Japanese companies are increasingly focusing on India as they look for growth opportunities outside their home market. With limited expansion prospects in Japan, India’s strong economic momentum, rising credit demand, and large consumer base have made it a preferred destination for long-term investments, particularly in financial services.

Major Investment Highlights Rising Confidence

A major Japanese financial group is set to invest nearly ₹39,600 crore for a 20% stake in Shriram Finance Ltd through a preferential equity issuance. This transaction ranks among the largest cross-border deals of the year and reflects growing confidence in India’s non-banking financial sector. The deal values Shriram Finance at close to ₹2 trillion and is being executed at a premium to its current market value.

Japan–India Financial Corridor Gains Strength

This investment adds to the strong momentum seen in the India–Japan financial corridor. Over the past year, several Japanese financial institutions have made strategic moves into India by acquiring stakes in banks, investment firms, and financial services companies. These transactions point to a long-term strategy of building partnerships and gaining exposure to India’s expanding financial ecosystem.

Strong Market Performance Supports Deal Activity

Shriram Finance’s stock has delivered strong returns over the past year, reflecting investor confidence in the company’s business model and growth outlook. The valuation premium paid by the Japanese investor underlines expectations of stable earnings, scale advantages, and long-term growth potential in India’s lending market.

India Sees Surge in Large Strategic Deals

India has witnessed several large strategic and financial sponsor-led transactions this year across sectors. Global banks, industrial groups, and investment firms have committed billions of dollars to acquire stakes in Indian companies, highlighting India’s attractiveness as a deal destination. These investments span banking, manufacturing, technology services, and financial services.

