Hero MotoCorp, the world’s largest manufacturer of two-wheelers, has once again demonstrated its robust financial and operational performance in Q3FY25, marking a significant milestone in its growth trajectory. With strong sales volumes, strategic investments, and key product launches, the company continues to solidify its leadership in both the traditional and electric two-wheeler segments.

Strong Sales and Revenue Performance

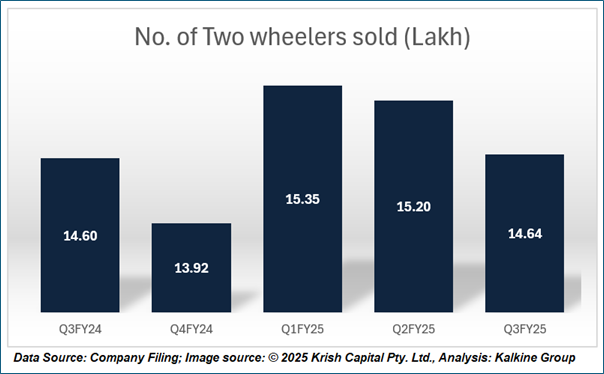

In Q3FY25, Hero MotoCorp sold 14.64 lakh units of two-wheelers, a slight increase from the 14.60 lakh units sold in Q3FY24. This growth, although modest, highlights the company’s ability to maintain steady sales despite a competitive and dynamic market environment. The company’s diversified product portfolio, which includes motorcycles, scooters, and electric vehicles (EVs), has enabled Hero MotoCorp to cater to a wide customer base, ensuring resilience in fluctuating market conditions.

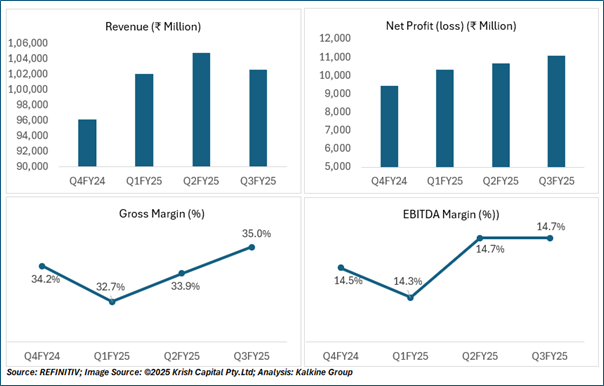

Revenue from operations stood at ₹10,210.78 crore in Q3FY25, representing a 5% year-on-year growth from ₹9,723.73 crore in the same period last year. This increase is primarily attributed to higher sales volumes of motorcycles and scooters, which have been the backbone of the company’s core business. As demand for two-wheelers remains strong, Hero MotoCorp has leveraged its brand recognition and established presence in key markets to maintain a healthy revenue stream.

Hero MotoCorp’s EBITDA for Q3FY25 grew 8% to ₹1,476 crore, reflecting improved operational efficiency and cost management. The company’s PAT rose 12% to ₹1,203 crore, driven by higher revenues and effective cost control, highlighting its strong financial health.

Dividends and Capital Allocation

Hero MotoCorp’s strong earnings have translated into value for shareholders, with the company declaring an interim dividend of ₹100 per share for Q3FY25. The dividend payout reflects the company’s financial strength and commitment to delivering shareholder value. This marks a strategic decision to return capital to investors, balancing the need for reinvestment in future growth initiatives.

EV Segment and Global Expansion Boost Hero MotoCorp’s Growth

Hero MotoCorp’s electric vehicle (EV) brand, VIDA, saw significant success in Q3FY25, with a record 11,600 units sold during the 32-day festive period. This surge highlights the growing acceptance of electric two-wheelers in India. The introduction of the VIDA V2 series further strengthens Hero’s position in the mass-market EV segment, catering to eco-conscious consumers.

On the global front, Hero’s international business expanded, particularly in Bangladesh and Colombia, driving revenue growth. The company’s product diversification in these markets positions it for continued global success.

Looking ahead, Hero MotoCorp has set a ₹1,200 crore capex guidance for FY25, including a ₹600 crore investment in GPC 2.0 to enhance its global parts distribution network. The company is also planning six new launches, including models like the Destini 125, Xoom 125, and Xtreme 250R, aimed at further diversifying its portfolio and fueling future growth.

Technical Analysis

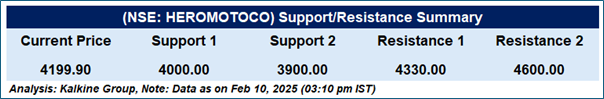

The stock has been in a downtrend since its peak in October, forming lower highs and lower lows. However, recent price action suggests a potential stabilization, as the stock is now trading above the 21-day EMA (₹4,194.02) but still below the 50-day EMA (₹4,330.41). This positioning indicates an early attempt at recovery, though confirmation is needed. The Relative Strength Index (RSI) stands at 49.34, signaling neutral momentum, with a move above 50 potentially strengthening bullish sentiment.

Key support levels are at ₹4,100 – ₹4,150, coinciding with recent lows and the 21 EMA, with stronger support around ₹3,900 – ₹4,000. On the upside, immediate resistance is at ₹4,330 – ₹4,350, near the 50 EMA, with a major hurdle at ₹4,600 – ₹4,700. A breakout above ₹4,330 could signal a trend reversal, while failing to hold ₹4,100 may push the stock toward ₹3,900. Traders should monitor these levels closely.

Conclusion

Hero MotoCorp’s Q3FY25 earnings demonstrate strong growth across both traditional and emerging segments. With robust sales, an expanding EV portfolio, and increasing global presence, the company is poised for continued success. Its focus on electric vehicles and international expansion positions it well within market trends, ensuring future growth. Hero MotoCorp’s financial strength and innovation keep it a leading player in the automotive sector, promising a bright future for investors and stakeholders.