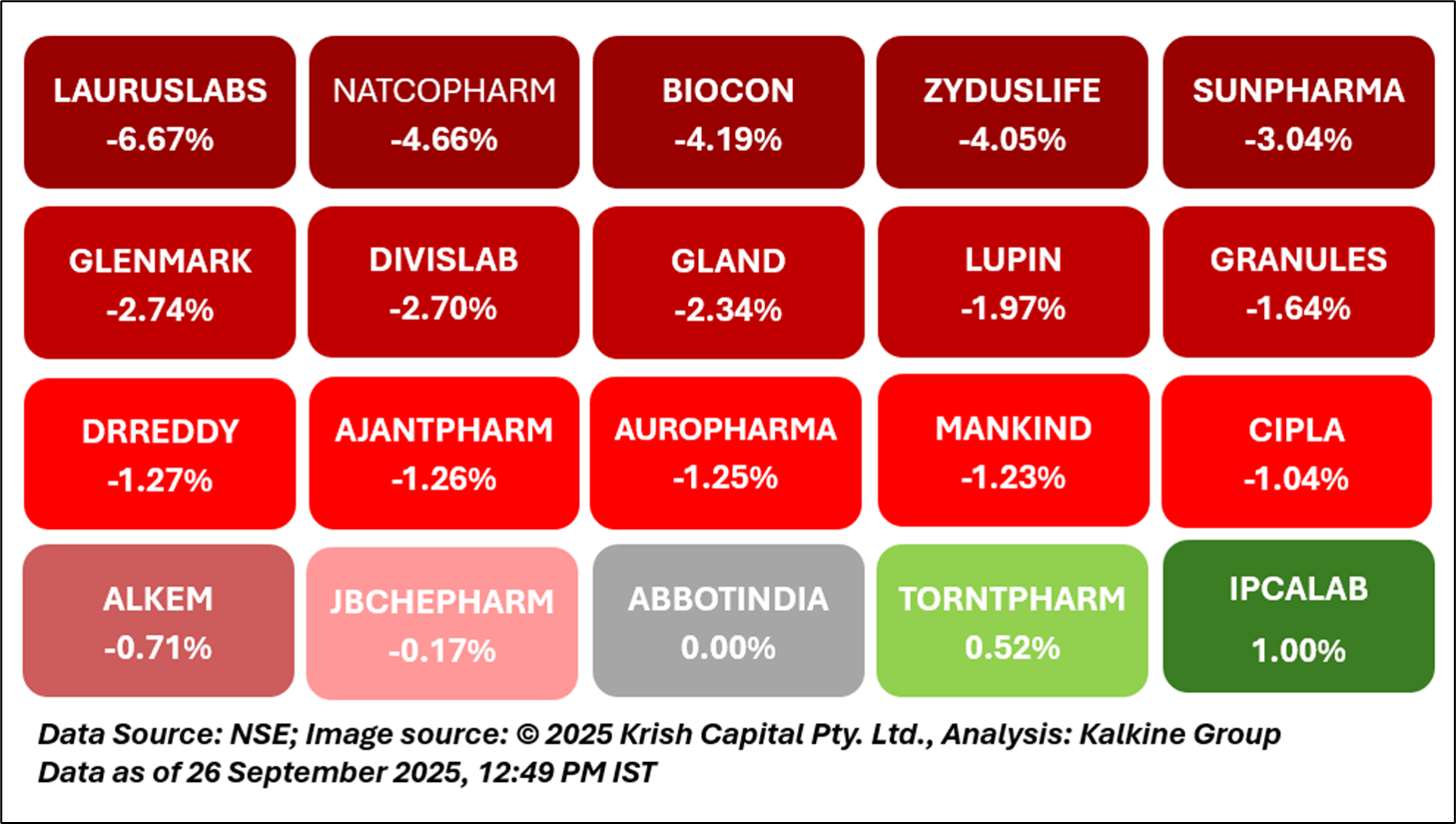

Investor Sentiment Weakens

Pharma stocks across the board witnessed selling pressure as traders weighed the risks of regulatory uncertainty, U.S. price erosion, and pending approvals. Export-oriented players, which derive a significant share of revenue from the U.S. market, are particularly vulnerable to policy shifts.

Strategic Importance of Generics

Generics account for over 85% of U.S. prescriptions by volume, with India supplying nearly 40% of these drugs. The exemption reflects the strategic importance of Indian pharma to global healthcare supply chains. Still, the policy unpredictability under the Trump administration poses a persistent overhang.

Sector Outlook

Analysts suggest that while the immediate tariff relief is positive, margin pressures, compliance challenges, and uncertain global trade dynamics will likely keep valuations under check. Select large-cap pharma companies with diversified product portfolios and strong compliance track records may remain relatively resilient.

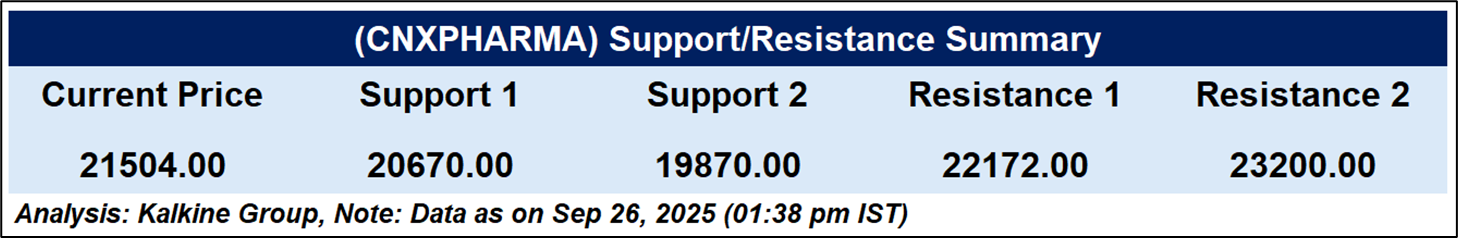

Technical Analysis

The Nifty Pharma Index fell 2.16% to 21,504, with the RSI at 35.61 signaling oversold conditions. Immediate support is seen at 20,670, while resistance levels are at 22,172. The overall trend remains bearish unless the index sustains above Resistance 1. Although oversold readings could trigger a short-term rebound, downside risks continue to dominate, suggesting cautious trading. Momentum indicators point to continued selling pressure in the near term.

Conclusion

While the U.S. tariff exemption offers temporary relief for Indian generics, broader sector risks persist. Regulatory uncertainty, margin pressures, and reliance on exports keep investor sentiment cautious. Technical indicators suggest limited rebound potential, but the overall bearish trend remains, warranting careful stock selection and risk-aware trading in pharma equities.