Shares of Kotak Mahindra Bank rose 4% on July 8, 2025, closing at ₹2,224.50, as investors responded positively to its Q1FY2026 business update. The private lender reported consistent growth in both advances and deposits, although the pace of growth in low-cost deposits moderated. The performance update was well-received by brokerages, indicating sustained confidence in the bank’s long-term fundamentals.

Business Update

The bank’s loan book expanded to ₹4.45 lakh crore as of June 30, 2025, marking a 14% year-on-year rise and a 4.2% increase sequentially from ₹4.27 lakh crore at the end of March 2025. The steady loan growth came across segments and highlighted the bank’s strategic push into secured retail lending and SME financing.

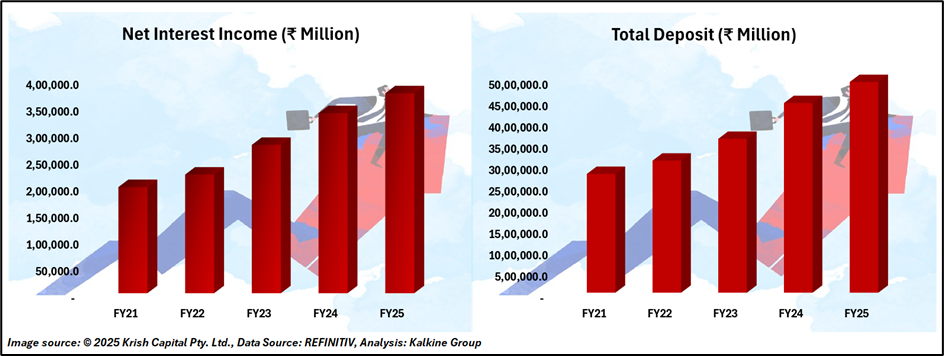

On the deposit front, end-of-period deposits stood at ₹5.13 lakh crore, reflecting a 14.6% YoY growth and a 2.8% QoQ increase. The bank’s average total deposits stood at ₹4.92 lakh crore, reflecting a year-on-year growth of nearly 13% and a 5% increase over the previous quarter, driven primarily by robust growth in term deposits.

However, low-cost CASA (current and savings account) deposits showed mixed performance. Average CASA deposits rose 4.2% YoY and 2.1% QoQ to ₹1.92 lakh crore. Yet, end-of-period CASA balances dipped 2.2% QoQ, although they were still 7.9% higher YoY, reflecting mild pressure on low-cost funding amidst a high-interest rate environment.

Financial Performance

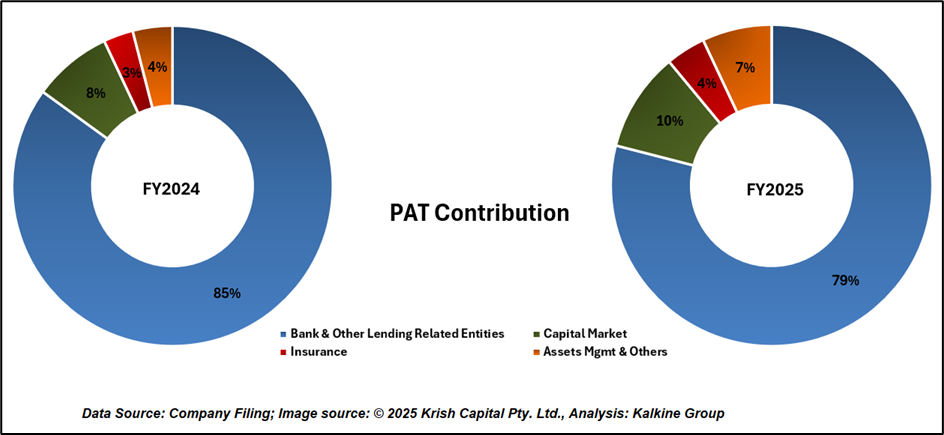

In Q4FY25, Kotak Mahindra Bank posted a net profit of ₹4,133 crore, marking a 25% year-on-year growth. The bank’s Net Interest Income (NII) stood at ₹6,909 crore, up 18% YoY, while Net Interest Margin (NIM) held steady at 5.28%, showcasing stable earnings efficiency.

The asset quality remained decent, with Gross NPA at 1.44% and Net NPA at 0.34%, underscoring Kotak’s prudent credit risk practices. Digital initiatives and lean operational processes further enhanced customer acquisition and service delivery.

Company Outlook

Kotak Mahindra Bank is focusing on digital growth with upgraded web and mobile onboarding platforms, including revamped Kotak811 and mobile apps for a smoother and safer user experience. The bank is also driving cost efficiency through over 50% automation in onboarding and AI tools like virtual assistants to streamline operations and cut drop-offs.

Technical Analysis

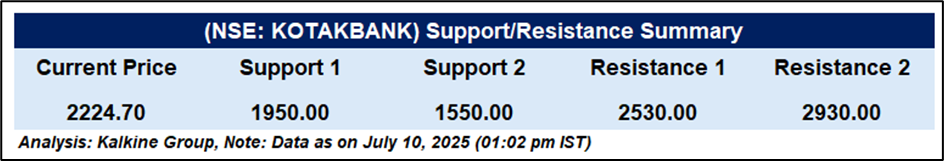

Kotak Mahindra Bank remains technically strong but is currently facing resistance and must break above recent highs to confirm a decisive upside move. The stock is trading well above key moving averages, indicating underlying strength, while the RSI at 61.56 reflects consistent buying interest. Support levels are placed at ₹1,950 and ₹1,550, with resistance near ₹2,530 and ₹2,930.

Conclusion

Kotak Mahindra Bank’s Q1FY26 update reinforces its steady growth trajectory, supported by strong loan and deposit expansion, healthy asset quality, and continued digital investments. Despite some pressure on low-cost deposits, the overall fundamentals remain robust. With positive technical indicators and strong investor sentiment, the stock is well-positioned for further upside, provided it sustains momentum above key resistance levels.