PC Jeweller Ltd, a once-beleaguered name in India’s branded jewellery retail space, has staged a powerful financial comeback in Q4 FY2025, driven by strong operational efficiency, improved market sentiment, and a sharp rebound in consumer demand.

Q4 FY2025: PC Jeweller Returns to Profitability with Strong Revenue Growth

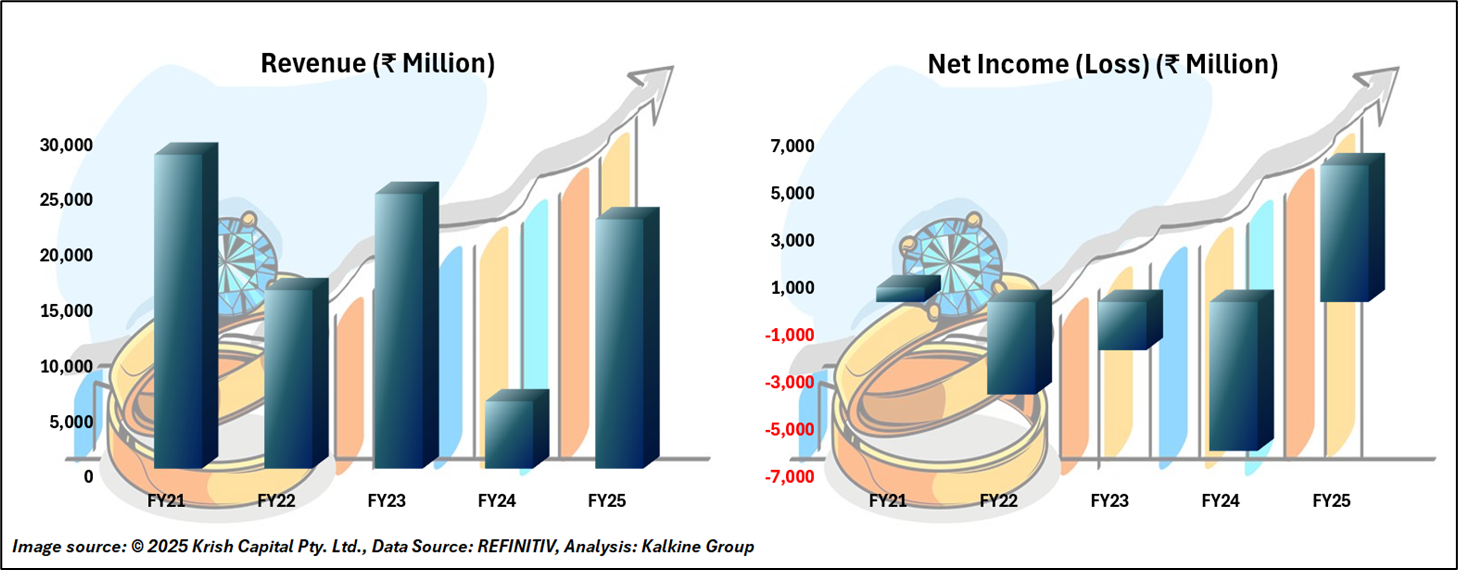

PC Jeweller reported a net profit of ₹95 crore for the quarter ended March 31, 2025, marking a significant recovery from a net loss of ₹124 crore in the same period last year. The turnaround was driven by a sharp rise in revenue, which increased over 13-fold year-on-year to ₹699 crore from ₹48 crore in Q4 FY2024.

Profitability metrics also improved notably. EBITDA rose to ₹144 crore from ₹10 crore a year ago, while gross profit expanded to ₹171 crore from ₹7 crore, reflecting a meaningful rebound in margins and sales volume.

The company attributed the performance to a better alignment with shifting consumer trends and strong demand during the festive and wedding seasons.

