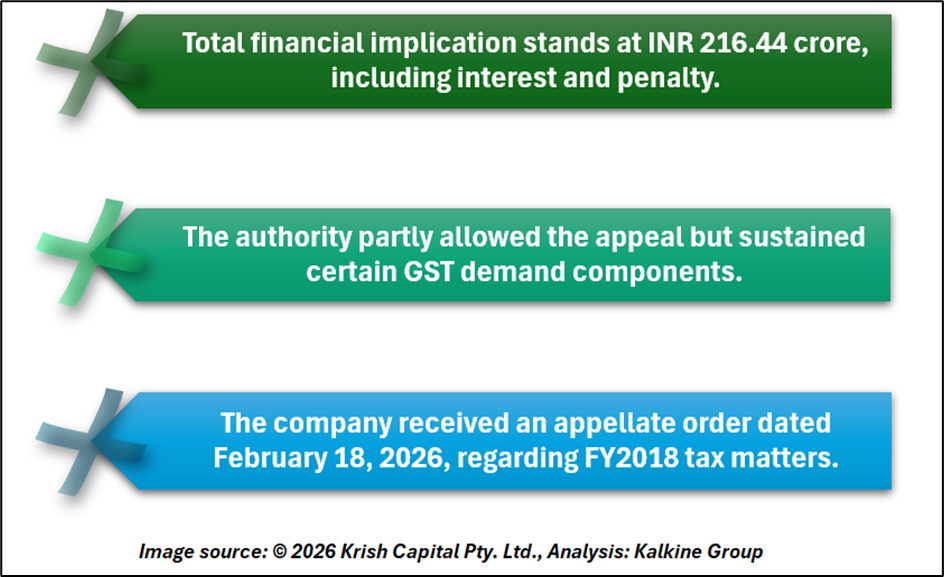

In a regulatory filing under the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, the company disclosed receipt of an appellate order dated February 18, 2026, from the Joint Commissioner of State Tax, Appellate Authority, Maharashtra, related to FY2018.

The appeal was partly allowed, while certain portions of the tax demand were sustained. The matter pertains to reversal of input tax credit, discrepancies between GST liability reported in GSTR-1 and GSTR-9, and mismatch in input tax credit claimed in GSTR-3B versus GSTR-2A.

The total financial implication arising from this order amounts to INR 216.44 crore, inclusive of GST, interest, and penalty. The company stated that there is no financial impact at this stage and that it intends to pursue a further appeal.

CGST Appeal Dismissed: Higher Demand Under Dispute

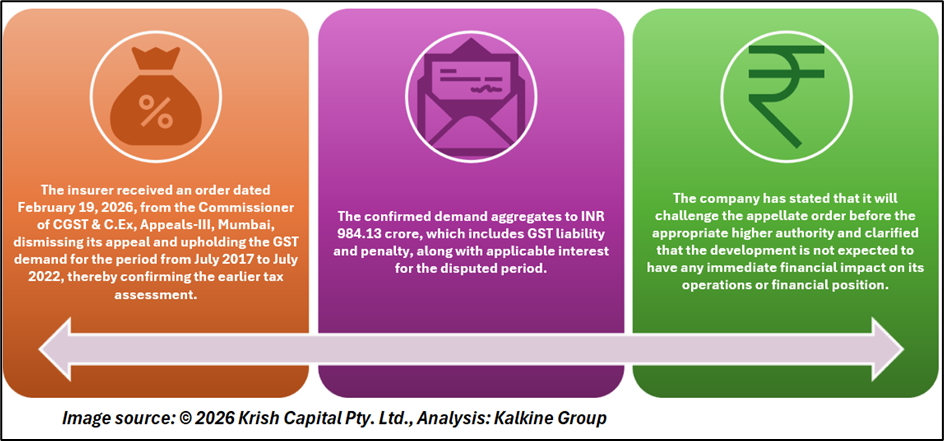

In a separate development, the insurer received an order dated February 19, 2026, from the Commissioner of CGST & C.Ex, Appeals-III, Mumbai. The authority dismissed the company’s appeal and upheld the tax demand for the period from July 2017 to July 2022.

