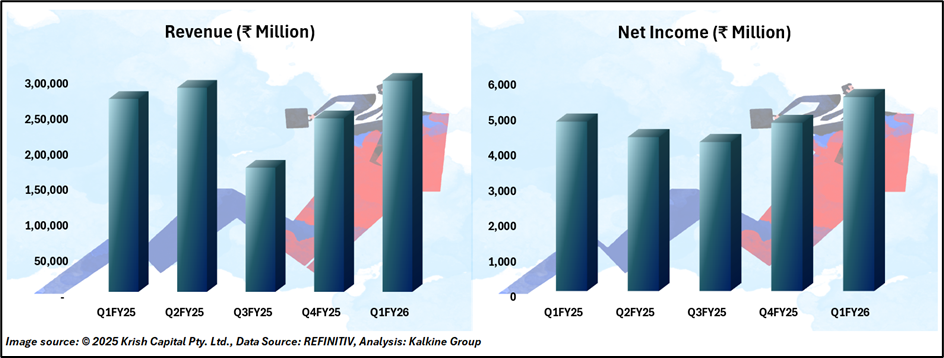

HDFC Life Insurance delivered a 14% year-on-year rise in net profit to ₹546 crore in Q1FY26, underpinned by a sharp recovery in investment income. However, the stock ended lower on the day, reflecting investor caution over slight misses in key growth metrics such as APE and VNB.

Financial Performance: Steady Expansion with Margin Strength

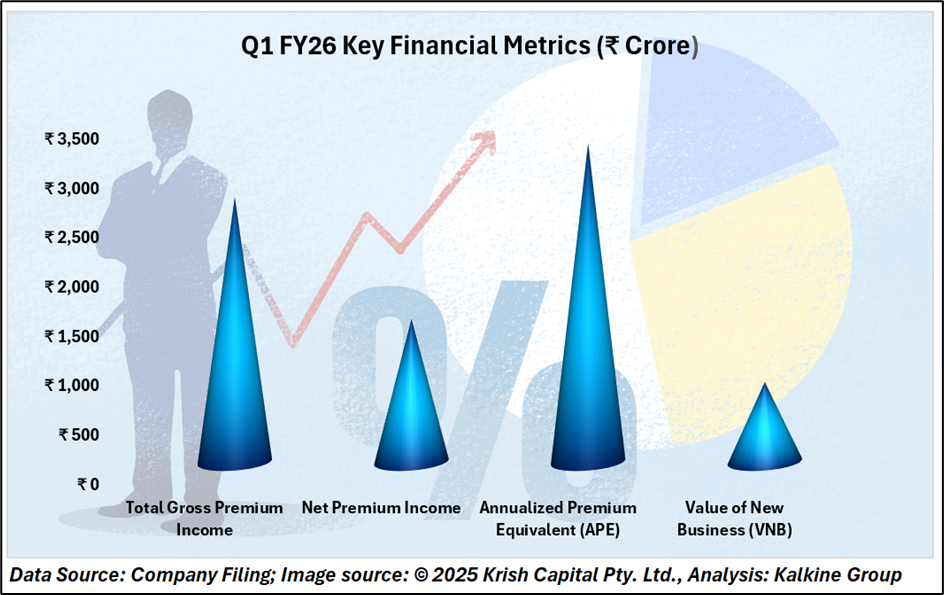

In Q1FY26, HDFC Life reported total gross premium income of ₹2,680 crore, comprising ₹1,487 crore from first-year premiums, ₹760 crore in renewals, and ₹472 crore from single premiums. Net premium income grew 16% year-on-year to ₹1,446 crore, underscoring robust underlying demand.

However, some growth metrics came in slightly below expectations. Annual Premium Equivalent (APE) stood at ₹3,225 crore, while Value of New Business (VNB) was ₹809 crore—just shy of the estimated ₹834 crore. Despite this, VNB grew 12.7% YoY, and the VNB margin expanded to 25.1%, driven by a favourable shift in product mix and enhanced operational efficiency.