Operational Excellence and Network Optimization

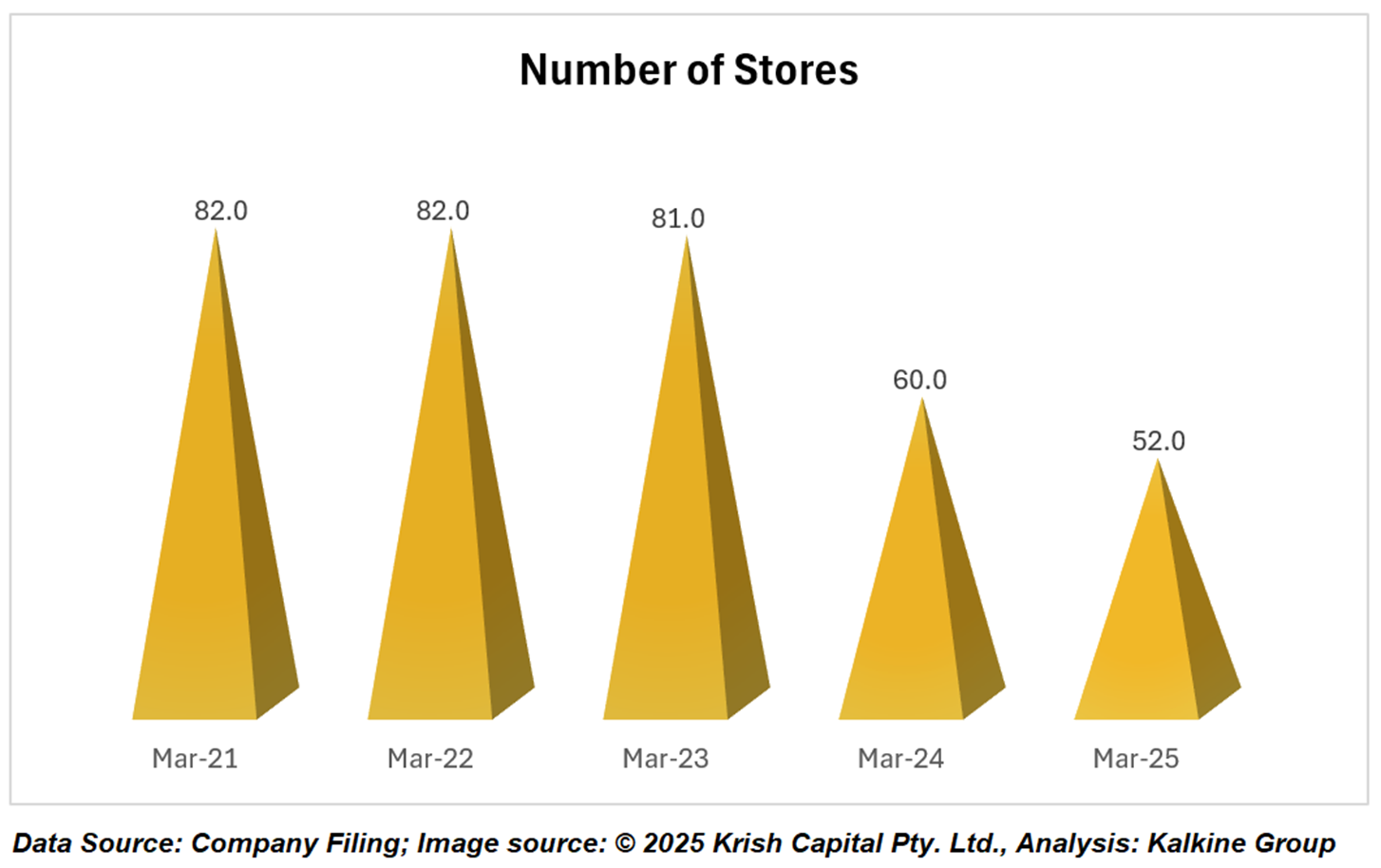

As of March 31, 2025, PC Jeweller operates 52 showrooms across 38 cities in 13 Indian states, including 3 franchisee outlets. During Q4, the company rationalized its retail footprint by closing underperforming stores in Siliguri, Durgapur, and Bhubaneshwar to focus on high-potential markets.

Despite volatility in gold prices, the brand leveraged its in-house design and manufacturing capabilities to offer differentiated, customer-centric collections – sustaining footfall and customer loyalty.

