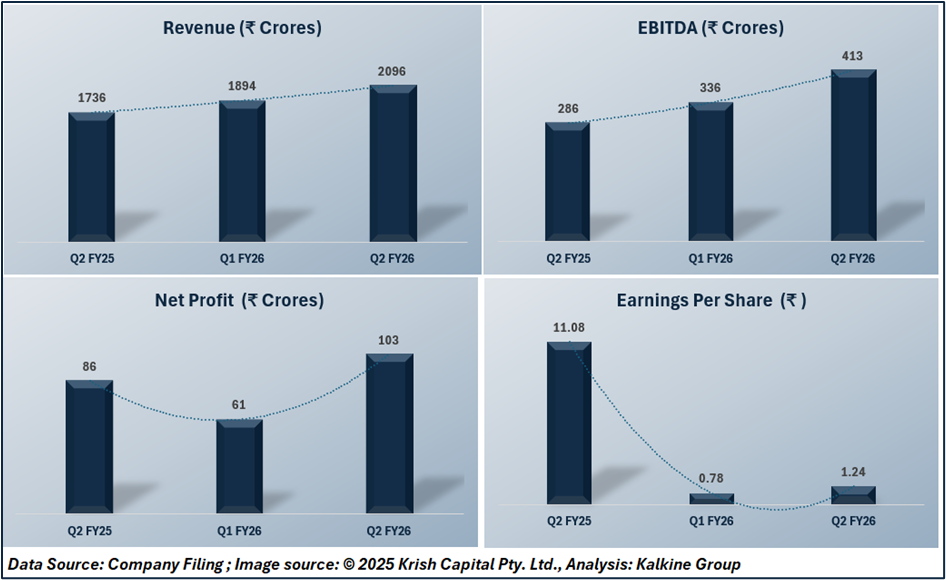

Lenskart Solutions (NSE:LENSKART) delivered a strong financial performance in the second quarter of FY26, reporting a 19.8% year-on-year increase in consolidated net profit to ₹103.4 crore, compared with ₹86.3 crore in Q2 FY25. The performance was driven by healthy revenue growth, expanding margins and rising operating leverage as the company continues to scale its technology-led omnichannel eyewear model.

Revenue from operations for the quarter rose 21% YoY to ₹2,096 crore, up from ₹1,736 crore a year earlier. Sequentially, revenue improved from ₹1,894 crore in Q1 FY26, underlining sustained demand momentum across India and international markets.

Margin Expansion and Operating Leverage

Profitability improved meaningfully during the quarter. EBITDA increased to ₹413 crore, with the EBITDA margin expanding to 20%, compared with 16% in Q2 FY25. Product margin accruals rose 26% YoY to ₹1,485 crore, while product margins strengthened to 69.2%, reflecting efficiencies from vertical integration, higher in-house manufacturing and automation-led cost control.

Lenskart’s management highlighted that each incremental rupee of revenue is now contributing more to profitability, as foundational investments in supply chain, technology and optometry infrastructure begin to pay off.

Operational Momentum and Customer Growth

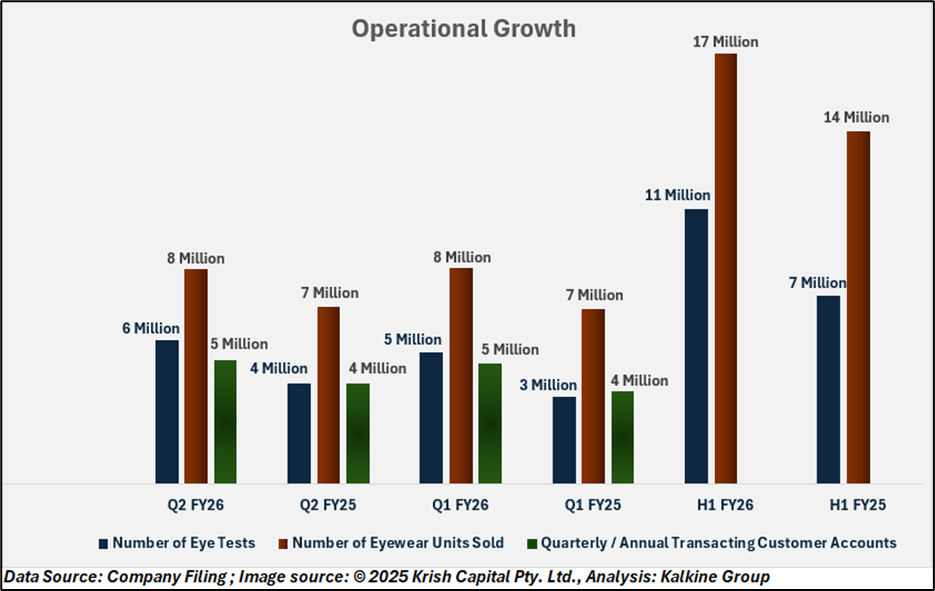

Operational performance remained robust in Q2 FY26. Eye tests conducted increased 44.3% year on year to 5.6 million, showcasing the company’s focus on expanding access to primary eye care. Eyewear units sold rose 20.2% to 8.35 million units, while transacting customer accounts grew 23.2% to 4.8 million.

Nearly 46% of eye tests were conducted for first-time users, reinforcing Lenskart’s strategy of creating new demand rather than merely capturing market share. Customer engagement also deepened, supported by a strong omnichannel ecosystem where a significant portion of customers interact digitally before purchasing in stores.

Store Expansion and Geographic Reach

During the quarter, Lenskart added 143 net new stores, taking the total active store count to 2,949, compared with 2,501 in Q2 FY25. Expansion remained strong across Tier 2 and Tier 3 cities, where store economics and payback periods continue to match metro and Tier 1 benchmarks.

The company reiterated its disciplined expansion strategy, guided by data-led site selection and consistent store-level profitability.

Conclusion

Lenskart’s Q2 FY26 performance highlights a phase of compounding growth, supported by revenue momentum, margin expansion and strong execution across operations. With improving profitability, rising customer adoption and an aggressive yet disciplined store rollout plan, the company remains well-positioned to scale further in India and international markets while sustaining long-term earnings growth.