Shriram Finance’s Evolution and Scale

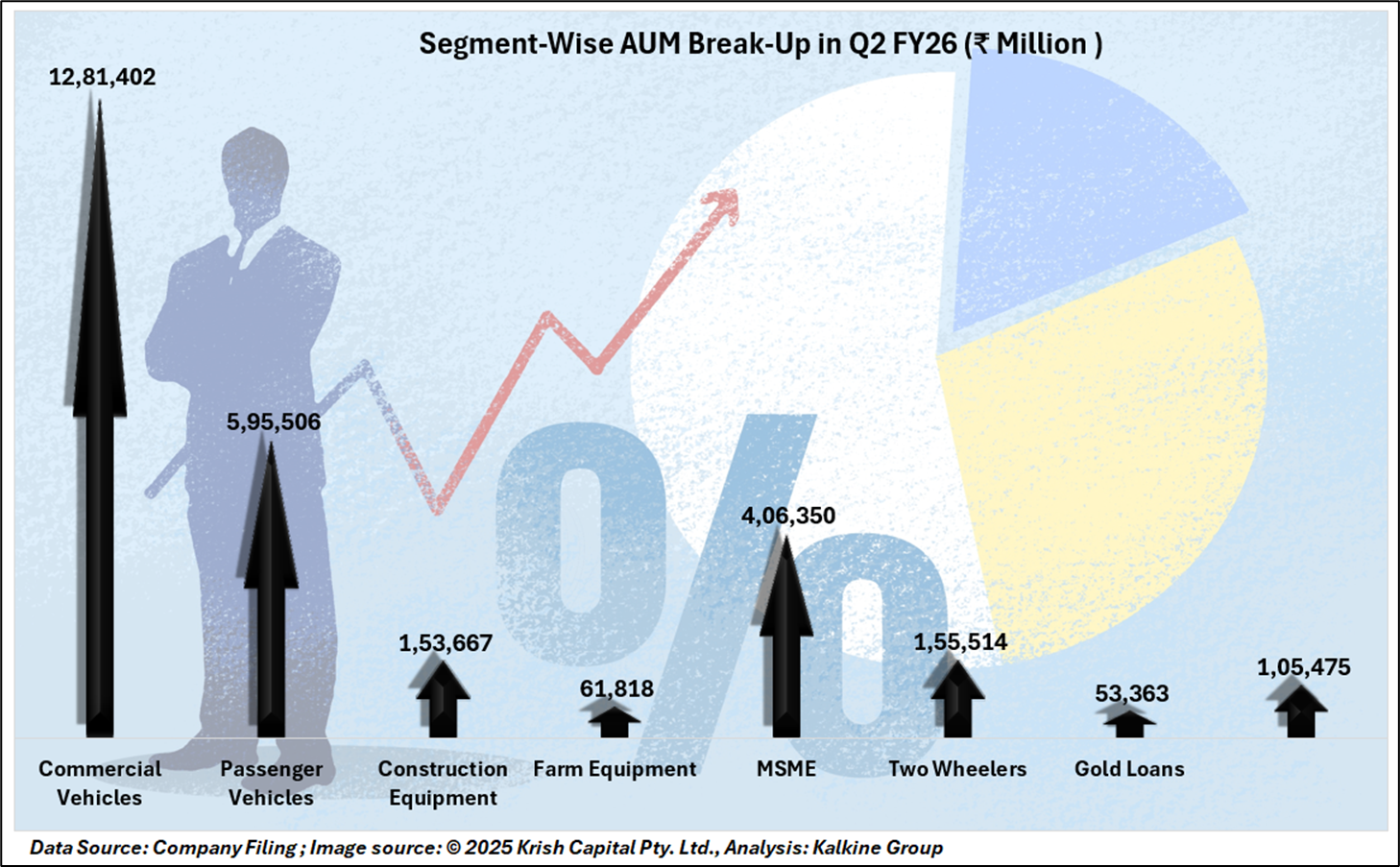

Shriram Finance is India’s second-largest non-banking finance company, managing assets worth over ₹2.8 trillion and operating through a nationwide network of more than 3,000 branches. Over the years, the company has undergone multiple restructurings and mergers, evolving from a vehicle-focused lender into a diversified financial services platform.

Strategic Shifts and New Growth Areas

In recent years, Shriram Finance has refined its lending strategy to reduce dependence on traditional vehicle finance. The company has expanded into emerging segments such as renewable energy, merchant lending, supply chain finance, fisheries, and digital partnerships. These initiatives are aimed at tapping new growth opportunities and diversifying revenue streams.