Individual APE grew 12.5% year-on-year, backed by a robust two-year compound annual growth rate (CAGR) of 21%. This led to a 70-basis point increase in overall market share, taking it to an all-time high of 12.1%. CEO Vibha Padalkar attributed the performance to “healthy growth across topline, value of new business, and steady margins,” reinforcing the insurer’s consistent business momentum.

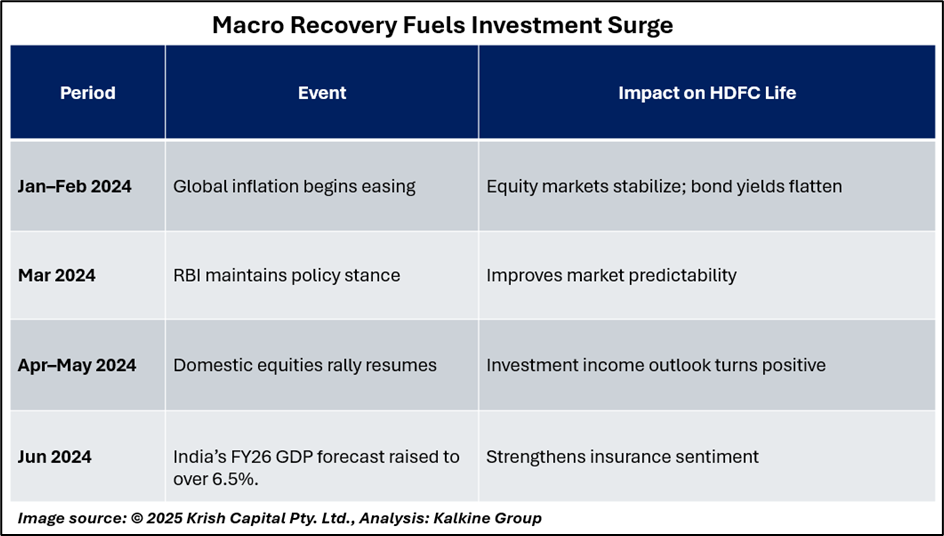

Macro Tailwinds Boost Investment Income

HDFC Life saw policyholder investment income rebound sharply to ₹1,459 crore in Q1FY26, up from just ₹1.8 crore in Q4FY25, driven by stronger equity markets and easing inflation. Unit-linked fund yields turned positive at 9.5% vs -4.5% earlier. With GDP growth forecast above 6.5%, macro conditions remain supportive. Shareholder investment income stood at ₹32 crore, while PBT rose to ₹56 crore. The solvency ratio remained strong at 192%.

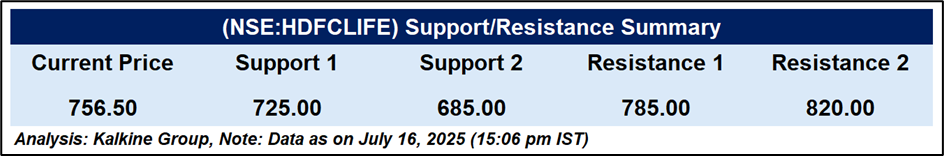

Technical Analysis

HDFC Life is trading at ₹756.50, just under its 51-day EMA, reflecting a mildly bearish undertone in the current technical setup. Immediate support is placed at ₹725, with a deeper support at ₹685 in case of further downside. On the upside, resistance is seen at ₹785, and a breakout above this level could take the stock toward ₹820. RSI at 40.90 suggests waning momentum. Unless the stock decisively moves above ₹785, the trend remains neutral to slightly bearish in the near term.

Conclusion

Despite robust profit growth and margin improvement in Q1FY26, HDFC Life came under selling pressure owing to slight misses in APE and VNB performance. Strong investment gains and a solid solvency ratio underscore the company’s underlying strength. However, near-term technical indicators remain cautious, with a breakout above ₹785 required to revive bullish momentum.