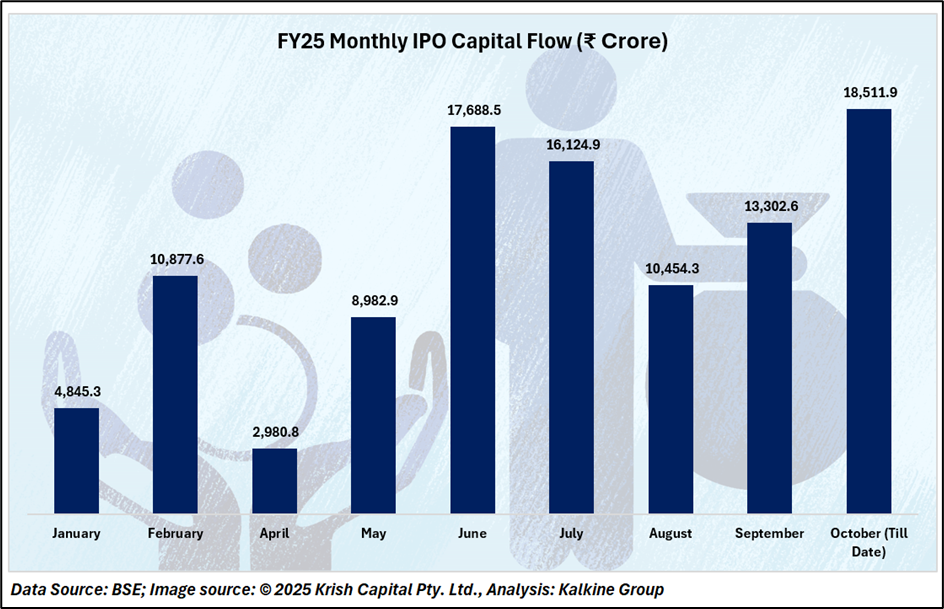

India’s primary markets remain abuzz with heightened IPO activity, underscoring the depth of investor interest across both mainboard and SME platforms. FY25 has already emerged as a vibrant year for capital mobilization, with monthly fundraising swinging between ₹2,981 crore and ₹17,688 crore, reflecting both the breadth and diversity of issues.

A Packed IPO Calendar

This week alone, 21 IPOs hit the market while 26 companies debuted on exchanges, marking one of the busiest stretches of the fiscal year. Such sustained activity highlights the strong pipeline of issuances as corporates continue to leverage buoyant investor appetite.

Recent Mainboard IPOs

Several notable mainboard issues launched recently, raising close to ₹3,227 crore.

SME IPOs – Diverse Participation, ₹598 crore Raised

The SME segment continues to see broad-based participation, with 16 IPOs opening in just two days (September 29–30). Companies spanned industries such as hospitality, logistics, biotech, IT services, dyes, e-mobility, and green technologies. Collectively, these offerings sought to raise ₹598 crore, reinforcing the SME platform’s growing role in enabling entrepreneurial capital access.

Market Debuts – 26 Companies Across Boards

The week also witnessed a surge in stock market debuts, with 11 mainboard and 15 SME listings. Notable mainboard entrants included Atlanta Electricals, Ganesh Consumer Products, Seshaasai Technologies, Jaro Institute, Anand Rathi Share & Stock Brokers, Solarworld Energy Solutions, Jain Resource Recycling, Epack Prefab Technologies, BMW Ventures, Trualt Bioenergy, and Jinkushal Industries. SME debutants ranged from Chatterbox Technologies to Telge Projects and Bhavik Enterprises, reflecting sectoral diversity.

Conclusion

India’s IPO market in FY25 is witnessing remarkable depth, with strong investor demand across mainboard and SME platforms. The surge of 21 new issues and 26 listings in a single week highlights vibrant capital mobilization, diverse sectoral participation, and the growing maturity of India’s equity markets.