Nucleus Software Exports Limited is a leading provider of lending and transaction banking products to the global financial services industry. With a presence in over 50 countries and powering operations of more than 200 financial institutions, the company’s platforms support retail lending, corporate banking, cash management, mobile and internet banking, and automotive finance. Its solutions facilitate over 26 million transactions daily, managing more than USD 200 billion in loans and enabling over 200,000 daily users.

Financial Performance

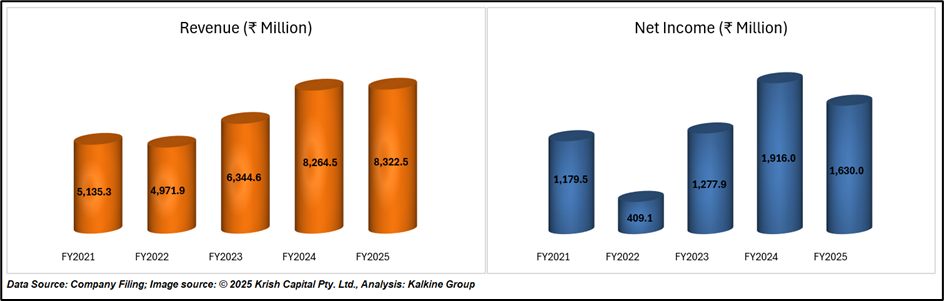

In the financial year ended March 31, 2025 (FY25), Nucleus Software reported revenue from operations of ₹832.25 crore, a marginal increase from ₹826.45 crore in FY24. This growth was primarily driven by income from fixed-price and time-and-material software development contracts.

Employee benefit expenses rose by 8.87% to ₹534.64 crore, accounting for 64.24% of revenue, up from 59.42% in FY24. Operating and other expenses grew by 12.41% to ₹129.26 crore, representing 15.53% of revenue compared to 13.91% in the previous year. Finance costs were modest at ₹0.75 crore, slightly lower than ₹0.95 crore in FY24.

Operating profit for FY25 stood at ₹167.60 crore, 20.14% of revenue, down from ₹219.45 crore (26.55%) in FY24, reflecting the impact of rising costs. Depreciation and amortization expenses were ₹14.81 crore, in line with the previous year.

Profit after tax was ₹163.00 crore, a decline from ₹191.60 crore in FY24, with the PAT margin narrowing to 19.59% from 23.18%. The company’s net cash flow from operating activities also declined, with ₹150.94 crore generated post working capital adjustments, compared to ₹222.03 crore in FY24.

During the year, Nucleus Software completed a buyback of 4,48,018 equity shares, reducing its paid-up capital to 2.63 crore shares. The Company established the Nucleus Software Foundation, a dedicated trust to carry out its CSR initiatives. During the year, it contributed ₹2.77 crore to the trust for these activities.

Company Outlook

The global fintech sector is thriving, driven by digital transformation, AI adoption, and rising demand for secure, personalized solutions. Nucleus Software is well-positioned with agile, AI-powered, API-driven platforms that support open banking and real-time insights. Its focus on cybersecurity, innovation, and customer experience reinforces its role as a trusted digital partner for modern financial institutions.

Technical Summary

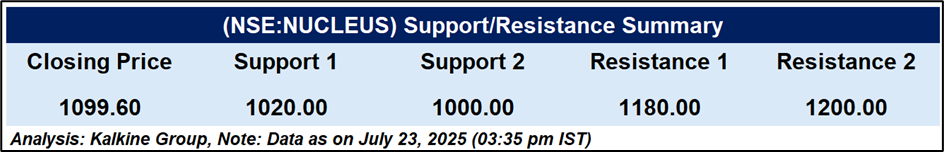

Nucleus Software closed at ₹1,099.60, recovering slightly but still trading below its 51-day EMA of ₹1,130.16. The RSI at 37.92 signals weak momentum and nearing oversold territory. Key support lies at ₹1,075, with further support at ₹1,020–₹1,000. Resistance levels are placed at ₹1,130 and ₹1,180–₹1,200. The stock remains in a short-term consolidation phase.

Conclusion

With a steady revenue base, ongoing product innovation, and deep domain expertise, Nucleus Software remains well-positioned in the evolving fintech landscape. As financial institutions strive to meet the growing demand for smarter, faster, and more secure digital services, Nucleus Software’s advanced platforms offer the tools to build resilient and future-ready banking operations.