The U.S. decision to impose a 25% tariff on steel and aluminum imports will affect Indian steel companies, even though India is not a significant exporter of primary metals to the U.S. The impact will primarily stem from potential changes in global supply chains, creating both challenges and opportunities for Indian manufacturers.

Increased Competition in India

One of the key challenges for Indian steel manufacturers is the possibility of excess steel production from countries like China and South Korea being redirected to markets such as India. This shift could intensify competition in the Indian market, putting pressure on prices and limiting the pricing power of domestic steel mills. As a result, Indian companies may face difficulties in maintaining profitability amidst increased competition.

Oversupply and Export Difficulties

The tariffs imposed by the U.S. could lead to further oversupply in global steel markets, making it harder for Indian producers to export their products. Over the past year, India has seen a rise in steel imports, which has already hurt prices and profit margins for Indian steel companies. If excess production from other regions floods the Indian market, it could exacerbate these issues, leading to reduced export opportunities and continued pressure on domestic prices.

Opportunities for Indian Companies with U.S. Operations

On a more positive note, Indian companies with operations in the U.S. stand to benefit from the tariffs. For instance, Hindalco Industries, through its subsidiary Novelis, could see improved performance as demand for U.S.-made aluminum and steel increases. Novelis contributes a large portion of Hindalco's overall revenue, and these trade actions may positively affect its profitability. Similarly, JSW Steel, with manufacturing plants in the U.S., could benefit from the tariffs, as higher import costs may lead to increased demand for locally produced steel.

Challenges for Stainless Steel Exporters

However, Indian companies such as Jindal Stainless, which rely on exports to the U.S., could face challenges. Jindal Stainless exports specialized stainless steel products, including those used in products like Gillette razors. The tariffs could make these products less competitive in the U.S. market, potentially affecting Jindal’s export volumes and impacting its earnings from this key market.

Technical Analysis

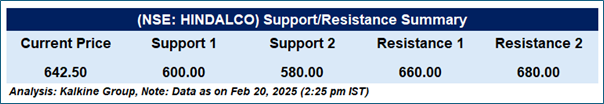

Hindalco Industries Ltd (NSE: HINDALCO) is in a bullish trend, and trading above the 50-day EMA (₹612.72). The RSI (67.02) indicates strong momentum, nearing the overbought zone. Volume (5.47M) suggests strong buying interest. Immediate support is at ₹612 (50-day EMA) and ₹600, while resistance is at ₹650-₹660. A breakout above ₹650 could push prices higher, while a dip below ₹612 may signal weakness.

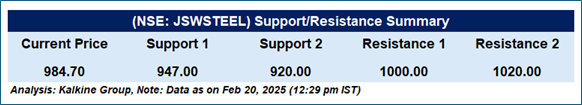

JSW Steel (NSE: JSWSTEEL) trading above the 21-day EMA (₹956.25) and 50-day EMA (₹947.59), indicating a bullish trend. The RSI (63.90) shows strong momentum but is nearing overbought levels. Support levels are at ₹956, ₹947, and ₹920, while resistance levels are at ₹990, ₹1,000, and ₹1,020. A breakout above ₹1,000 could drive further gains, while falling below ₹947 may weaken the trend.

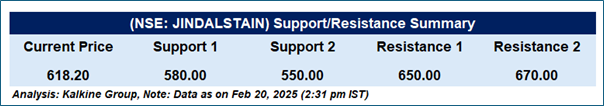

Jindal Stainless (NSE: JINDALSTAIN) trading near the 21-day EMA (₹618.15) but still below the 50-day EMA (₹645.06), indicating a weak trend with signs of recovery. The RSI (48.18) suggests neutral momentum. Support levels are at ₹600, ₹580, and ₹550, while resistance levels are at ₹620, ₹645, and ₹670. A breakout above ₹645 could signal a trend reversal, while a drop below ₹600 may extend the bearish trend.

Conclusion

In conclusion, while the U.S. tariffs offer opportunities for Indian companies with U.S. operations, such as Hindalco and JSW Steel, they also present challenges for those relying on exports, particularly in the stainless-steel segment. The increased competition and potential oversupply could make it more difficult for Indian manufacturers to maintain pricing power and export profitability, creating a complex landscape for the industry moving forward.