Highlights

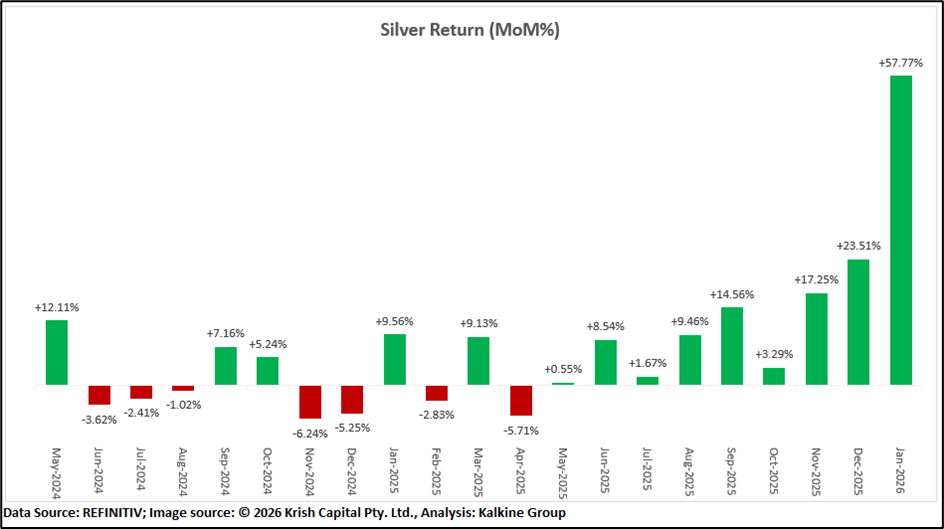

- Silver has experienced sharp price swings since 2024, influenced by inflation trends, expectations of lower interest rates, and lower dollar index.

- Structural industrial demand from solar, electronics, and EV supply chains remains a key pillar underpinning the medium-term outlook.

- Prices touched a record high of USD 121.75, supported by a softer U.S. dollar and elevated global uncertainty driving safe-haven demand.

- Silver later eased to around USD 111.36 per ounce as risk appetite shifted, following speculation around a potentially more hawkish Federal Reserve leadership.

- A steady policy stance with a mild easing bias has helped keep real yield expectations contained, continuing to support non-yielding assets.

Silver Overview

Since 2024, silver has remained one of the most dynamic metals, balancing its role as a monetary hedge and an industrial input. On 30 January 2026, spot prices fell 4.10% to USD 111.36 on hawkish policy rumours, yet the metal stayed on track for its strongest monthly gain since 2024. Persistent geopolitical and economic uncertainty continues to support safe-haven interest, while industrial demand keeps silver more volatile than gold, pointing to a phase of reassessment rather than trend exhaustion.

Silver Slides 4.10% on Hawkish Fed Talk, Yet Holds Strongest Run Since 2024

Silver eased 4.10% on rumours that the Federal Reserve could adopt a more hawkish stance, lift the U.S. dollar and prompt profit-taking after overbought conditions. Despite the retreat from record highs near USD 121.75 to around USD 111.36, the metal remained on track for its strongest performance since 2024, supported by safe-haven demand amid persistent geopolitical and economic uncertainty, alongside steady industrial consumption.

Technical View: Momentum Cools After RSI Touches 83.00: A Shift in Price Action?

From a technical perspective, silver spot prices continue to trade comfortably above the 21-day and 50-day Simple Moving Averages at USD 93.08 and USD 75.11, preserving a supportive broader structure. However, following the recent sharp rally, price action points to a developing bull–bear tussle, with upside momentum beginning to cool rather than extend immediately. The 14-day RSI at 74.10 remains in overbought territory but is easing. Support is located near USD 85.00 and USD 70.00, while resistance stands around USD 135.00 and USD 150.00, defining the near-term trading range.

Bottom Line: Silver’s Next Move: Pause or Push Higher?

After a sharp 250% rally, silver is entering a cooling and consolidation phase rather than showing clear trend exhaustion. Momentum has eased from overbought levels, but the broader structure remains supported by industrial demand and macro uncertainty, suggesting range-bound trade may precede the next decisive move.