The total demand in this matter stands at INR 984.13 crore, including GST and penalty, with applicable interest. The company has indicated that it will challenge the order before the appropriate authority.

Q3FY26 Financial Snapshot

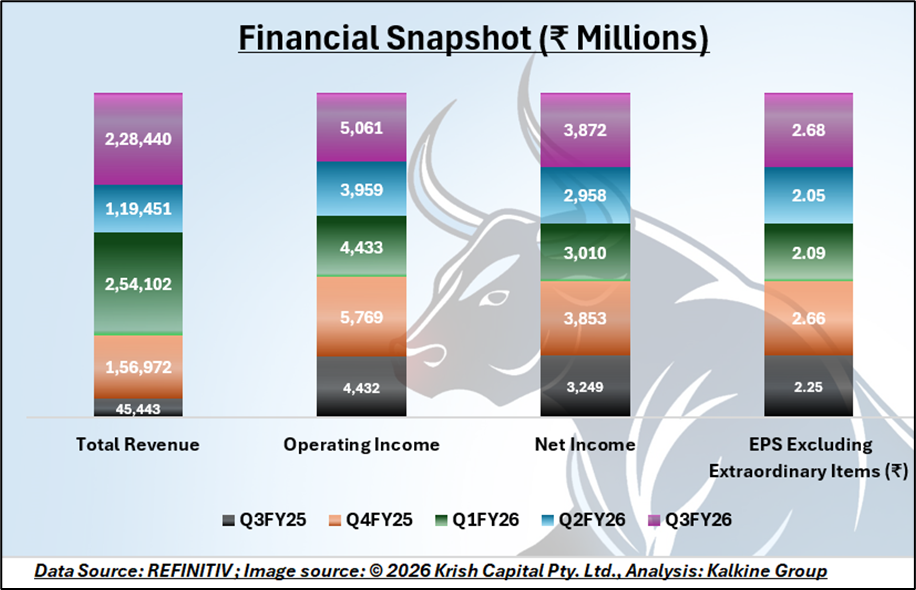

ICICI Prudential Life Insurance Company Limited reported total revenue of INR 2,28,440 in Q3FY26, compared with INR 1,19,451 in Q2FY26 and INR 45,443 in Q3FY25. Operating income for the quarter stood at INR 5,061, up from INR 3,959 in the previous quarter and INR 4,432 in the corresponding period last year.

Net income for Q3FY26 was INR 3,872, compared with INR 2,958 in Q2FY26 and INR 3,249 in Q3FY25. Basic EPS excluding extraordinary items came in at INR 2.68, higher than INR 2.05 in the preceding quarter and INR 2.25 in Q3FY25.

Sequentially, the company recorded improvement in operating income and profitability during the third quarter of FY26. On a year-on-year basis, revenue and earnings also reflected an increase compared to Q3FY25 levels.

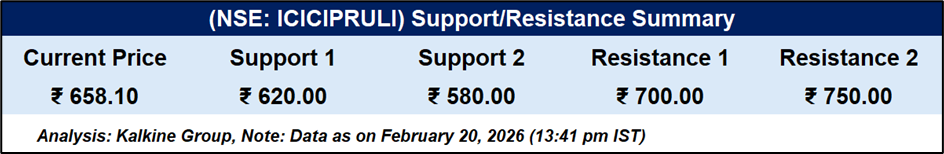

Technical summary

ICICI Prudential Life Insurance Company traded at ₹658.10, positioned between immediate support at ₹620 and resistance at ₹700. The price remains closer to the upper band of the support zone, indicating near-term consolidation within the ₹620–₹700 range. A sustained move above ₹700 may open the path toward the next resistance at ₹750. On the downside, failure to hold ₹620 could extend weakness toward the stronger base at ₹580. Overall structure reflects a defined trading range, with directional momentum likely to emerge on a decisive breakout beyond ₹700 or breakdown below ₹620.

Conclusion

ICICI Prudential Life Insurance is facing substantial tax disputes, with cumulative demands exceeding ₹1,200 crore across GST and CGST matters. While the company has stated there is no immediate financial impact and plans to pursue further appeals, the sizeable quantum under dispute could remain a key risk factor. The outcome of these legal proceedings will be critical in determining the eventual financial and regulatory implications.