Varun Beverages Limited (NSE:VBL), PepsiCo’s second-largest global bottling partner, has announced its entry into the alcoholic beverages space, marking a major diversification move beyond its core soft drink portfolio. The company’s board has approved the inclusion of the alcohol business in its Memorandum of Association, paving the way for the manufacture and distribution of beer, wine, and other spirits both in India and overseas.

Diversification into Alcoholic Beverages

VBL said certain African subsidiaries will test market Carlsberg beer under an exclusive distribution agreement with Carlsberg Breweries A/S. The company also plans to establish a wholly owned subsidiary in Kenya to handle beverage manufacturing and sales operations across the region.

“The move reflects our continued commitment to broadening our product base and strengthening our presence across key growth markets,” said Ravi Jaipuria, Chairman of Varun Beverages. “We see a strong opportunity in the growing popularity of ready-to-drink (RTD) and alcoholic beverages globally.”

The step marks VBL’s first foray into the alcohol segment — a category outside its traditional PepsiCo franchise, which includes brands such as Pepsi, Mountain Dew, Mirinda, Slice, and Aquafina.

Steady Q3 Performance Despite Weather Impact

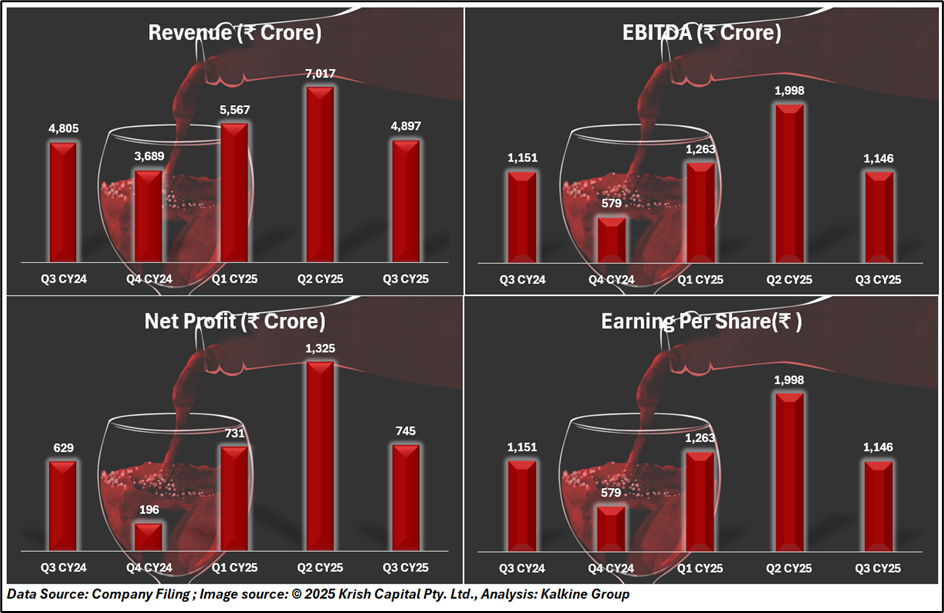

For the quarter ended September 2025, VBL reported a net profit of ₹745 crore, up 18.5% year-on-year, driven by lower finance costs and strong international performance.

Revenue from operations grew 1.9% YoY to ₹4,897 crore, while EBITDA stood at ₹1,146 crore, translating to a margin of 23.4%.

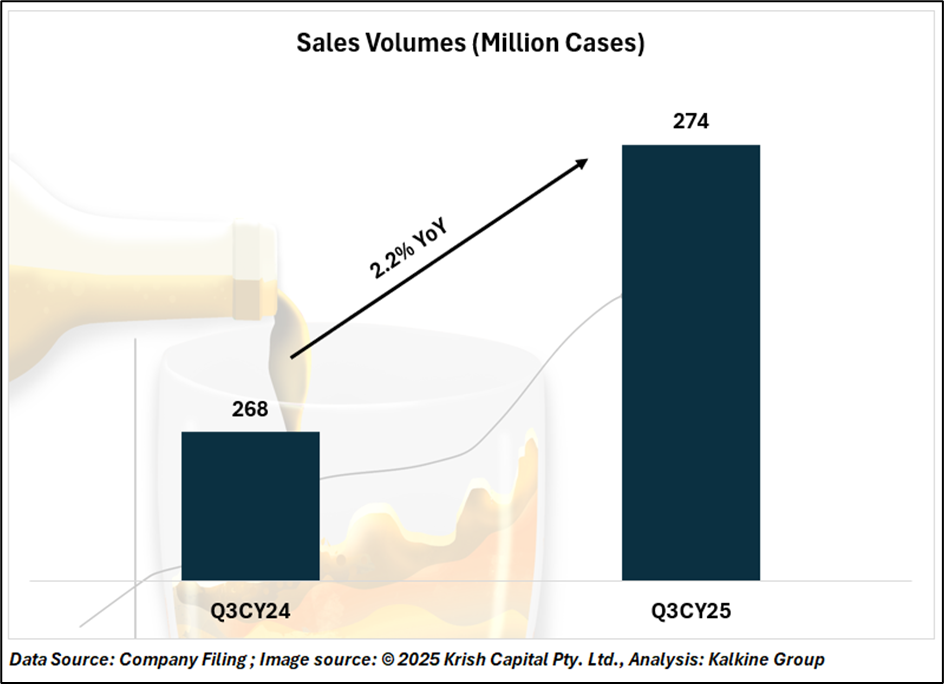

Consolidated sales

Consolidated sales volumes rose 2.4% during the quarter to 273.8 million cases, with international markets — led by South Africa — growing 9%, offsetting subdued domestic demand caused by extended monsoon conditions.

Technical Summary

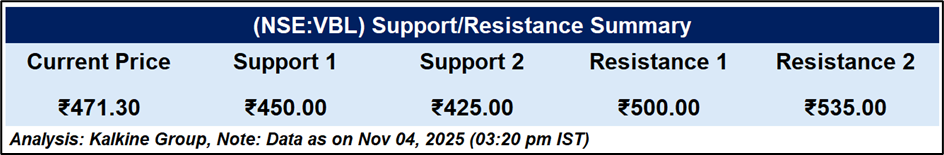

Varun Beverages Ltd. (NSE: VBL) is trading around ₹471.30, down 0.73%. The stock is hovering near the 51-day EMA at ₹467.51, indicating a potential support zone. RSI at 53.69 signals neutral momentum. Price action suggests consolidation after a recent rebound, with immediate support near ₹460 and resistance in the ₹500–₹535 range.

Conclusion

Varun Beverages’ strategic entry into the alcoholic beverages segment marks a significant diversification beyond its core PepsiCo portfolio. Strong Q3 results, expanding international presence, and stable technical indicators position the company for long-term growth, though near-term consolidation may persist as markets assess the new business transition.