Meesho, the social commerce platform, made a notable debut on the Indian stock market. Its shares opened at around ₹161–₹162, nearly 46% higher than the IPO price of ₹111 per share. This surge indicates strong interest from investors in the company’s business model and growth prospects.

IPO Details and Investor Demand

The initial public offering (IPO) raised about ₹5,421 crore, which included ₹4,250 crore from a fresh issue and the remaining through an offer-for-sale. The IPO was oversubscribed almost 79 times, showing high demand from both retail and institutional investors.

Business Growth and Financial Performance

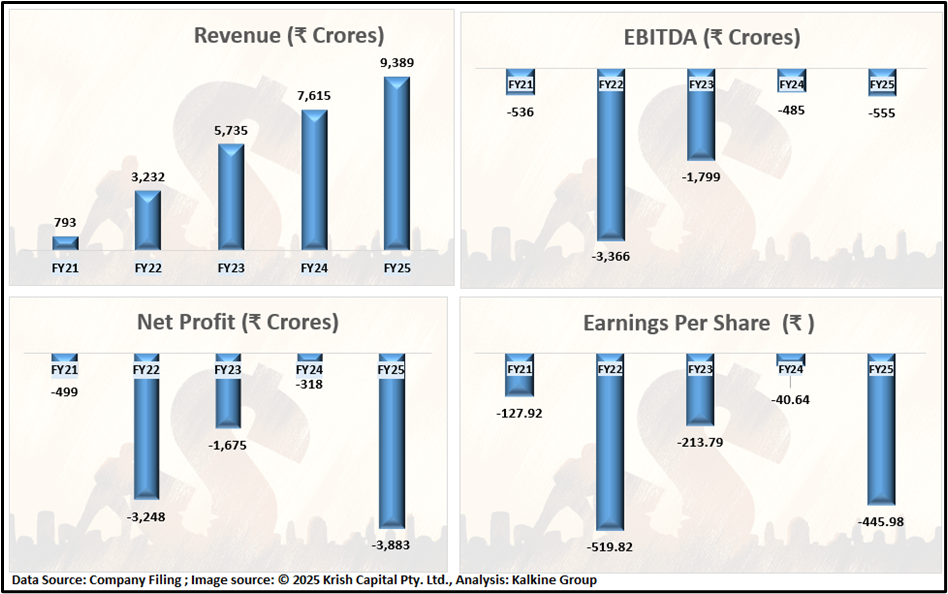

Meesho’s platform connects sellers, consumers, and logistics partners. In the financial year 2025, the company reported revenues of approximately ₹9,390 crore, marking a 23.3% increase from the previous year. The company has also reduced its EBITDA losses and maintained consistent free cash flow over the past two years. Growth is visible across several areas, including order volumes, product listings, and contribution margins, highlighting the platform’s increasing reach in the Indian e-commerce market.

Challenges Ahead

Despite these positive signs, some challenges remain. Meesho has not yet achieved net profitability and continues to rely significantly on cash-on-delivery orders. This model can create risks, such as order cancellations or fraud. Additionally, maintaining timely deliveries, ensuring quality control, and developing effective monetization strategies, particularly in smaller towns and rural regions, will be important for sustaining growth.

Investor Outlook

Analysts note that short-term investors may have benefited from booking profits on the listing day. Those with a longer investment horizon—12 to 18 months or more—might find potential in Meesho’s growth plans, cost-optimization efforts, and expansion into areas with increasing e-commerce adoption.

Conclusion

In conclusion, Meesho’s stock market debut has drawn attention from investors, reflecting confidence in the company’s business. Future performance will depend on how effectively the platform handles competition, operational challenges, and its path to profitability.