Debt Reduction Milestone Achieved

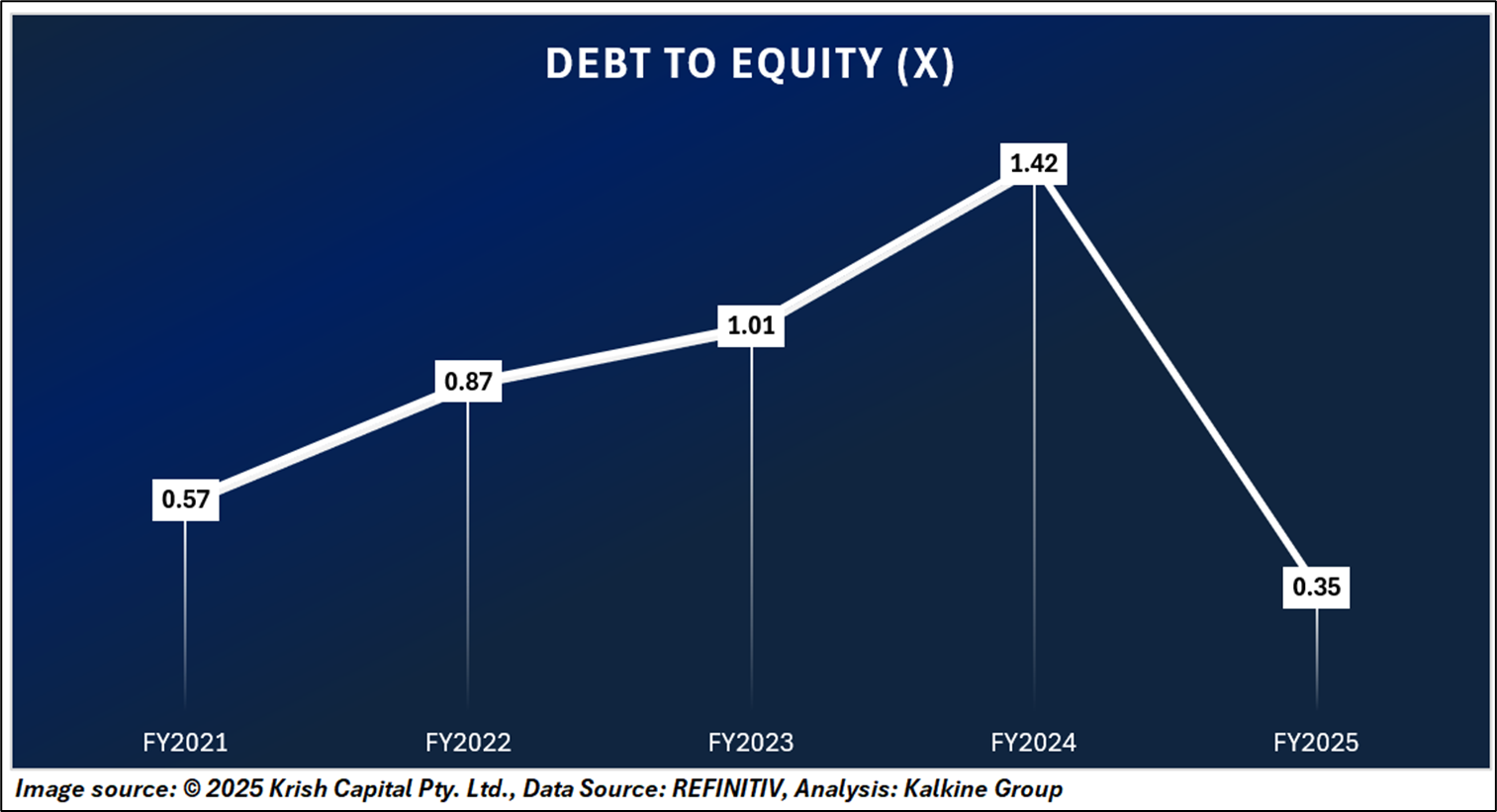

PC Jeweller made significant progress on its deleveraging strategy in FY2025. Following the execution of a Settlement Agreement with its consortium of bankers on September 30, 2024, the company reduced its outstanding debt by nearly 50% by fiscal year-end.

The momentum continued into the June 2025 quarter, with an additional 7.5% reduction in liabilities. This steady progress underscores the company’s stated goal of achieving a debt-free balance sheet by FY2026.

“Our financial transformation is now clearly reflected in the numbers, and we remain confident of becoming debt-free in the coming fiscal,” the management stated in its update.

Business Outlook: Poised for Sustained Growth

Looking ahead, PC Jeweller remains optimistic about the future. The company expects continued momentum, fueled by:

- Festive and wedding season demand

- Strategic store network optimization

- Strengthening of backend operations, including ERP and customer service systems

- Cost control and working capital discipline

Management reaffirmed its focus on preserving the company’s core strengths – including its vertically integrated manufacturing, skilled workforce, and quality-centric sourcing.

Technical Analysis

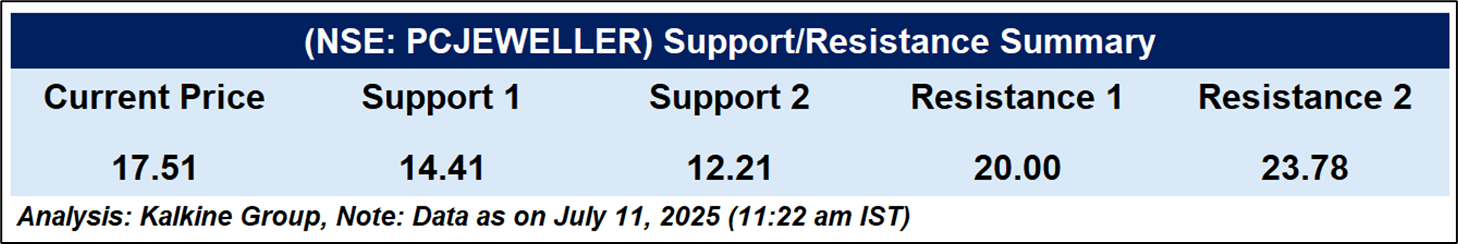

PC Jeweller Ltd is currently trading at ₹17.51, down 6.51% after facing resistance near ₹20 Despite the pullback, the stock remains above its 51-day Exponential Moving Average of ₹13.77, indicating sustained bullish momentum. The RSI (14) stands at 70, nearing the overbought zone, suggesting that the stock may witness short-term consolidation or profit booking. A strong rally in recent sessions followed by a sharp correction signals heightened volatility. Immediate support is seen around ₹14.41, and a breakdown below this level could invite further downside. Conversely, a breakout above ₹20 may trigger renewed buying and push the stock to fresh highs.

Conclusion

PC Jeweller’s Q4 FY2025 performance marks a strong turnaround, backed by robust revenue growth, margin recovery, and debt reduction. With improving fundamentals, strategic focus, and positive market sentiment, the company is well-positioned for sustained growth. Continued execution and demand tailwinds could further boost its recovery trajectory and investor confidence.