Wipro Limited (NSE: WIPRO), a leading global technology services and consulting firm, delivered a resilient performance for the quarter ended June 30, 2025 (Q1 FY26), with strong deal wins and margin expansion overshadowing a muted topline. While revenue remained under pressure, investors cheered the company’s 10.9% YoY profit growth and robust operating metrics, pushing shares up 3% to ₹271 on July

Financial Highlights: Margin Strength and Cash Flow Efficiency Shine

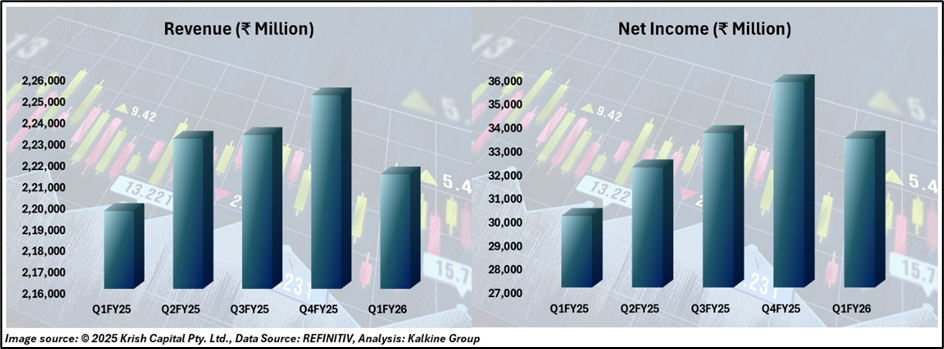

Wipro posted gross revenue of ₹221.3 billion ($2.58 billion) for Q1 FY26, a 0.8% YoY increase, though sequentially down by 1.6%. Revenue from the IT Services segment came in at $2.59 billion, marking a 1.5% YoY decline in USD terms and 2.3% drop in constant currency (CC). Despite top-line weakness, the company’s operating margin improved to 17.3%, expanding 80 basis points YoY, a sign of disciplined cost optimization and operational efficiency.

Wipro reported a 10.9% year-on-year rise in net income to ₹33.3 billion ($388.4 million), with earnings per share increasing 10.8% YoY to ₹3.2 ($0.04), reflecting consistent profitability growth. The company maintained strong cash generation, with operating cash flow reaching ₹41.1 billion ($479.6 million), accounting for 123.2% of net income highlighting healthy operational strength.

Bookings Surge, Large Deals Drive Visibility

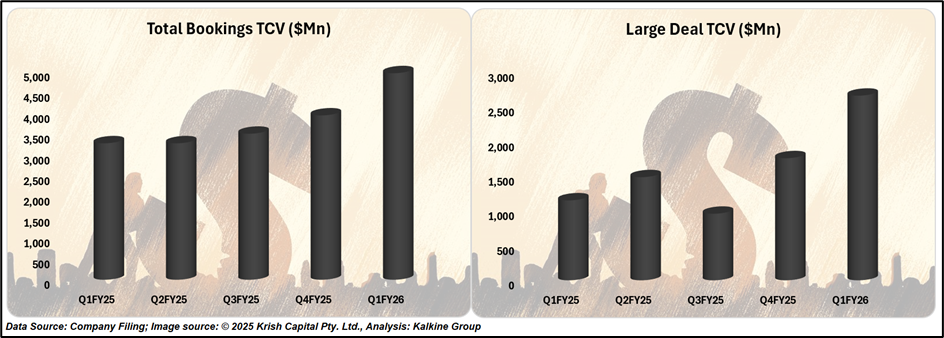

Wipro reported total bookings of $4.97 billion, marking a 50.7% year-on-year rise in constant currency, driven by robust demand for core transformation initiatives. Notably, large deal bookings soared 130.8% YoY to $2.67 billion among the strongest in recent quarters highlighting sustained momentum in long-term, high-value contracts, particularly in cloud and cost-efficiency programs.

Management Commentary & Outlook

Wipro’s management voiced optimism about a recovery in the second half, citing strong deal closures and signs of a steadily improving demand landscape as key drivers of future growth. The company has guided Q2 FY26 IT services revenue in the range of $2.56 billion to $2.612 billion, translating to a sequential growth range of -1.0% to +1.0% in CC terms.

While growth remains constrained due to delayed decision-making and cautious client spending, the strong bookings momentum and margin discipline provide a stable foundation for recovery.

Technical Analysis

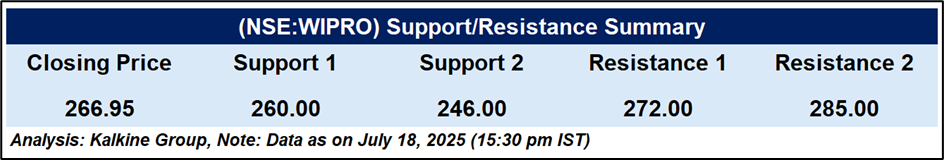

Wipro Ltd. surged 2.44% to close at ₹266.95, rebounding strongly from its ascending trendline support and reclaiming the 51-day EMA at ₹260.66, signaling renewed bullish momentum. The RSI has turned up to 56.23 with a bullish crossover, indicating improving strength. Sustaining above ₹260 keeps the near-term outlook positive, with resistance seen at ₹272–285. A breakout above this zone could drive further upside, while a fall below the trendline may weaken the setup.

Conclusion

Wipro’s Q1 FY26 performance reflects resilience amid a challenging demand environment, with strong margin expansion, robust cash flows, and record deal bookings offering encouraging signs for future growth. While topline pressures persist, disciplined execution and improving deal momentum position the company well for a potential second-half rebound. Continued focus on large-scale transformation programs, operational efficiency, and client confidence reinforces a cautiously optimistic outlook going forward.