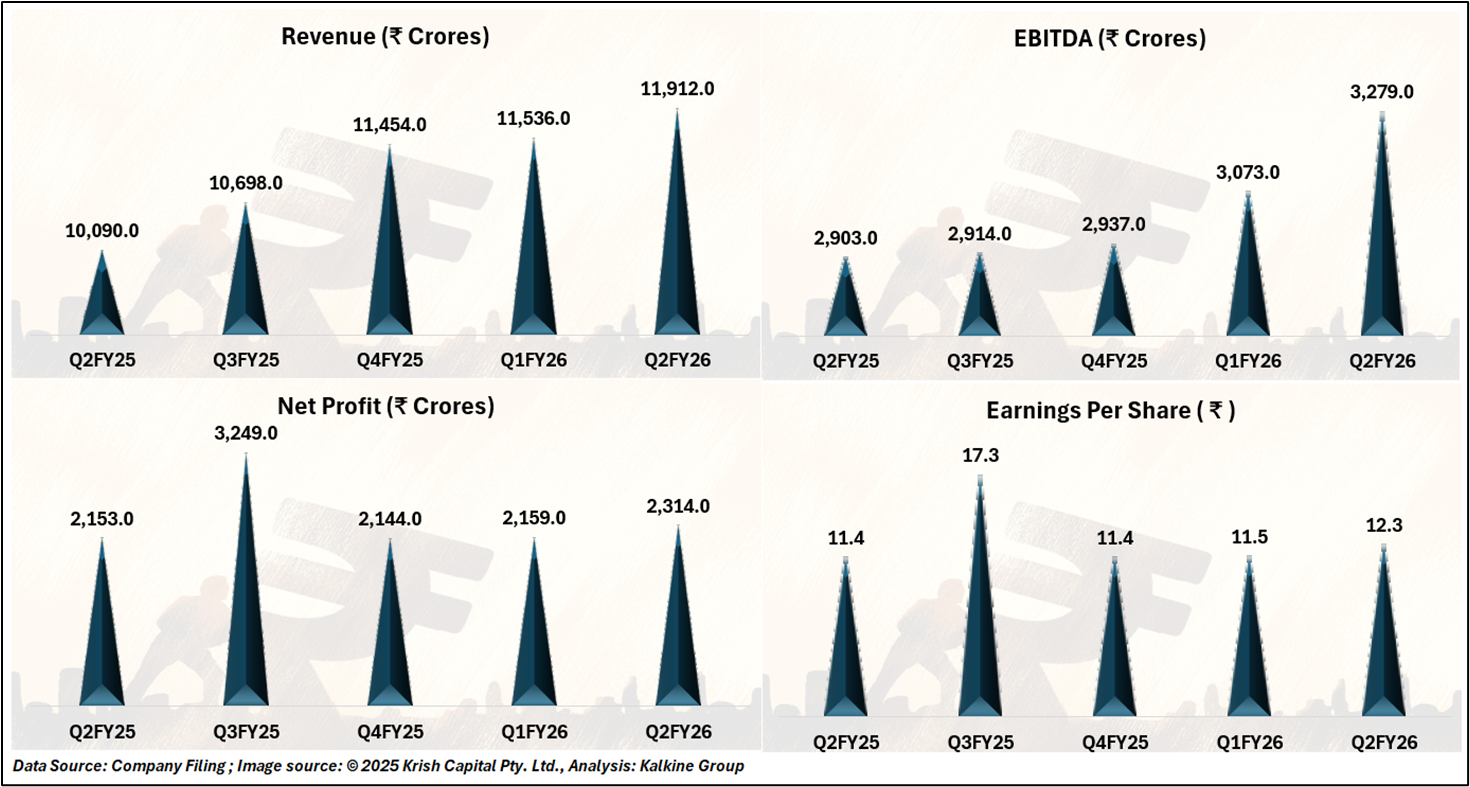

Healthy Financial Performance Backs Expansion

The company has delivered a steady improvement in its financial performance, supported by strong growth in income and profits during the latest financial year. Improving profitability, and a stable funding profile have strengthened Shriram Finance’s appeal as a long-term strategic investment partner.

Technical Summary

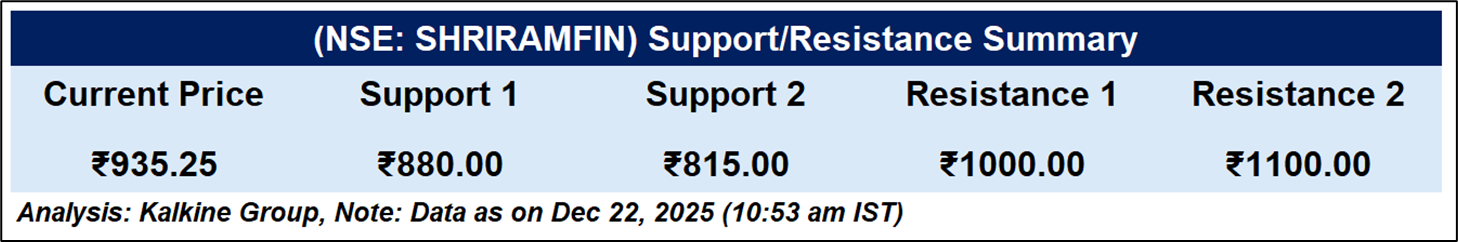

Shriram Finance is currently trading near ₹935.25, sustaining a strong bullish structure above its 50-day EMA (~₹802). Momentum remains robust, with the RSI in the overbought zone, indicating strength while allowing room for short-term consolidation. Immediate support is placed near ₹815, while a decisive breakout above ₹950 could pave the way for an extended upside towards the ₹1,000–1,100 zone.

Conclusion

The strategic Japanese investment underscores growing global confidence in India’s financial services sector and Shriram Finance’s scalable, diversified business model. Supported by strong fundamentals, improving financial performance, and a bullish technical structure, the company remains well positioned to capitalise on long-term credit growth opportunities in India.