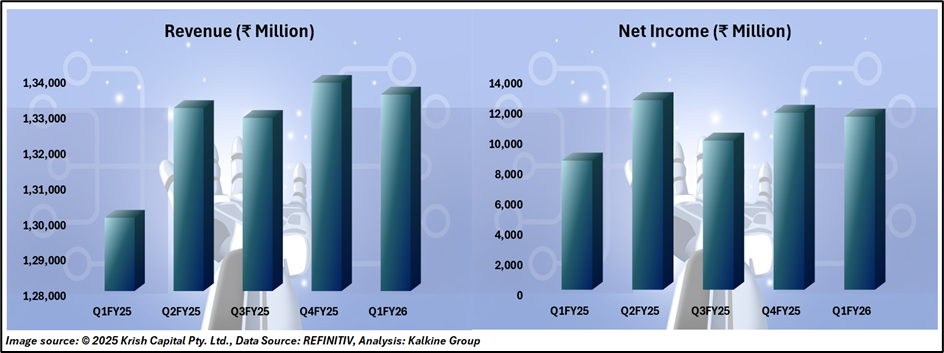

Tech Mahindra (NSE: TECHM), the IT and consulting arm of the Mahindra Group, posted robust earnings rebound in Q1 FY26, powered by strategic execution and operational efficiency. Revenue in rupee terms edged up 2.7% YoY to ₹13,351 crore, while EBIT soared 34% to ₹1,477 crore, driving a 34% YoY jump in PAT to ₹1,141 crore. Diluted EPS rose to ₹12.86, underlining improved shareholder value.

In USD terms, revenue stood at $1,564 million, reflecting marginal YoY growth of 0.4%, but profitability metrics showed notable improvement. EBIT jumped 30.2% YoY to $172 million with margins expanding by 260 bps to 11.1%, and PAT rose to $133 million, with the margin improving 190 bps to 8.5%. The company generated $86 million in free cash flow, even as Days Sales Outstanding inched up to 95.

With a healthy liquidity buffer of ₹8,072 crore, controlled attrition at 12.6%, and net new deal wins worth $809 million in TCV, Tech Mahindra underscored its strong demand visibility and continued focus on sustainable, profitable growth.

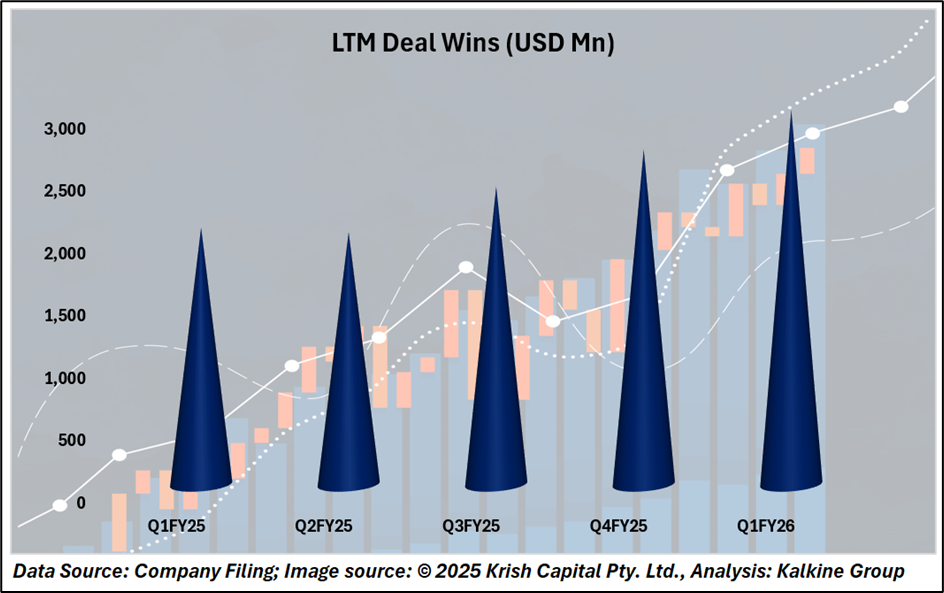

Strategic Wins Power Global Momentum

Tech Mahindra’s deal-making engine is firing on all cylinders, with a 44% YoY surge in total contract value over the past 12 months. The company continues to build its global footprint across industries with a strong focus on digital transformation:

- North America: Secured a major customer operations contract with a top U.S. wireless operator and an enterprise application development deal for a leading railroad company.

- Digital Experience: Partnered with a global hi-tech player to enhance user experience on an AI-driven platform serving over 2 billion users.

- Europe & UK: Won transformation-led engagements with a prominent UK-based manufacturer and a global fashion brand.

- Asia & MEA: Bagged strategic deals across telecom, insurance, and asset management in Japan, the Middle East, and Africa.

These wins underline Tech Mahindra’s deepening expertise in AI, cloud, and digital platforms, and reinforce its position as a trusted partner in large-scale enterprise modernisation.

Technical Summary

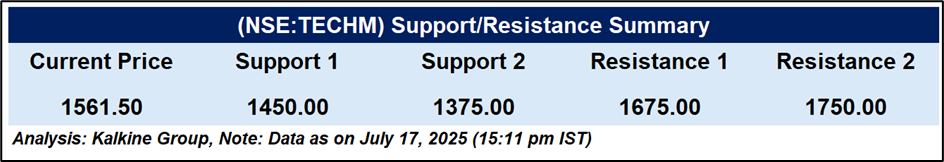

Tech Mahindra is currently trading at ₹1,561.50, showing signs of weakness after slipping below its 51-day EMA of ₹1,605.30. The stock is in a corrective phase, struggling to regain bullish momentum. With the RSI at 37.27, it is approaching oversold territory, indicating limited downside in the short term but still reflecting weak buying interest. If the price fails to hold above the ₹1,450–₹1,375 support zone, further declines may follow. A sustained move back above ₹1,605 would be needed to shift the near-term trend back to positive.

Conclusion

Tech Mahindra’s Q1 FY26 showcased strong profit recovery, robust deal wins, and healthy cash flows, highlighting its digital and operational strength. While revenue growth was modest, margin expansion and execution stood out. Technically, the stock is under pressure but holds key support near ₹1,450. A breakout above ₹1,605 could revive momentum, offering a positive long-term outlook.