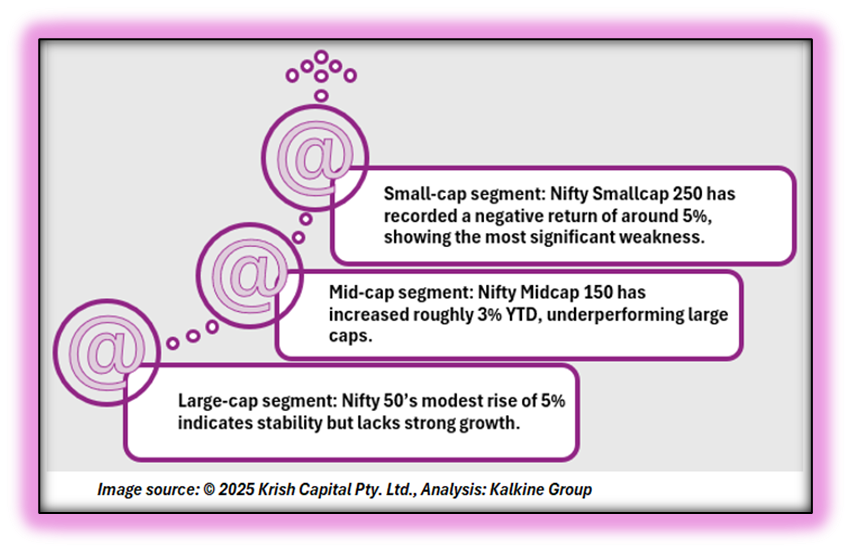

India’s benchmark Nifty 50 index has recorded only a 5% year-to-date gain in 2025, making it the worst-performing major market globally so far this year. While global peers have posted higher returns, Indian equities have struggled to sustain momentum, weighed down by high valuations and cautious investor sentiment.

Muted Market Gains Amid Global Outperformance

Across market segments, large-cap stocks have provided some stability, with the Nifty 50 rising modestly, but mid-cap and small-cap stocks have lagged behind. Nifty Midcap 150 has increased approximately 3% YTD, while Nifty Smallcap 250 has declined nearly 5%, highlighting broader market weakness and investor caution toward smaller companies.

Valuations Remain Stretched, Limiting Upside Potential

One of the main factors behind this underperformance is elevated valuations. Nifty 50’s median price-to-earnings (P/E) ratio has risen from 32.1 in October 2024 to around 33.2 in October 2025, suggesting that market prices are already stretched and limiting upside potential. High valuations tend to reduce investor confidence, particularly in an environment of slower earnings growth and heightened macroeconomic uncertainty.

Foreign Outflows Deepen Pressure on Equities

Another key factor is persistent foreign portfolio investor (FPI) outflows. Global uncertainties and cautious investor sentiment have led to net withdrawals from Indian equities, particularly affecting mid- and small-cap segments. These outflows, combined with domestic market challenges, have further restricted overall market performance.

Macro Headwinds Weigh on Market Sentiment

Global and domestic headwinds have also played a role. Factors such as global economic slowdown, trade uncertainties, policy challenges, and domestic economic pressures have collectively acted as a drag on market growth, making it difficult for Indian equities to keep pace with other major markets.

Selective Opportunities for Investors

For investors, these conditions signal a period of market consolidation. Broad-market exposure may not yield significant returns, and a more selective investment approach focusing on sectors and companies with strong fundamentals or growth potential may provide better risk-adjusted outcomes.

While profit cycles appear to have bottomed out, stronger corporate earnings in upcoming quarters could stabilize market sentiment. Close monitoring of corporate performance, foreign investment trends, and global economic developments will remain critical for assessing market direction.

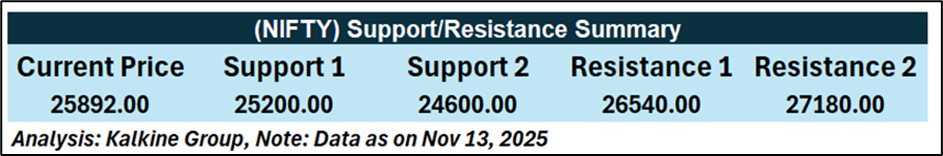

Technical Outlook: Key Levels to Watch

The Nifty 50 Index is currently trading at 25,892. Immediate support is seen at 25,200, followed by a stronger support level at 24,600, which could provide a base in case of a pullback. On the upside, the index faces resistance at 26,540, with the next key resistance at 27,180, which may act as a hurdle for further upside. Overall, the index is consolidating in a defined range, and a breakout above resistance or a breakdown below support could set the next trend.

Final Takeaways

In summary, India’s equity market, and particularly the Nifty 50, is navigating a year of subdued performance. Elevated valuations, slower earnings growth, foreign outflows, and external economic pressures have limited YTD returns to 5%, making India the worst-performing major market in 2025.

Investors are advised to remain selective, focus on resilient sectors, and adopt a measured approach while navigating this period of market recalibration and consolidation.